[ad_1]

Here is an fascinating reality: The has not had a 5%+ drawdown from a peak for the previous ten months. This timeframe equates to over 200 periods. As this sizzling run continues, an increasing number of analysts come out of the woodwork, predicting that it’s going to shortly come to an finish.

Maybe these analysts are right, and the S&P 500 will hit a wall at 4,500, a price the index crossed for the first-time final Friday. Coincidently, it was additionally the time the S&P 500 hit its eighth 100-point day for 2021.

Because it stood at time of writing, the S&P 500 was at 4,528.79, up one other 19 factors on Monday buying and selling.

In fact, this constant rise of the SPX is out of the norm and, subsequently, considerations traders. Whereas we can’t management the unforeseeable, we are able to observe the market bulletins popping out of the US (or different acceptable areas) that may preserve us abreast of potential adjustments in market sentiment and course.

Financial studies

It’s an atypically quiet week on the US studies entrance; it isn’t till Wednesday that the large boy studies are launched.

ADP Employment Change

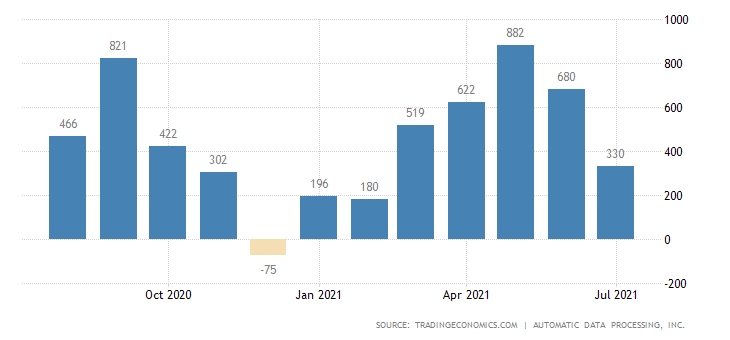

The precursor to the , the , is forecasting 500K jobs added to the US non-public sector financial system in August. Keep in mind that this report’s estimates have been off by greater than 70% (330K vs 695K anticipated) final month.

If the ADP Employment Change quantity is available in at 500K, it is going to sign an enormous turnaround for the non-public sector job placement, which has steadily declined since a report 882K jobs in Might. This decline may very well be forgivable if the 20 million jobs misplaced in April 2020 had since been regained. Nonetheless, because it stands, the US financial system remains to be down a web 4 million jobs.

EUR/USD NFP tank

NFP Creeps In On Friday

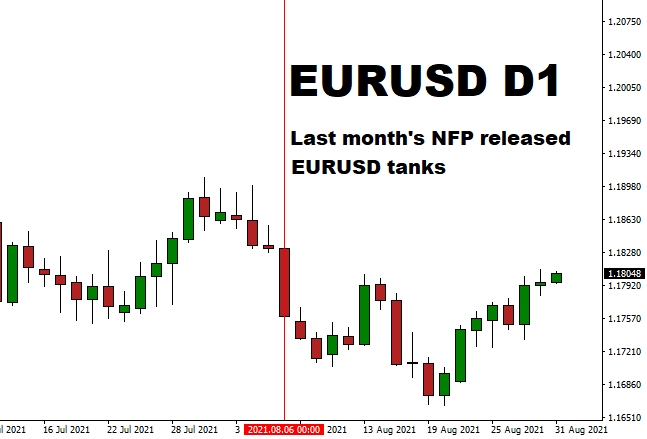

The consensus is that 750K jobs have been added to the US financial system in August, greater than 100K lower than anticipated final month. However, as everyone knows, NFP beat the expectations of July by a big quantity and injected an excessive amount of optimism within the USD (see chart).

How did this large NFP beat translate on the S&P 500?

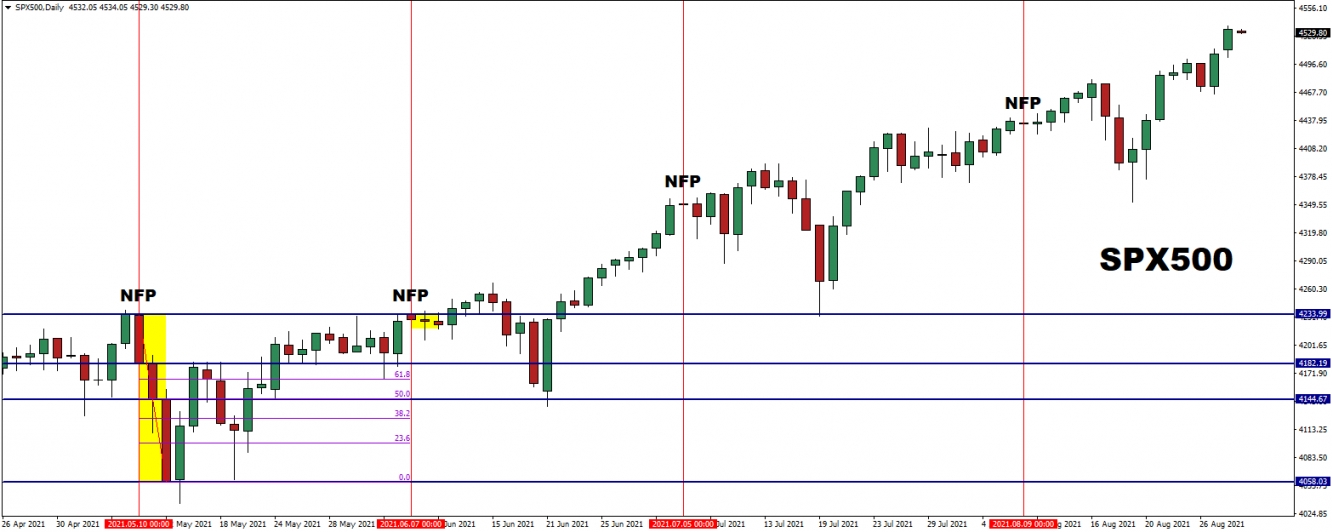

For the previous 4 NFP job studies, we are able to observe a sample.

When the NFP disappoints, the S&P 500 has a tough few days. This tough patch is clearly illustrated in Might, the place the NFP reported a paltry 266K jobs vs an anticipated 978K. What ensued on the next Monday was three days of promoting, ensuing within the S&P 500 falling from 4,233 to 4,058. The SPX didn’t achieve again these losses till the day earlier than the following NFP was launched.

When the NFP beats, the S&P 500 falls, however by far lower than when it misses. This begs the query: What is going to it take for the S&P 500 to react positively? I believe it’s ready for an NFP to report greater than one million jobs, like final reported in August 2020 (July Job numbers). In any other case, the Index would be the largest beneficiary of the optimistic, however not grand, NFP studies.

[ad_2]