[ad_1]

Shares are going sideways since final Friday. Will they break greater and return to the file excessive? Or the alternative? It nonetheless doesn’t look bullish.

The broad inventory market index misplaced 0.16% on Thursday because it fluctuated inside a short-term consolidation following final week’s declines. On September 2 the index reached a brand new file excessive of 4,545.85. Since then it has misplaced over 110 factors. This morning shares are anticipated to open just about flat once more following a pre-session rebound from in a single day lows.

The index stays elevated after the current run-up, so we might even see extra profound profit-taking motion in some unspecified time in the future.

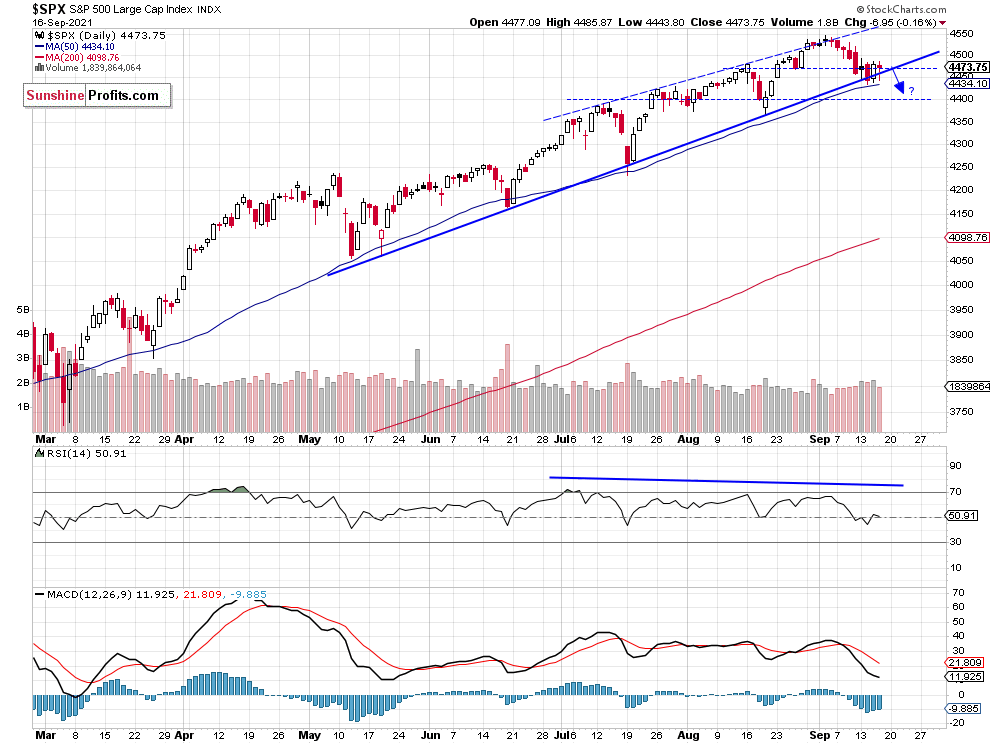

The closest necessary help degree of the broad inventory market index is now at 4,435-4,450 and the following help degree is at 4,400-4,410. Then again, the closest necessary resistance degree is now at 4,490-4,500, marked by the earlier help degree. The bounced off its over four-month-long upward development line, as we are able to see on the each day chart (chart by courtesy of http://stockcharts.com):

