TYPE OF THE SCHEME- HDFC Arbitrage Fund is an open-ended scheme investing in

arbitrage alternate options

WHAT IS THE INVESTMENT OBJECTIVE OF THE SCHEME?- To generate income by the use of arbitrage alternate options and debt & money market units. There is not an assurance that the funding purpose of the scheme might be realized

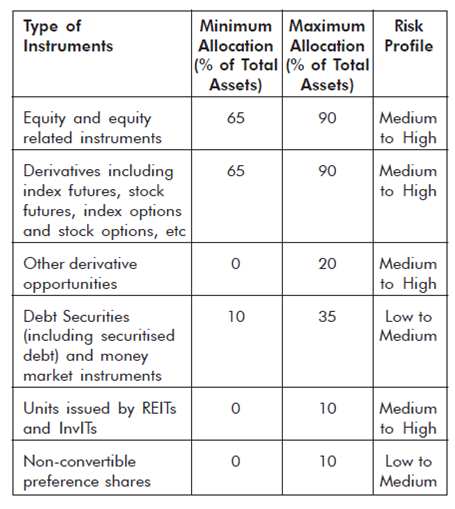

HDFC Arbitrage Fund- SCHEME ALLOCATE ITS ASSETS?

ASSET ALLOCATION: Beneath common circumstances, the asset allocation might be as

follows:

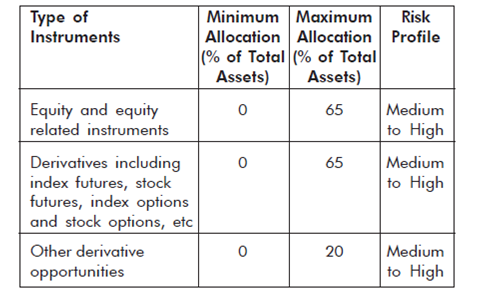

In defensive circumstances, the asset allocation might be as

per the beneath desk:

The Scheme would possibly put cash into the schemes of Mutual Funds in accordance with the related extant SEBI (Mutual Funds) Guidelines as amended often. The Scheme would possibly make investments as much as a most 35% of the total belongings in Worldwide Securities and as much as 100% of its full belongings in Derivatives. The Scheme would possibly undertake (i) repo / reverse repo transactions in Firm Debt Securities; (ii) Credit score rating Default Swaps; and (iii) Transient Selling and such totally different transactions in accordance with ideas issued by SEBI often. Pending deployment of funds of the Scheme insecurities in terms of the funding purpose of the Scheme the AMC would possibly park the funds of the Scheme briefly time interval deposits of scheduled industrial banks, subject to the principles issued by SEBI vide

its spherical dated April 16, 2007, as amended occasionally along with SEBI Spherical No. SEBI/HO/IMD/DF4/CIR/P/ 2019/093 dated August 16, 2019. The AMC shall not value funding administration

and advisory costs on such investments.

Stock Lending by the Fund

Securities Lending Scheme, 1997, SEBI Spherical No MFD/CIR/ 01/ 047/99 dated February 10, 1999, SEBI Spherical no. SEBI /IMD / CIR No 14 / 187175/ 2009 dated December 15, 2009, and framework for temporary selling and borrowing and lending of securities notified by SEBI vide spherical No MRD/DoP/SE/Dep/Cir-14/2007 dated December 20, 2007, as may be amended often, the Scheme seeks to interact in Stock Lending. Time interval Deposits positioned as margin might be coated in publicity to cash and cash equal. The AMC shall adhere to the following limits should it interact in Stock Lending. 1. Not more than 25% of the online belongings of the Scheme can usually be deployed in Stock Lending.2. Not more than 5% of the online belongings of the Scheme can usually be deployed in Stock Lending to any single permitted intermediary. The Mutual Fund may not be able to selling such lent out securities and this may end in short-term illiquidity.

Publicity limits for participation in repo in company debt securities

The gross publicity of the scheme to repo transactions in firm debt securities shall not be better than 10% of the online belongings of the scheme or as permitted by extant SEBI regulation. Furthermore, totally different restrictions on exposures to the repo in firm debt securities like tenor, rating class, and so forth. may very well be related, as permitted by SEBI and RBI often.

