NEW DELHI: Extra curiosity quantity or late charges paid by any taxpayer whereas submitting revenue tax returns (ITR) for the monetary yr 2020-21 shall be refunded, the tax division mentioned on Wednesday.

The deadline to file revenue tax for FY21 was prolonged from July 31 to September 30 by the federal government in wake of the challenges confronted by taxpayers because of the Covid-19 pandemic.

Nonetheless, a number of taxpayers had been charged a late price in addition to incorrect curiosity after they submitted their ITRs after the sooner deadline of July 31.

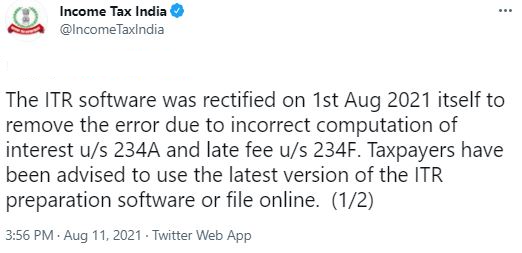

In a tweet, the tax division mentioned that the software program error was rectified on August 1 itself and urged taxpayers to make use of the newest model of the software program.

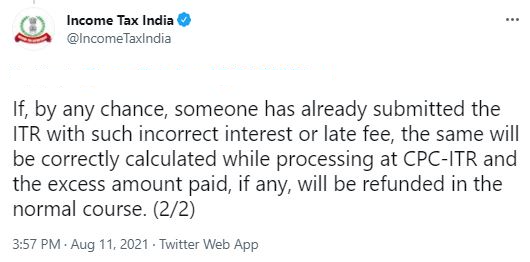

It additional assured that if anybody has submitted ITR with incorrect curiosity and late price quantity then the surplus quantity shall be refunded to them, after cautious calculations.

The brand new revenue tax e-filing portal www.incometax.gov.in had a bumpy beginning from the day of its launch on June 7 because it continued to face tech glitches.

The tax division has taken corrective measures by Infosys primarily based on suggestions from taxpayers, tax professionals, and representatives of the Institute of Chartered Accountants of India (ICAI).

Sure key functionalities like person profile, ITR 1, 2 and 4 submitting, e-proceedings, viewing of previous ITRs, can be found to the customers on the brand new revenue tax portal, the federal government knowledgeable.