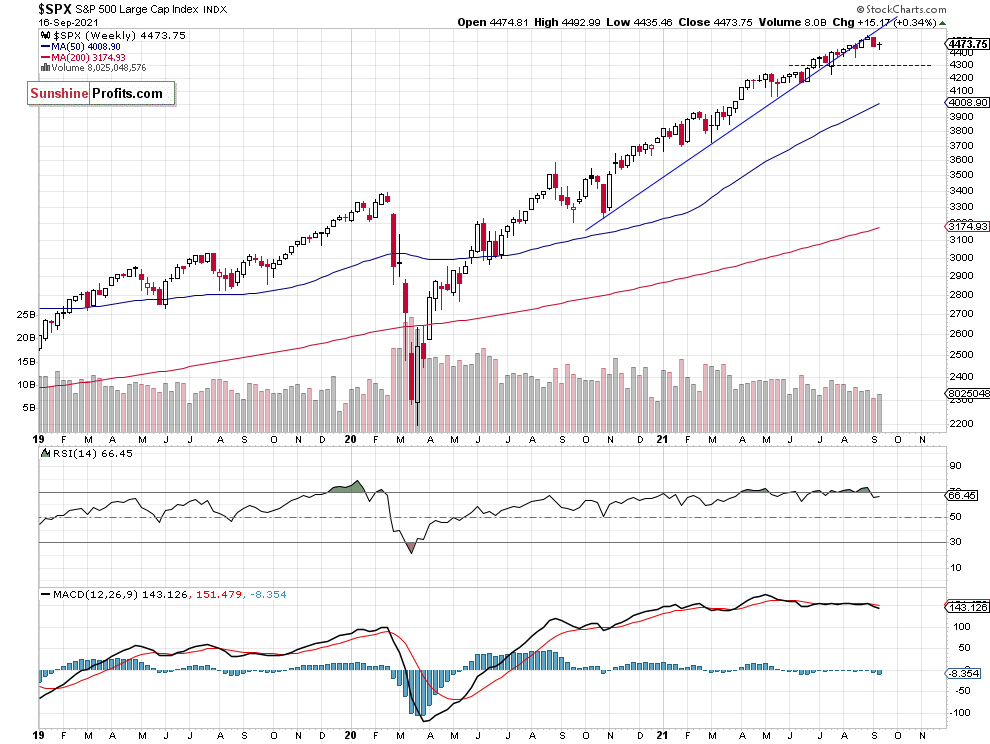

The S&P 500 index broke beneath its medium-term upward development line a number of weeks in the past. Nevertheless, it’s nonetheless comparatively near the file excessive. The closest necessary help degree is at 4,300, as we are able to see on the weekly chart:

Dow Jones Trades Inside A Consolidation

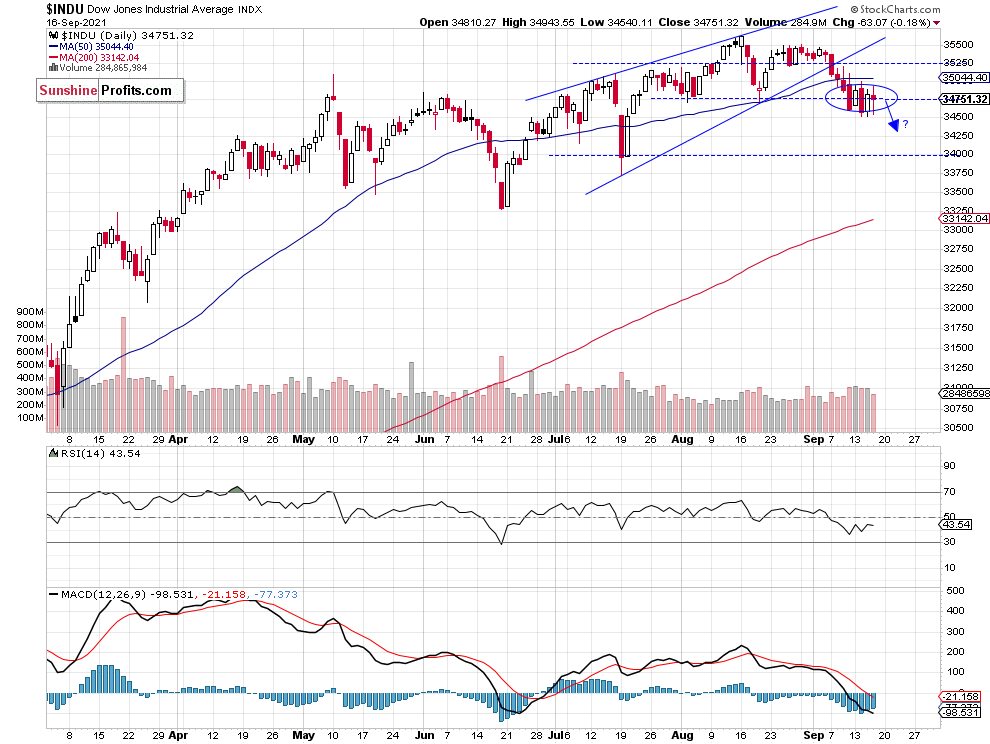

Let’s check out the chart. The blue-chip index broke beneath a possible two-month-long rising wedge downward reversal sample lately. It remained comparatively weaker in August-September, because it didn’t attain a brand new file excessive just like the S&P 500 and the . The help degree is now at round 34,500 and the close to resistance degree is at 35,000, marked by the current help degree, as we are able to see on the each day chart:

