[ad_1]

We surveyed greater than 1,000 members of the sandwich technology—individuals who look after each their kids and their mother and father. Right here’s what they advised us.

John Latona, basic supervisor at Haven Life, is aware of all concerning the fear. His father simply turned 91, his mom is in her late 80s, and whereas each mother and father nonetheless stay independently, Latona says “I’m simply ready for the decision.” He and his spouse have two kids, each beneath seven years previous, and each few months they make the 10-hour journey to go to Latona’s mother and father and guarantee everybody’s doing okay — however even this association received’t be viable long-term. “There’s going to be some extent the place my mother and father want extra assist.”

That’s going to be the truth for lots of Individuals: Sooner or later, your aged mother or father(s) are going to wish extra assist, and we’re going to wish to determine the right way to present it. The Pew Analysis Middle stories that, as of 2013, almost half of adults (47%) of their 40s or 50s had a mother or father age 65 or older and have been concurrently both elevating a younger baby or serving to a grown baby financially — and roughly 15% of middle-aged adults have been offering monetary help to each a mother or father and a toddler.

Individuals who present long-term care to each older kinfolk and rising kids are also known as the “Sandwich Era,” since they’ve tasks urgent in on each side. What do these sandwiched household caregivers want — each to assist their members of the family and to assist themselves?

The Sandwich Era Report, carried out by on-line life insurance coverage company Haven Life, interviewed 1,078 contributors between the ages of 30-55 years previous who self-identified as offering care or decision-making help to each a dependent baby (or kids) and getting old mother and father. Our objective was to study extra about the place the Sandwich Era feels probably the most pressure, in addition to what they consider may present probably the most assist as they proceed to navigate this financially and emotionally tough life stage.