Change in Asset Allocation Sample

Subject to SEBI (MF) Guidelines the asset allocation pattern indicated above would possibly change often, conserving in view market circumstances, market alternate options, related guidelines, and political and monetary parts. It ought to be clearly understood that the probabilities acknowledged above are solely indicative and by no means absolute and that they are going to fluctuate significantly relying upon the notion of the Funding Supervisor, the intention being all the time to hunt to protect the pursuits of the Unitholders. Such modifications throughout the funding pattern might be for the temporary time interval and for defensive consideration solely. Inside the event of change throughout the asset allocation, the fund supervisor will carry out portfolio rebalancing inside 30 Days. Moreover, in case the portfolio is simply not rebalanced contained in the interval

of 30 days, justification for the same shall be positioned sooner than the funding committee and causes for the same shall be recorded in writing. The funding committee shall then resolve on the plan of motion.

Debt Market In India

The units obtainable within the Indian Debt Market are categorized

into two courses, notably Authorities and Non – Authorities

debt. The units obtainable in these courses embody:

A] Authorities Debt –

n Central Authorities Debt

n Treasury Funds

n Dated Authorities Securities

– Coupon Bearing Bonds

– Floating Worth Bonds

– Zero-Coupon Bonds

n State Authorities Debt

– State Authorities Loans

– Coupon Bearing Bonds

B] Non-Authorities Debt

n Units issued by Authorities Firms and totally different

Statutory Our our bodies

n Authorities Assured Bonds

n PSU Bonds

n Units issued by Public Sector Undertakings

n Enterprise Paper

n PSU Bonds

n Fixed Coupon Bonds

n Floating Worth Bonds

n Zero-Coupon Bonds

n Units issued by Banks and Progress Financial

Institutions

n Certificates of Deposit

n Promissory Notes

n Bonds

n Fixed Coupon Bonds

n Floating Worth Bonds

n Zero-Coupon Bonds

n Units issued by Firm Our our bodies

n Enterprise Paper

n Non-Convertible Debentures

n Fixed Coupon Debentures

Floating Worth Debentures

n Zero-Coupon Debentures

n Cross By way of Securities

Train throughout the Main and Secondary Market is dominated by Central Authorities Securities along with Treasury Funds. These, units comprise close to 60% of all glorious debt and better than 75% of the every day shopping for and promoting amount on the Wholesale Debt Market Part of the Nationwide Stock Alternate of India Restricted.

Inside the money market, train ranges of the Authorities and Non- Authorities Debt fluctuate often. Units that comprise a good portion of money market train embody,

n In a single day Identify

n Repo/Reverse Repo Agreements

n Tri-party Repos on Authorities securities or treasury funds

(TREPS)

n Treasury Funds

n Authorities Securities with a residual maturity of < 1 yr

n Enterprise Paper

n Certificates of Deposit

n Funds Rediscounting Scheme

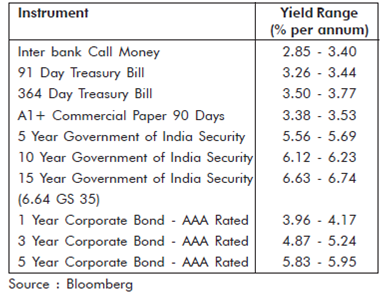

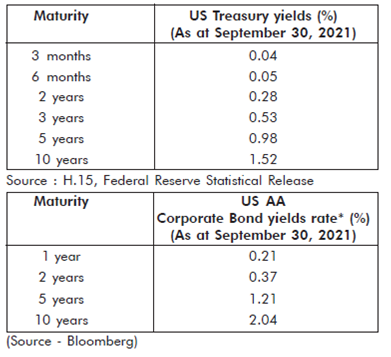

Though not strictly categorized as Money Market Units, PSU/ DFI / Firm paper with a residual maturity of < 1, yr, are actively traded and provide a viable funding chance. The subsequent desk gives approximate yields prevailing all through the month ended September 30, 2021, on a couple of of the units. These yields are indicative and do not point out yields that could be obtained sooner or later as charges of curiosity protect altering consequent to modifications in macro-financial circumstances and RBI protection.

