Mumbai Indian shares tanked 2% on Monday as growing circumstances of Omicron spooked traders who feared its unfold would begin to take a toll on companies if international locations convey again stringent curbs to comprise the unfold of the brand new coronavirus variant.

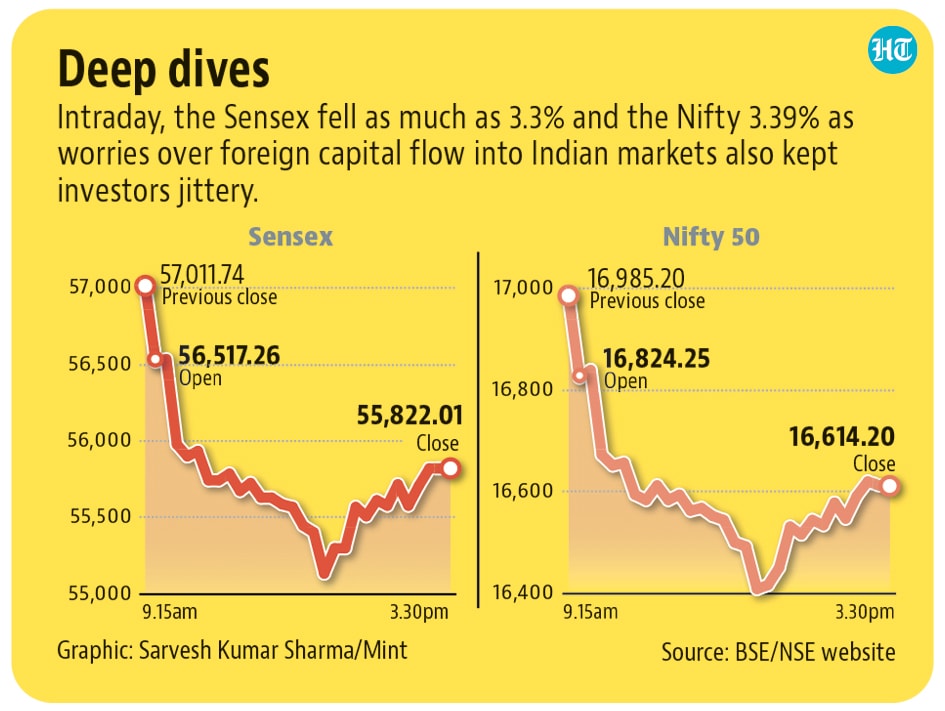

Worries over international capital move into Indian markets additionally stored traders jittery because the Sensex closed at 55,822.01, down 2.09%, and the Nifty ended the day at 16,614.20, declining 2.18%. Intraday, the 2 indices fell as a lot as 3.3% and three.39%, respectively.

From December 10, the Sensex and Nifty have corrected by 5.04% and 5.12%, respectively, whereas the volatility index VIX shot up 18.05%, indicating that traders are involved in regards to the market course within the coming days.

Rising Omicron circumstances have added to world macro challenges akin to inflation and tightening of financial insurance policies by main central banks and are prone to maintain traders on edge within the coming days. Consequently, markets could proceed to see promoting stress.

“Markets have corrected by ~10% from their peak, pushed by constant FIIs promoting, tightening financial coverage by central banks globally and concern over financial restoration as a consequence of rising Omicron circumstances. The general market breadth stays damaging and would require robust constructive triggers for altering the present damaging pattern. Promoting stress is unbroken at larger ranges, and any restoration or bounce is being utilized by merchants to go quick available on the market. Thus, we preserve our cautious view available in the market for the following couple of days,” stated brokerage Motilal Oswal in a observe on Monday. Market consultants see inflation and Omicron issues enjoying a significant function in market course going forward and don’t rule out additional corrections.

“The sell-off in at the moment’s commerce is among the most important promoting pressures witnessed lately on Dalal Road. So long as headline inflation+omricon dangers stay elevated, traders want to stay nimble-footed because the financial restoration will most likely be in a zig-zag mode. The continued pessimism signifies that latest dramatic crash is nowhere close to over,” stated Prashant Tapse, vice-president (analysis) at Mehta Equities.

Different Asian markets, too, had been below promoting stress on Monday, with Japan’s Nikkei 225 falling by 2.13%, Hong Kong’s Hold Seng closing 1.93% down, whereas the Shanghai Composite Index was down 1.07%, as traders feared tighter pandemic curbs, particularly in Europe as a consequence of an increase in Covid circumstances.

“Asian share markets fell, and oil costs slid on Monday as surging Omicron circumstances triggered tighter restrictions in Europe and threatened to pull on the worldwide financial system into the brand new 12 months. European shares fell greater than 2% on Monday amid a world sell-off in equities, with traders fretting over the spectre of tighter pandemic curbs hitting the worldwide financial system as circumstances of the Omicron Covid-19 variant surge,” stated Deepak Jasani, head of retail analysis at HDFC Securities.

Jasani stated different world cues akin to a political logjam within the US over President Joe Biden’s large infrastructure spending invoice are additionally protecting traders apprehensive.