The Sandwich Era feels overwhelmed, usually or continuously

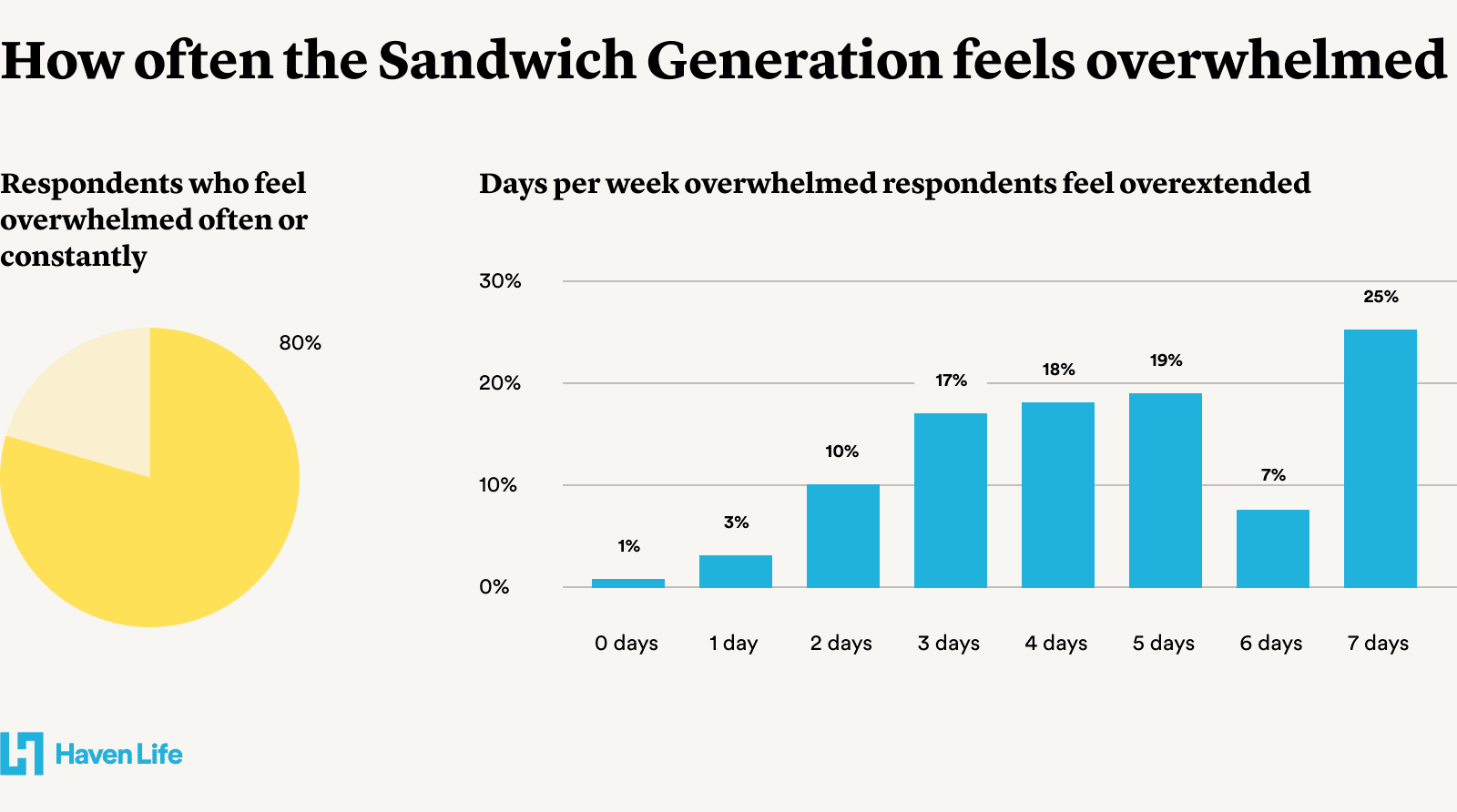

Unsurprisingly, the vast majority of survey contributors reported feeling overwhelmed with their tasks. In actual fact, 80% of respondents really feel overwhelmed usually or continuously. These identical people additionally indicated they really feel overextended almost 5 out of seven days of the week on common.

Whether or not these within the Sandwich Era are actively concerned in day-to-day parental care or try to have tough conversations with older kinfolk from a distance, balancing new caregiving tasks with present tasks to companions, younger kids and careers turns into extraordinarily tough — and very anxious.

The Sandwich Era wants assist with monetary planning, decision-making and psychological well being