These yields are indicative and do not level out yields that could be obtained sooner or later as charges of curiosity protect altering consequent to modifications in macro-financial circumstances and RBI protection. The worth and yield on assorted debt units fluctuate often relying upon the macro-financial state of affairs, inflation

cost, complete liquidity place, worldwide change state of affairs, and so forth. Moreover, the worth and yield fluctuate in accordance with maturity profile, credit score rating hazard and so forth. Sometimes, for units issued by a non-authorities entity (firm / PSU bonds), the yield is bigger than the yield on an Authorities Security with the corresponding maturity. The excellence, typically referred to as credit score rating unfolds, depends on the credit score standing of the entity.

Abroad Debt Market

The character and number of debt units obtainable in worldwide debt markets could also be very large. By the use of numerous units along with liquidity, overseas debt markets provide good depth and are terribly successfully developed. Funding in worldwide debt enormously expands the universe of high-quality debt, which isn’t restricted to the restricted papers obtainable throughout the dwelling debt market. The higher rated overseas sovereign, quasi-government and firm debt provide lower default hazard together with offering an extreme diploma of liquidity since these are traded all through principal worldwide markets. Investments in rated worldwide debt provide various

benefits of hazard low cost, so much wider universe of high-quality debt and likewise potential good factors from overseas cash actions. Investments in worldwide markets are most ceaselessly in U.S. {{dollars}}, though the Euro, Pound Sterling and the Yen are moreover principal currencies. Though this market is geographically successfully unfolding all through world financial facilities, the markets throughout the U.S., European Union and London provide basically essentially the most liquidity and depth of units.

Other than parts specific to the nation/issuer, worldwide bond prices are influenced to a giant extent by a whole lot of totally different parts; chief amongst these are the worldwide monetary outlook, modifications in charges of curiosity in principal economies, shopping for and promoting volumes in overseas markets, cross overseas cash actions amongst principal currencies, rating modifications of countries/firms and principal political modifications globally. The approximate yields to maturity throughout the US Bond Market are as follows:

WHERE WILL THE SCHEME INVEST?

The corpus of the Scheme shall be invested in accordance with

the funding purpose in any (nevertheless not utterly) of the

following securities:

Equity and equity related units Investments in these securities might be as per the boundaries

specified throughout the asset allocation desk of Scheme, subject

to permissible limits laid beneath SEBI (MF) Guidelines.

Debt securities :

The Scheme will retain the pliability to place cash into your full fluctuate of debt units and money market units. These units are additional notably highlighted beneath: l Debt units (inside the kind of non-convertible debentures, bonds, secured premium notes, zero curiosity bonds, deep low-cost bonds, floating cost

bond/notes, securitized debt, cross by the use of certificates, asset-backed securities, mortgage-backed

securities and each different dwelling fixed income securities along with structured obligations and so forth.) embody, nevertheless normally aren’t restricted to:

1. Debt issuances of the Authorities of India,

State and native Governments, Authorities

Firms and statutory our bodies (which might or

may not carry a state / central authorities

guarantee),

2. Debt Units which have been assured by

Authorities of India and State Governments,

3. Debt Units issued by Firm Entities

(Public / Private sector undertakings),

4. Debt Units issued by Public / Private sector

banks and enchancment financial institutions.