Apple At Help Stage

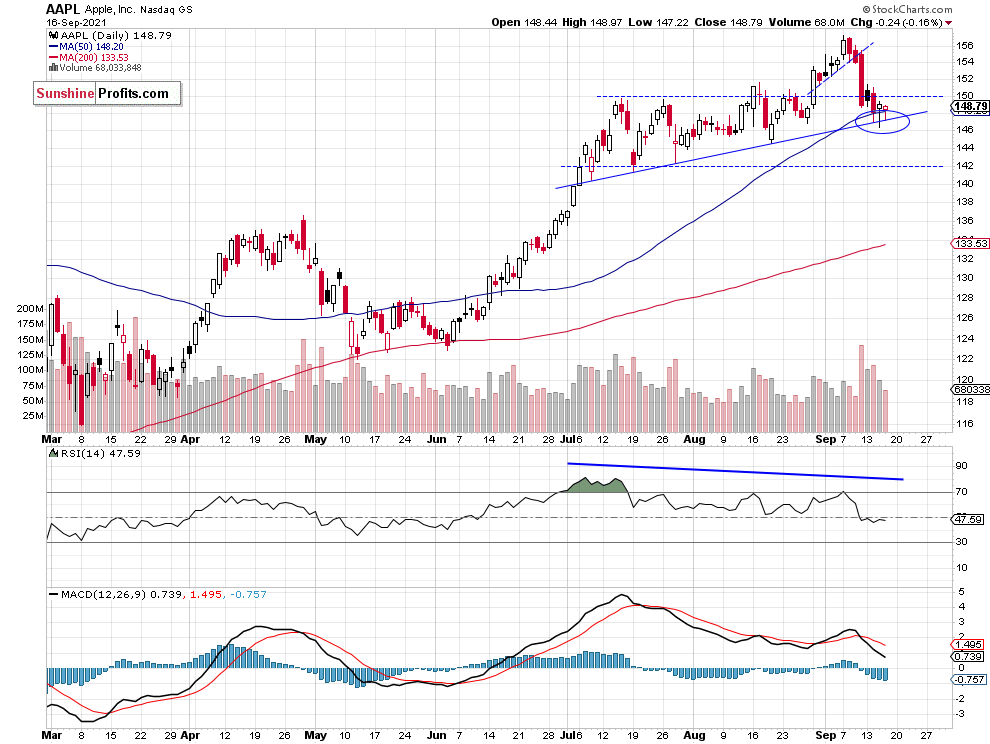

Apple Inc (NASDAQ:) inventory weighs round 6.3% within the S&P 500 index, so it is vital for the entire broad inventory market image. Final week it reached a brand new file excessive of $157.26. And since then it has been declining. So it seemed like a bull entice buying and selling motion. On Friday the inventory accelerated its downtrend following an unfavorable federal choose’s ruling. We will nonetheless see unfavourable technical divergences between the worth and indicators and a possible topping sample. The inventory is at an over two-month-long upward development line – it’s a ‘make or break’ state of affairs.

Conclusion

The S&P 500 index continued to commerce inside a short-term consolidation yesterday. It’s been every week for the reason that market reached the present value ranges. So is that this a flat correction inside a downtrend or some bottoming sample? Right now we’ll almost definitely see one other flat opening of the buying and selling session – later within the day we might even see some extra volatility due to a quarterly derivatives expiration often known as ‘quadruple witching Friday.

The market appears overbought, and we might even see some extra profound downward correction quickly. Due to this fact, we predict that the quick place is justified from the chance/reward perspective.

Right here’s the breakdown:

- The market retraced extra of its current advances this week, because the S&P 500 index prolonged its decline beneath 4,450 degree.

- Our speculative quick place continues to be justified from the chance/reward perspective.

- We expect a 5% or greater correction from the file excessive.

[ad_2]