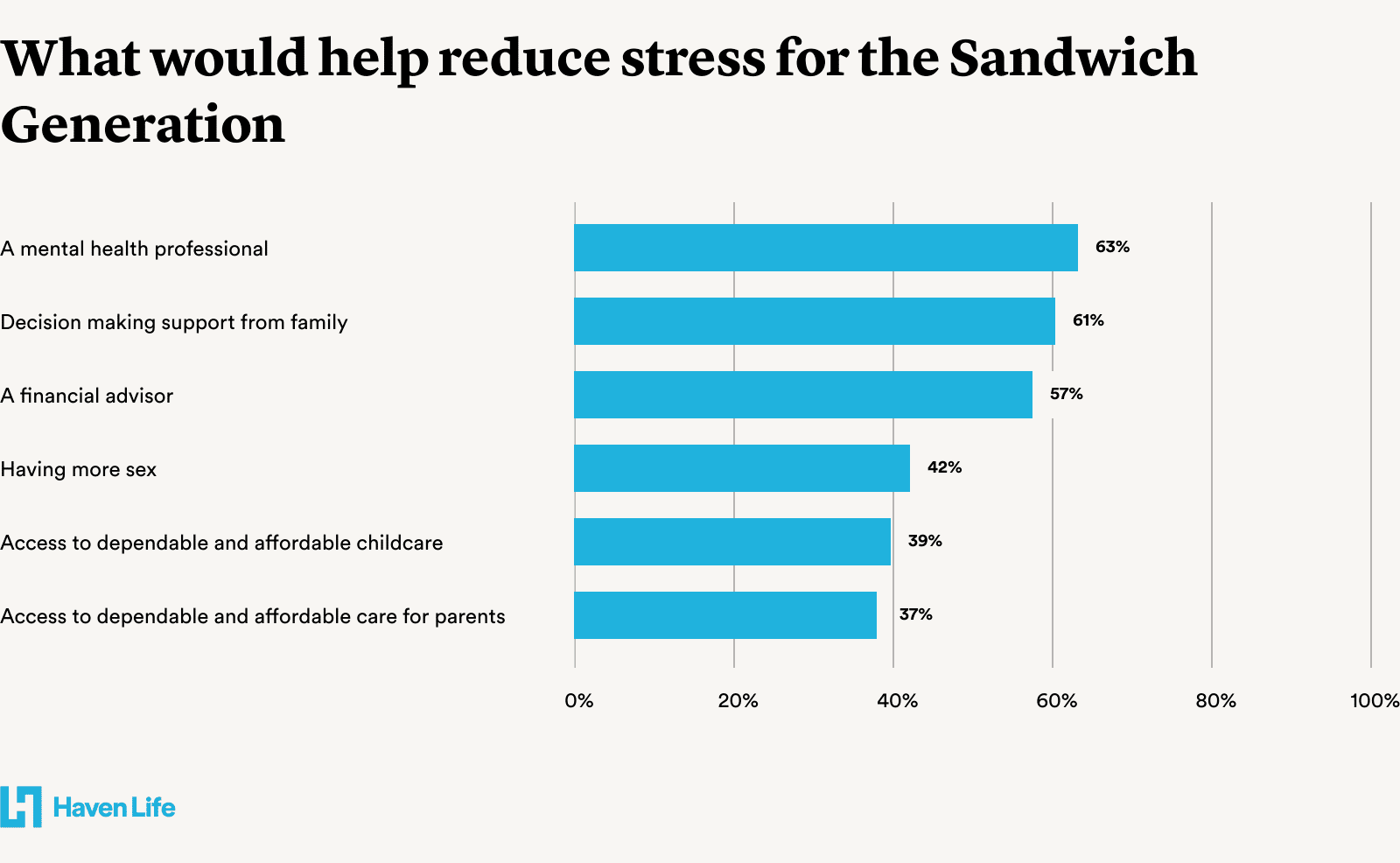

What do Sandwich Era caregivers need? Extra help. When requested what would assist to cut back their stress, the highest three selections chosen by respondents included entry to a psychological well being skilled (63%), decision-making help from their household (61%) and a monetary advisor (57%). And, if given the selection, they’d desire these sorts of long-term help programs over day-to-day help like childcare or in-home care.

Kim Egel, a licensed marriage and household therapist in San Diego who works with purchasers each in particular person and nearly throughout the nation, needs Sandwich Era caregivers to grasp the significance of prioritizing their very own psychological well being. “There are penalties for not making time for one thing [your mental health] you may’t neglect.” Egel notes that, though a weekly or bi-weekly remedy appointment may look like yet another merchandise on the calendar, prioritizing psychological well being can truly save caregivers time in the long term — by giving them a chance to course of sophisticated ideas and emotions, for instance, as a substitute of ruminating on their nervousness, anger and worries all day (and, as many Sandwich Era caregivers know properly, all evening).

“I believe typically, the emotions simply want an area to be heard,” Egel says. A psychological well being skilled can present a recent perspective, counsel self-care methods, prescribe medicine if essential and easily present emotional help to individuals who may really feel prefer it’s their duty to help everybody else.

Sleep and self-care are almost definitely to endure

Plenty of busy Individuals really feel sleep-deprived. And whenever you’re coping with each the psychological load and monetary duty concerned in caring for getting old mother and father and younger kids, you’re in all probability getting even much less sleep than ordinary. You additionally in all probability don’t have numerous time for self-care, which will be outlined because the restorative features of life (train, socializing, relaxation and rest) and is crucial for stopping burnout. At this level, a caregiver watching over their aged mother and father and children might really feel like they’re compromising their very own well being and well-being.

