[ad_1]

Bitcoin follows what Senior Commodity Strategist for Bloomberg Intelligence, Mike McGlone, calls an “enduring trajectory”. The benchmark crypto is among the best-performing property in historical past, because the knowledgeable mentioned in a latest report, and could be on monitor to document contemporary positive factors within the second half of 2022.

On the time of writing, BTC’s worth trades at $23,900 with a 3% revenue over at the moment’s buying and selling session and a 2.4% revenue over the previous week. The cryptocurrency appears to be trending upwards on the again of a lower in inflationary expectations for July’s Shopper Worth Index (CPI) print.

This metric has been recording multi-decade highs forcing the U.S. Federal Reserve (Fed) to take measures by lowering its stability sheet and climbing rates of interest. Thus, making a hostile financial atmosphere for risk-on property, equivalent to Bitcoin and equities.

The cryptocurrency would possibly profit from deflationary forces, McGlone believes. Bloomberg’s Commodities Index, and the value of key commodities, equivalent to Oil and Copper, are hinting at this pattern.

In that sense, the consultants anticipate property with fastened provides to rally. This might set Gold and Bitcoin to hit $2,000 and $100,000, respectively, in the long run.

McGlone believes that the benchmark crypto is turning into a extra secure, and fewer dangerous asset. This might translate into BTC working as a “high-beta model of the steel (Gold) and Treasury bonds”.

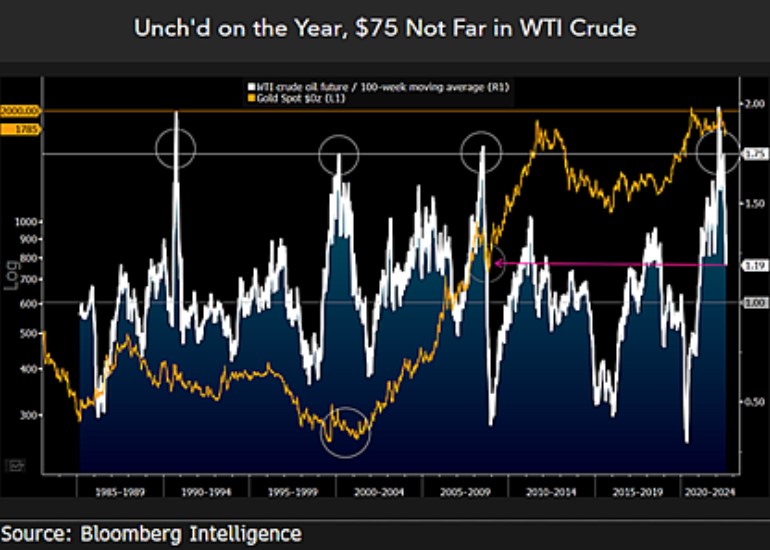

The value of Bitcoin and Gold would possibly begin “accelerating”, the report says, if the West Texas Intermediate (WTI) oil, a benchmark for oil pricing, follows the draw back pattern in commodities. McGlone wrote:

It’s a query of provide, demand and adoption within the subsequent 14 years that ought to drive costs, and we see little cause to complicate what look like enduring trajectories, notable in advancing expertise (…).

The Different Facet Of The Coin, Why Bitcoin May Maintain Its Features

As seen beneath, the value of WTI oil broke above an necessary resistance stage in 2021. McGlone famous that the value of Gold and oil have been traditionally inversely correlated.

Thus, why he appears satisfied that oil is hinting at appreciation for the dear steel and its 2.0 model, Bitcoin. The Bloomberg Intelligence knowledgeable mentioned:

Our bias is tilted towards extra of the identical pendulum (Oil down with Gold rising) swinging tendency for oil to proceed downward in 2H. To the extent that sinking copper portend world deflationary developments and the potential for an finish of Fed charge hikes, gold ought to acquire underpinning to breach $2,000 an oz.

[ad_2]