5. Securitized Debt, Structured Obligations, Credit score rating

enhanced Debt

6. Non-Convertible Alternative Shares

l Money Market Units embody:

1. Enterprise papers

2. Enterprise funds

3. Treasury funds

4. Authorities securities having an unexpired

maturity as much as one yr

5. Tri-party Repos on Authorities securities or

treasury funds (TREPS)

6. Certificates of deposit

7. Usance funds

8. Permitted securities beneath a repo / reverse repo

settlement

9. Each different like gadget as may be permitted

by RBI / SEBI often

Funding in debt will usually be in units, which have been assessed as “extreme funding grade” by at least one credit score standing firm licensed to carry out such train beneath the related guidelines. Pursuant to SEBI Spherical No. MFD/CIR/9/120/2000 dated November 24, 2000, the AMC would possibly signify committee(s) to approve proposals for investments in unrated debt units. The AMC Board and the Trustee shall approve the detailed parameters for such investments. The small print of such investments may very well be communicated by the AMC to the Trustee of their periodical experiences. It might even be clearly talked about throughout the experiences, how the parameters have been complied with. Nonetheless, in case any unrated debt security does not fall beneath the parameters, the prior approval of the Board of AMC and Trustee shall be sought. Funding in debt units shall usually have a low hazard profile and other people in money market units shall have a superb lower hazard profile. The maturity profile of debt units might be chosen in accordance with the AMC’s

view regarding current market circumstances, price of curiosity outlook, and the stability of rankings. Investments in Debt and Money Market Units might be as per the boundaries specified throughout the asset allocation desk(s) of the Scheme, subject to permissible limits laid beneath SEBI (MF) Guidelines. Investments in every equity and debt might be made by way of secondary market purchases, preliminary public presents, totally different public presents, placements, and correct presents (together with renunciation). The securities is perhaps listed, unlisted (as permitted), privately positioned, secured / unsecured, rated/unrated. n Pending deployment as per funding purpose, the cash beneath the Scheme may be parked in short-term deposits of Scheduled Enterprise Banks. The Scheme shall abide by the principles for parking of funds briefly time interval deposits as per SEBI Spherical No. SEBI/ IMD/CIR No. 1/91171/07 dated April 16, 2007, as may be amended from to time. For particulars consult with ‘What are the Funding Restrictions’ on Internet web page 37.

n The Scheme would possibly put cash into totally different schemes managed by the AMC or throughout the schemes of each different mutual fund,

provided it is in conformity with the funding targets of the Scheme and in terms of the prevailing SEBI (MF) Guidelines. As per the SEBI (MF) Guidelines, no funding administration costs might be charged for such investments and the combination inter scheme funding made by all the schemes of HDFC Mutual Fund or throughout the schemes of various mutual funds shall not exceed 5% of the online asset value of the HDFC Mutual Fund.

n Funding in Worldwide Securities The Scheme may also put cash into acceptable funding avenues in overseas financial markets for the intention of diversification, yield enhancement and to revenue from potential worldwide overseas cash appreciation, commensurate with the Scheme’s targets and subject to the provisions of SEBI Spherical No.SEBI/IMD/ CIR No.7/104753/07 dated September 26, 2007 as may be amended often and each different necessity as may be stipulated by SEBI/RBI often. Within the route of this end, the Mutual Fund may also appoint overseas funding advisors and totally different service suppliers, as and when permissible beneath the principles. The Scheme would possibly, in terms of its funding targets with the approval of SEBI/RBI put cash into the next Worldwide Securities: i. ADRs/ GDRs issued by Indian or worldwide companies ii. Equity of overseas firms listed on acknowledged stock exchanges overseas iii. Preliminary and adjust to on public selections for itemizing at acknowledged stock exchanges overseas iv. Worldwide debt securities throughout the nations with completely convertible currencies, temporary time interval along with long run debt units with a rating not beneath funding grade by accredited/registered credit score standing firms v. Money market units rated not beneath funding grade. Repos inside the kind of funding, the place the counterparty is rated not beneath funding grade; stories should not nonetheless, include any borrowing of funds by mutual funds vii. Authorities securities the place the nations are rated not beneath funding grade viii. Derivatives traded on acknowledged stock exchanges overseas only for hedging and portfolio balancing with underlying as securities ix. Transient-time interval deposits with banks overseas the place the issuer is rated not beneath funding grade x. Gadgets/securities issued by overseas mutual funds or unit trusts registered with abroad regulators and investing in (a) aforesaid securities, (b) Precise Property Funding Trusts (REITs) listed in acknowledged stock exchanges overseas or (c) permitted unlisted overseas securities (not exceeding 10% of their net belongings).