As Dr. Emily Nagoski and Amelia Nagoski clarify of their e book Burnout: The Secret to Unlocking the Stress Cycle, the standard particular person must spend roughly 42 p.c of their time at relaxation. That’s 8 hours of sleep and two hours of restorative self-care per day, give or take — and Sandwich Era members usually tend to give that point to others than take it for themselves.

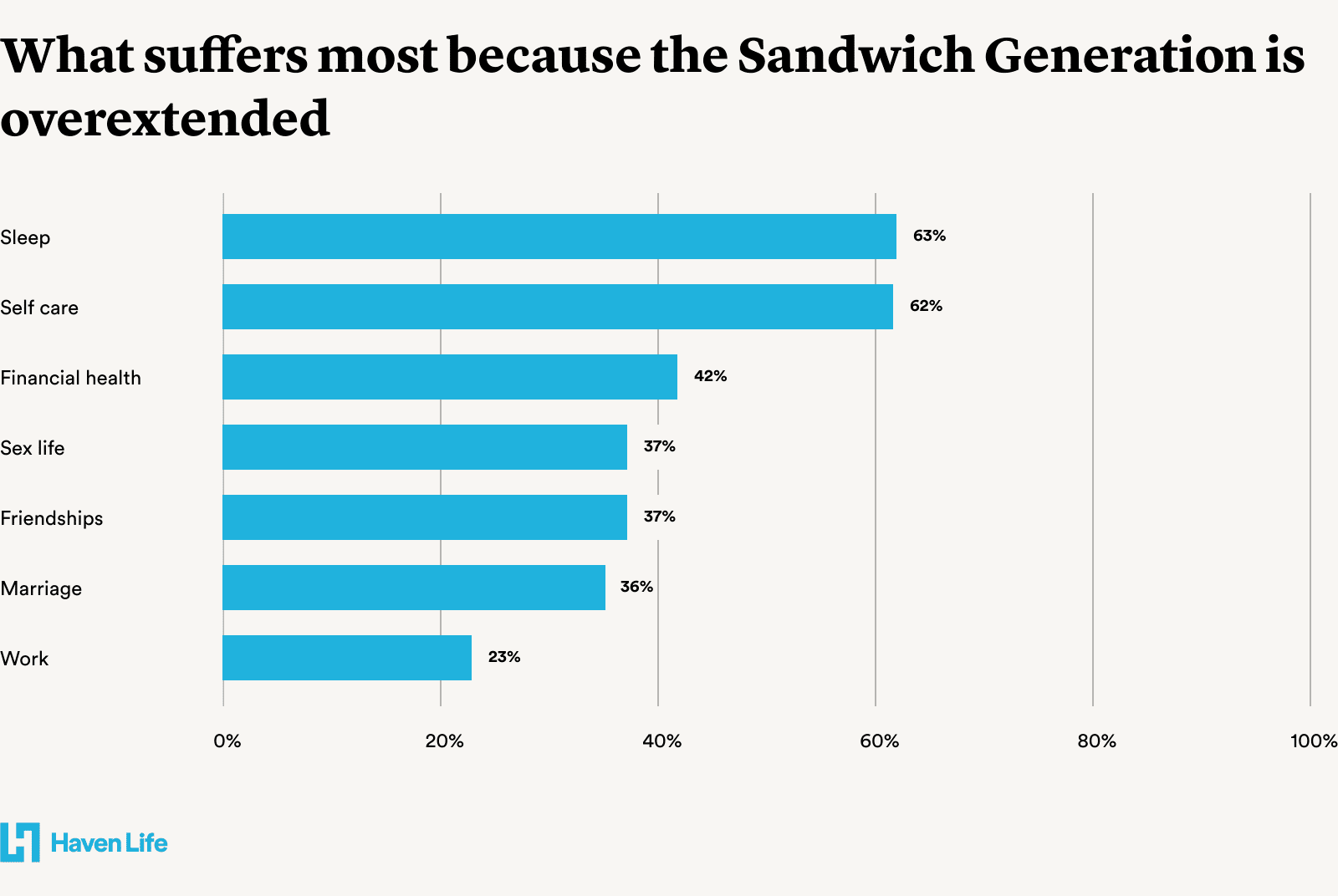

Our survey respondents cited each sleep and self-care as two of the three features which had suffered most since they took on Sandwich Era tasks. The highest three selections included self-care (63%), sleep (62%) and monetary well being (43%). Once you’re caring for others, it’s laborious to look after your self — and, as many individuals shortly study, it prices some huge cash.

