Efficient shut of enterprise hours of June 1, 2018, HDFC Prudence Fund merged with HDFC Progress Fund (HDFC Balanced Benefit Fund after adjustments in basic attributes). Because the portfolio traits and the broad funding technique of HDFC Balanced Benefit Fund is much like that of erstwhile HDFC Prudence Fund, the observe report (i.e. since inception date, dividend historical past, and so on.) / previous efficiency of erstwhile HDFC Prudence Fund have been thought-about, according to SEBI round on Efficiency disclosure submit consolidation/ merger of scheme dated April 12, 2018.).

HDFC Balanced Advantage Fund – Ideally suited for long run Investments

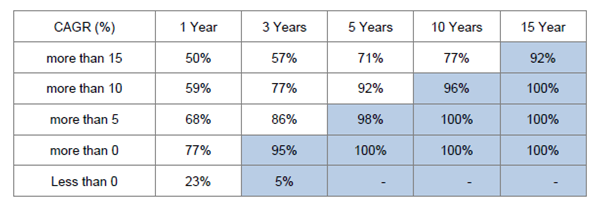

• HDFC Balanced Benefit Fund has delivered greater than 10% CAGR over 10 yr durations in 96% cases, since inception in 1994

It may be clearly seen, that because the holding interval will increase, return profile improves. • That is in keeping with the assumption that equities are a long run asset class and that threat usually reduces as holding interval will increase. • HDFC Balanced Benefit Fund maintains vital publicity to equities (No less than 65% of Complete Property) and is due to this fact suited to long run traders with funding horizon of 5 years or extra.

HDFC Balanced Advantage Fund – A fund that has carried out throughout market cycles, crises, market bubbles and so on.

HDFC Balanced Advantage Fund – Covid-19 correction performed proper!

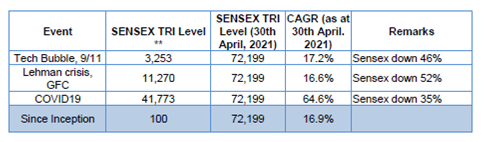

• Covid-19 precipitated untold ache to people, households and financial system. Nonetheless, it additionally offered a chance to enhance long run returns to discerning traders by staying invested / growing fairness publicity.

• Nonetheless solely few made the most effective out of this chance as headlines made them fearful. Funding selections have been pushed by feelings / brief time period pondering as an alternative of rationality / long run pondering.

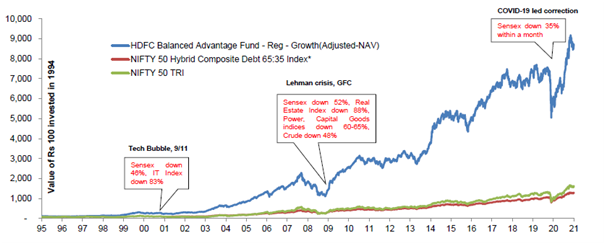

• S&P BSE Sensex TRI (SENSEX TRI) has compounded at 15% CAGR vs common inflation of 6% over final 20 years. Rs 100 invested in 1999 has develop into ~Rs 1650 in nominal phrases & ~Rs 560 in actual phrases (Supply: BSE, RBI). To realize this persistence and tolerance for volatility by way of occasions like 9/11, GFC, Eurozone crises, Brexit, Covid-19 and so on. was the important thing.

• SENSEX has witnessed occasional deep corrections. Investments made round these occasions delivered larger CAGR returns. That is a method to enhance long run returns.

HDFC Balanced Advantage Fund – Fairness Market Outlook

Markets bounce again needs to be seen within the context of :

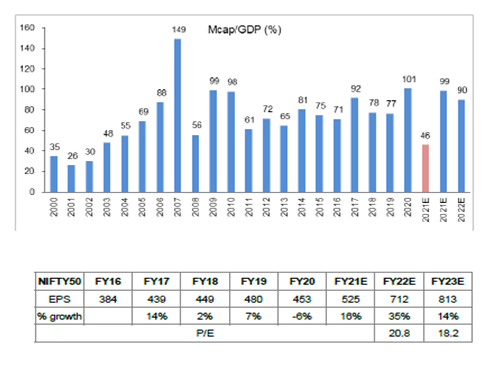

• Indian market capitalization regardless of the current rally, is presently ~90% of GDP (primarily based on CY 2022 GDP), At its backside in March 20, it had fallen near 46% (primarily based on CY 2021 GDP).

• Regardless of the sharp rise, NIFTY 50 returns over the previous 10 years and 15 years are ~11% CAGR, largely according to nominal GDP development.

• Company earnings in Q2FY21 & Q3FY21 have been higher than anticipated and resulted in broad primarily based earnings upgrades.

• FY2021-22 Funds with its concentrate on development & capex augurs effectively for brand new funding cycle and earnings development.

• NIFTY 50 is buying and selling close to 21x FY22E and 18x FY23E worth to earnings ratio. In our view, these are affordable multiples, particularly given the low rate of interest setting and bettering development outlook.

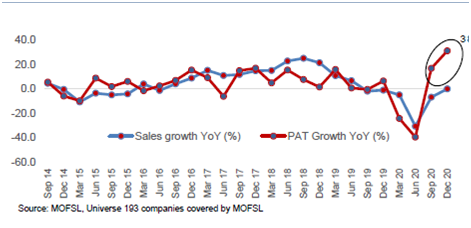

HDFC Balanced Advantage Fund : Indicators of revival in 2QFY21 & 3QFY21 outcomes

Company earnings in Q2FY21 & Q3FY21 have been higher than anticipated and resulted in broad primarily based earnings upgrades

• Q3FY21 turned out to be the most effective incomes seasons in final 6 years (since Sep 14) up to now with PAT development of 31% regardless of de-growth in income

Revenue development has been pushed by : Banks -Decrease Provisioning, IT- Decrease prices, FMCG – Regular development, Capital Items – Bettering execution ,Healthcare – Regular development, working leverage, Metals – Larger spreads Utilities – Regular development, Telecom -Larger ARPUs, working leverage Cement – Good pricing, decrease prices.