1. As per SEBI Circulars No. SEBI/IMD/CIR No.7/104753/ 07 dated September 26, 2007, and No. SEBI/HO/IMD/

DF3/CIR/P/2020/225 dated November 5, 2020, and No. SEBI/HO/IMD/IMD-II/DOF3/P/CIR/2021/571 dated June

03, 2021: 1.1. Mutual Funds might make overseas investments topic to a most of US $ 600 million per utual Fund, inside the entire commerce prohibit of US $ 7 billion. 1.2. Mutual Funds might make investments in overseas Alternate Traded Fund (ETF(s)) subject to a most of US $ 200 million per Mutual Fund, inside the entire

commerce prohibit of US $ 1 billion. 2. The allocation methodology of the aforementioned limits shall be as follows: 2.1. In case of overseas investments specified at Para 1.1above, US $ 50 million may very well be reserved for each Mutual

Fund individually, inside the entire commerce prohibit of US $ 7 billion. As per extant norms, 20% of the frequent AUM in Overseas securities / Overseas ETFs of the sooner three calendar months may very well be obtainable to the Mutual Fund for funding that month to place cash into Overseas securities / Overseas ETFs subject to most limits specified at Para 1 above. Nonetheless the above, the restriction for funding in overseas securities along with ETFs shall be as permitted by SEBI often. The Scheme shall not have publicity of better than 35%

of its net belongings in worldwide securities, subject to regulatory limits specified often. Subject to the approval of the RBI / SEBI and circumstances as may be prescribed by them, the Mutual Fund would possibly open various worldwide overseas cash accounts abroad each straight, or by the use of the custodian/sub-custodian, to facilitate investments and to enter into/deal in forward overseas cash contracts, overseas cash futures, index selections, index futures, price of curiosity futures/swaps, overseas cash selections for the intention of hedging the risks of belongings of a portfolio or for its environment-friendly administration. The Mutual Fund would possibly, the place compulsory appoint intermediaries as sub-managers, sub-custodians, and so forth. for managing and administering such investments. The appointment of such intermediaries shall be in accordance with the related requirements of SEBI and contained in the permissible ceilings of payments as acknowledged beneath Regulation 52 of SEBI (MF) Guidelines.

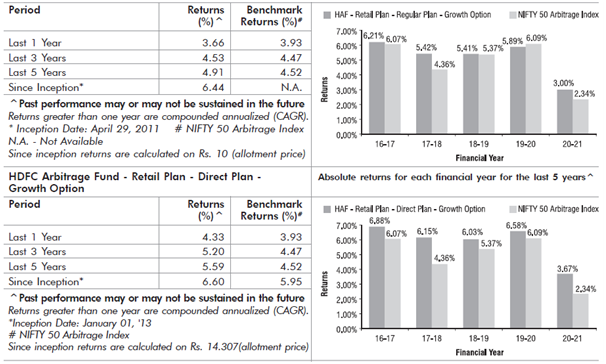

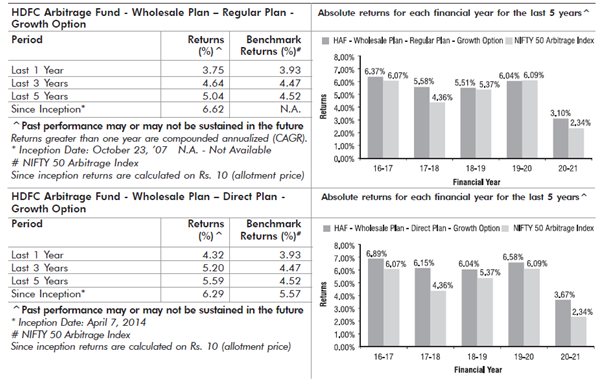

HOW HAS THE SCHEME PERFORMED?

The effectivity of the Scheme (as at September 30, 2021) (Benchmarked to the Full Returns Index (TRI)

A variant of the Index)

HDFC Arbitrage Fund – Retail Plan – Frequent Plan – Growth Alternative Absolute returns for each financial yr for the ultimate 5 years