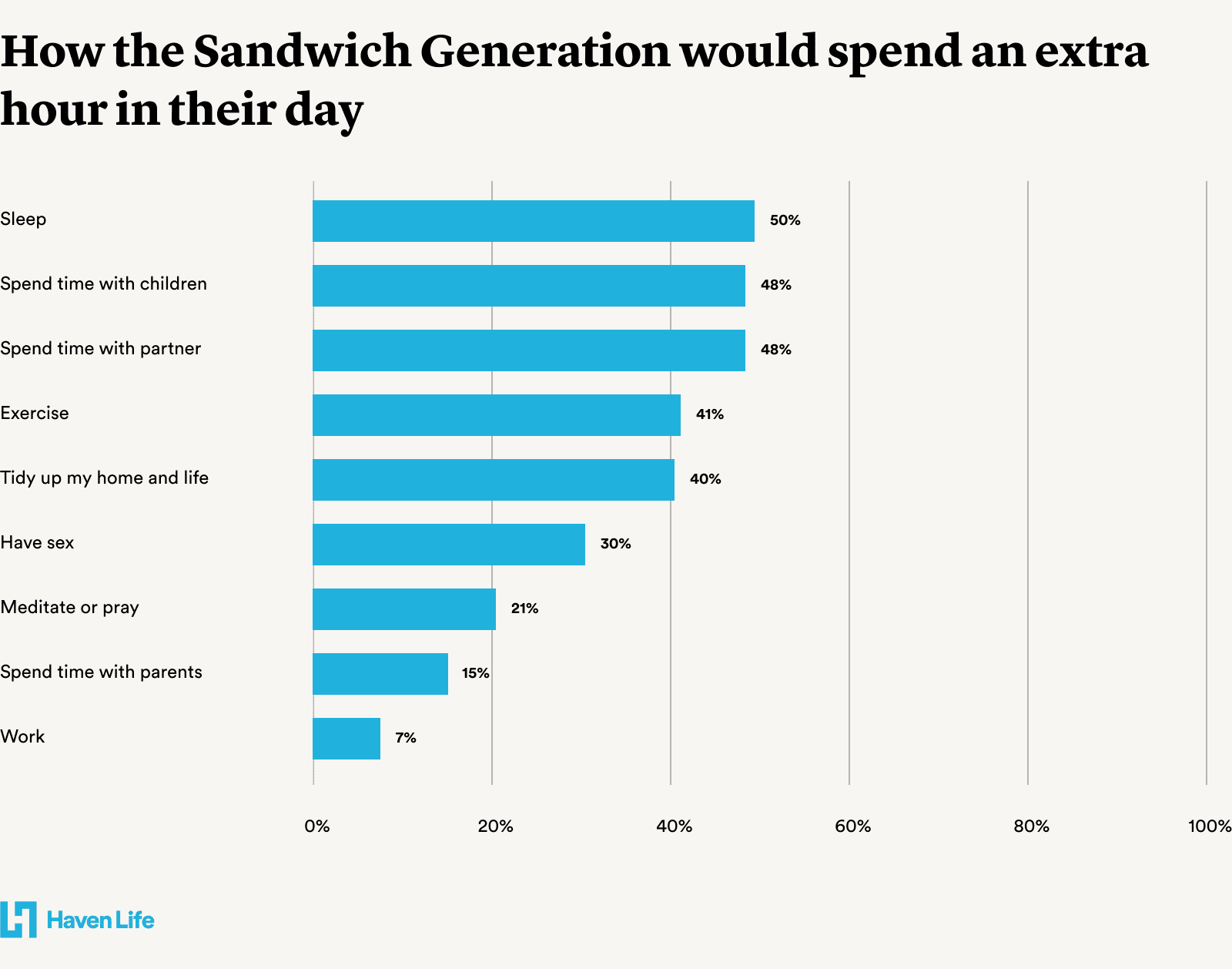

If the Sandwich Era had an additional hour of their day, they’d put it to good use. Respondents indicated they’d spend time with their kids and companion and seize some further slumber.

The Sandwich Era is struggling to save lots of for his or her retirement

Serving to your mother and father by means of their retirement years usually conflicts with saving on your personal retirement — as does elevating kids. Fifty-nine p.c of survey respondents anticipate to financially help their mother and father or in-laws as they age.

Whether or not Sandwich Era members downscale their careers to spend extra time with getting old household or take out loans to assist cowl their kids’s instructional bills, they usually discover themselves having to rethink their very own long-term monetary objectives.

Fifty-nine p.c of the Sandwich Era anticipate to financially help their mother and father or in-laws as they age