HDFC Balanced Advantage Fund – Portfolio technique / Asset Allocation

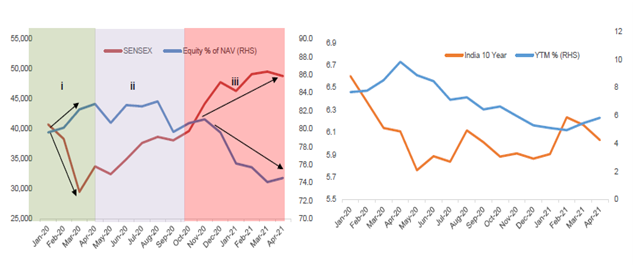

HDFC Balanced Benefit Fund tactically managed the fairness publicity in three phases as highlighted in chart above:

- Markets corrected significantly – Fund elevated its allocation to equities

- ii. Markets recovering – Fund maintained its allocation to equities

- iii. Markets above Pre Covid-19 ranges – Fund decreasing its allocation to equities

• Whereas the Fund has lowered the fairness allocation with rising markets, it continues to stay obese fairness led by a optimistic outlook for equities over medium time period

• Within the fastened earnings portfolio, the Fund period has been lowered as rates of interest moved down

• Going ahead, the long run asset allocation might be pushed by fairness valuations & outlook for earnings development, rates of interest and so on.

HDFC Balanced Advantage Fund -fund fact

Kind of the Scheme – An open ended balanced benefit fund

Inception Date (For Efficiency) – February 01, 1994

Funding Goal – The funding goal of the Scheme is to offer long run capital appreciation/earnings from a dynamic mixture of fairness and debt investments. There isn’t a assurance that the funding goal of the scheme might be realized

Fund Supervisor – Prashant Jain

Funding Plan – Common & Direct

Funding Choices- Underneath Every Plan: Progress & Revenue Distribution cum Capital Withdrawal (IDCW) Possibility. The IDCW Possibility affords following Sub-Choices: Payout of Revenue Distribution cum Capital Withdrawal (IDCW) Possibility; and Reinvestment of Revenue Distribution cum Capital Withdrawal (IDCW) Possibility.

Minimal Software Quantity. (Underneath Every Plan/Possibility) – Buy: Rs. 5,000 and any quantity thereafter Further Buy: Rs. 1,000 and any quantity thereafter

Load Construction- Entry Load: • Not Relevant

Exit Load:

• In respect of every buy / switch-in of Items, as much as 15% of the models could also be redeemed with none exit load from the date of allotment.

• Any redemption in extra of the above restrict shall be topic to the next exit load: – Exit Load of 1.00% is payable if models are redeemed/switched-out inside 1 yr from the date of allotment of models

• No Exit Load is payable if Items are redeemed / switched out after 1 yr from the date of allotment

• In case of Systematic Transactions akin to SIP, GSIP, STP, Flex STP, Swing STP, Flex index; Exit Load, if any, prevailing on the date of registration / enrolment shall be levied.

Benchmark – NIFTY 50 Hybrid Composite Debt 65:35 Index

Fund Supervisor Abroad funding – Mr Sankalp Baid

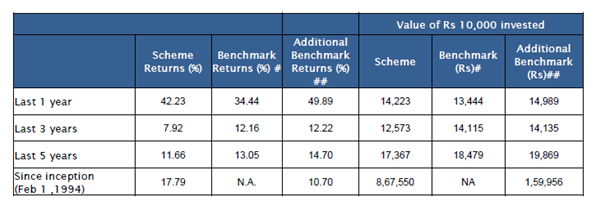

HDFC Balanced Advantage Fund – Scheme Efficiency Abstract

Returns are for Common Plan-Progress possibility. The above scheme has been managed by Mr Prashant Jain, the fund supervisor since June 20, 2003. The efficiency of the Scheme is benchmarked to the Complete Return Index (TRI) Variant of the Indices. Previous efficiency might or might not be sustained sooner or later. Since Inception Date = Date of First allotment within the Scheme / Plan The above returns are of Common Plan – Progress Possibility. Returns higher than 1 yr interval are compounded annualized (CAGR). Load is just not considered for computation of efficiency. #NIFTY 50 Hybrid Composite Debt 65:35 Index ## NIFTY 50 (TRI). Totally different plans viz. Common Plan and Direct Plan have a special expense construction. The bills of the Direct Plan below the Scheme might be decrease to the extent of the distribution bills / fee charged within the Common Plan. Returns as on thirtieth April 2021.

Efficient shut of enterprise hours of June 1, 2018, HDFC Prudence Fund merged with HDFC Progress Fund (HDFC Balanced Benefit Fund after adjustments in basic attributes). Because the portfolio traits and the broad funding technique of HDFC Balanced Benefit Fund is much like that of erstwhile HDFC Prudence Fund, the observe report (i.e. since inception date, dividend historical past, and so on.) / previous efficiency of erstwhile HDFC Prudence Fund have been thought-about, according to SEBI round on Efficiency disclosure post-consolidation/merger of scheme dated April 12, 2018. for all scheme releted particulars https://www.hdfcsec.com/stock-market/mutual-fund-scheme/scheme-623

learn extra – Nippon India mf

Disclaimer- Mutual fund investments are topic to market dangers, learn all scheme associated paperwork rigorously