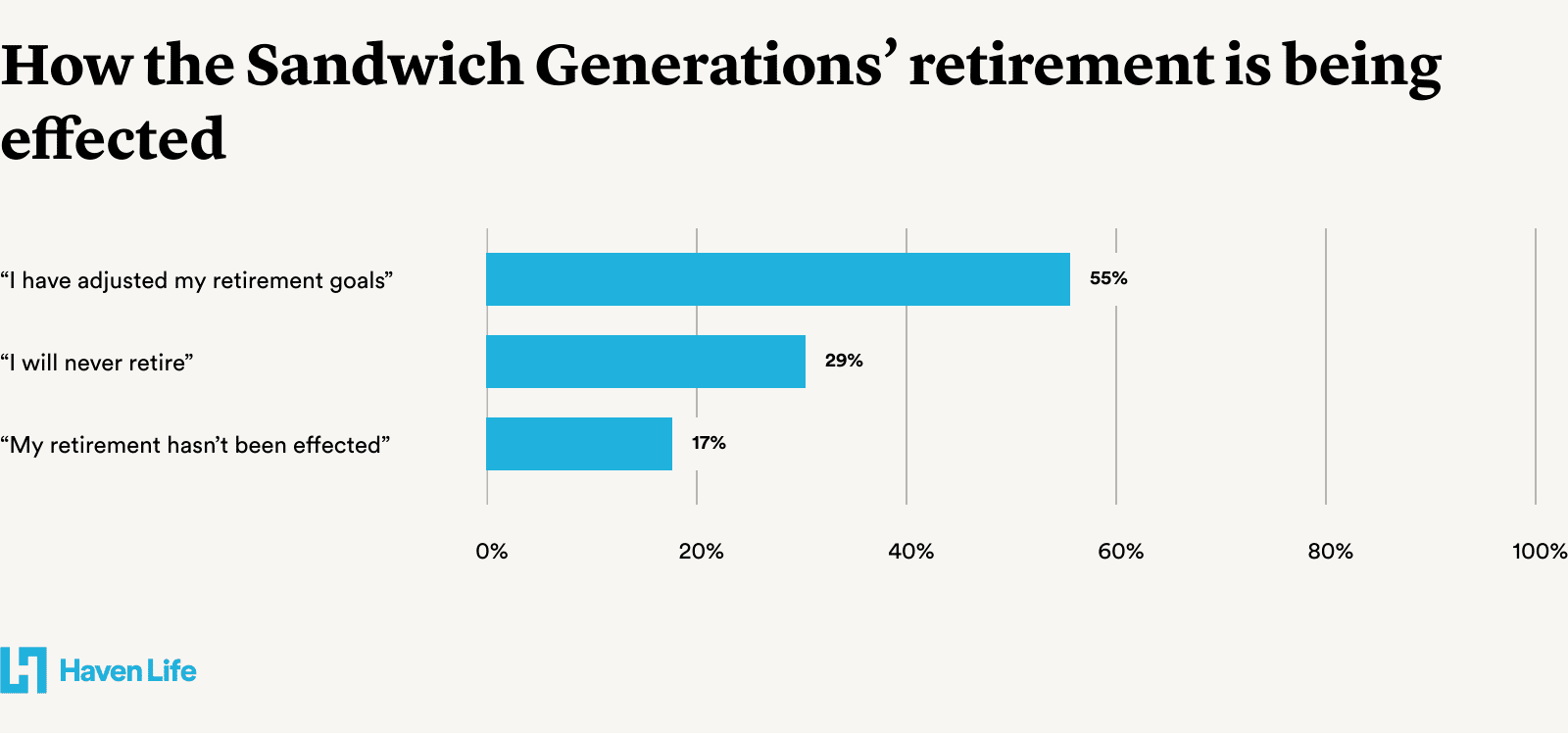

Fifty-five p.c of our survey contributors report that they’ve adjusted their retirement objectives because of their monetary tasks. A further 29% of the Sandwich Era really feel that they may by no means be capable to retire, which is a barely greater ratio when in comparison with the typical American (23% based on a latest research). General, our survey contributors who felt overwhelmed by their tasks have been extra more likely to report that they’d by no means retire.

As creator Laura Zigman lately wrote in a strong New York Instances essay about caring for 2 generations concurrently: “It didn’t happen to me then how caretaking would have an effect on me financially — my potential to earn, to generate work, to protect our financial savings and retirement — for years to return.”

Mary Beth Storjohann, CERTIFIED FINANCIAL PLANNER(TM) skilled and the founding father of Workable Wealth, advises Sandwich Era members to think twice earlier than slicing again on a profession or pulling cash out of retirement accounts. Keep in mind that you’re not simply giving up right now’s wage or financial savings; you’re additionally giving up all cash you may be incomes sooner or later, whether or not by means of funding progress or profession progress. “Have a look at the numbers first and make an informed choice,” Storjohann says. There is perhaps artistic choices that you simply and your loved ones haven’t but thought of, that may enable your mother and father to get the assistance they want with out requiring you to surrender a job or jeopardize your personal monetary safety.

For those who do determine to make use of a part of your nest egg to assist getting old mother and father or members of the family, Storjohann suggests making a plan to pay your self again. “For those who’re spending down your personal financial savings to assist your loved ones, what is going to it take from you, and what sort of modifications will you have to make to your personal monetary plan, to switch that?”

Nearly all of the Sandwich Era has monetary safety

Given the large tasks of offering bodily, emotional and monetary help for his or her mother and father and children, the Sandwich Era appears to grasp the significance of monetary safety — with two-thirds of survey respondents having life insurance coverage. For this group particularly, life insurance coverage is a vital security web for guaranteeing that your family members will likely be taken care of financially when you have been to die.

Of these with out life insurance coverage, 66 p.c of survey respondents reported that being a member of the Sandwich Era prevents them from getting protection — and Sandwich Era caregivers who felt overwhelmed have been much less more likely to have a coverage.

Two out of three (61%) Sandwich Era respondents have life insurance coverage

Storjohann advises her purchasers to begin pondering forward concerning the monetary plans and protections they’ll have to put into place earlier than they turn into full-fledged Sandwich Era caregivers — and to hunt out skilled help to keep away from any monetary burdens down the street. “For those who’re attempting to plan on your personal monetary future and your mother and father’, get skilled assist. It’s not one thing you need to attempt to do by yourself.” A caregiver on a finances can search out hourly-rate monetary planners by means of respected providers just like the XY Planning Community or the Garrett Planning Community.

Storjohann notes that discovering a impartial third get together that can assist you navigate the funds of elder care also can assist with a number of the extra thorny emotional features as properly. Monetary planners can also be capable to assist caregivers have tough conversations with their mother and father, whether or not these conversations contain budgeting, downsizing or just getting an correct image of a mother or father’s monetary belongings. As soon as you start speaking along with your mother and father about their monetary wants — a dialog which Storjohann suggests having as early as attainable — a trusted monetary planner may help you leverage each your and your mother and father’ assets successfully.

That method, you’ll have one much less factor to fret about — and can be capable to dedicate extra of your time in direction of taking good care of your family members, elevating kids, and taking good care of your self.

Survey methodology: Haven Life carried out a quantitative survey between January 23 – 28, 2020 and picked up N=1,078 accomplished responses. Respondents have been required to be between 30-55 years previous, have dependent younger or grownup kids and supply decision-making help or look after at the very least one mother or father. About 75% of respondents have been between the ages of 30 – 44, and 58% of respondents have a family earnings between $25,000 – $100,000.

Our editorial coverage

Haven Life is a customer-centric life insurance coverage company that’s backed and wholly owned by Massachusetts Mutual Life Insurance coverage Firm (MassMutual). We consider navigating selections about life insurance coverage, your private funds and general wellness will be refreshingly easy.

Our editorial coverage

Haven Life is a buyer centric life insurance coverage company that’s backed and wholly owned by Massachusetts Mutual Life Insurance coverage Firm (MassMutual). We consider navigating selections about life insurance coverage, your private funds and general wellness will be refreshingly easy.

Our content material is created for instructional functions solely. Haven Life doesn’t endorse the businesses, merchandise, providers or methods mentioned right here, however we hope they’ll make your life rather less laborious if they’re a match on your scenario.

Haven Life is just not licensed to offer tax, authorized or funding recommendation. This materials is just not meant to supply, and shouldn’t be relied on for tax, authorized, or funding recommendation. People are inspired to seed recommendation from their very own tax or authorized counsel.

Our disclosures

Haven Time period is a Time period Life Insurance coverage Coverage (DTC and ICC17DTC in sure states, together with NC) issued by Massachusetts Mutual Life Insurance coverage Firm (MassMutual), Springfield, MA 01111-0001 and provided solely by means of Haven Life Insurance coverage Company, LLC. In NY, Haven Time period is DTC-NY 1017. In CA, Haven Time period is DTC-CA 042017. Haven Time period Simplified is a Simplified Challenge Time period Life Insurance coverage Coverage (ICC19PCM-SI 0819 in sure states, together with NC) issued by the C.M. Life Insurance coverage Firm, Enfield, CT 06082. Coverage and rider kind numbers and options might differ by state and will not be out there in all states. Our Company license quantity in California is OK71922 and in Arkansas 100139527.

MassMutual is rated by A.M. Greatest Firm as A++ (Superior; Prime class of 15). The ranking is as of Aril 1, 2020 and is topic to vary. MassMutual has obtained completely different scores from different ranking businesses.

Haven Life Plus (Plus) is the advertising and marketing identify for the Plus rider, which is included as a part of the Haven Time period coverage and affords entry to further providers and advantages for free of charge or at a reduction. The rider is just not out there in each state and is topic to vary at any time. Neither Haven Life nor MassMutual are answerable for the availability of the advantages and providers made accessible beneath the Plus Rider, that are supplied by third get together distributors (companions). For extra details about Haven Life Plus, please go to: https://havenlife.com/plus.html

[ad_2]