[ad_1]

Time to ask a pertinent query at this stage of our macro journey: What if?

No, not the ‘what if’ of the assorted worst case eventualities which are presently being propagated throughout us, and lots of with nicely based issues thoughts you.

No, I’ve been presenting these arguments myself for some time and readers are nicely conscious of those. Relatively I wish to spotlight a wholly completely different ‘what if’ situation, that of the bullish facet, no less than for some time.

I’ll spotlight 3 mission important themes on this article: Technical & macro context outlined in January, an replace on the not too long ago outlined trifecta, and a few notable market historical past.

First the technical and macro context.

Rewind to the start of January.

As was making new all time highs into 4800, Wall Road proposed largely bullish worth targets for the tip of the yr with some skeptics among the many outlook:

Jonathan Ferro Tweet

There was little to no discuss of an enormous correction dropping SPX into 3850 because it has completed twice now. Relatively, what we’ve seen is the all acquainted Wall Road recreation of elevating goal costs on the best way up after which reducing them on the best way down:

Sven Henrich Tweet

And so that you go from a 5,100 worth goal to a 3,600 threat goal in a matter of some months. Which will have been useful in the beginning of the yr earlier than main buyers off the cliff, not after a lot of the harm has already been completed, however that’s simply an ordinary script we’ve seen unfold time and time once more.

However my level right here is to not bash Wall Road, however somewhat to supply context, for nothing that has occurred right here to this point is a shock. At the least to me or readers I hope.

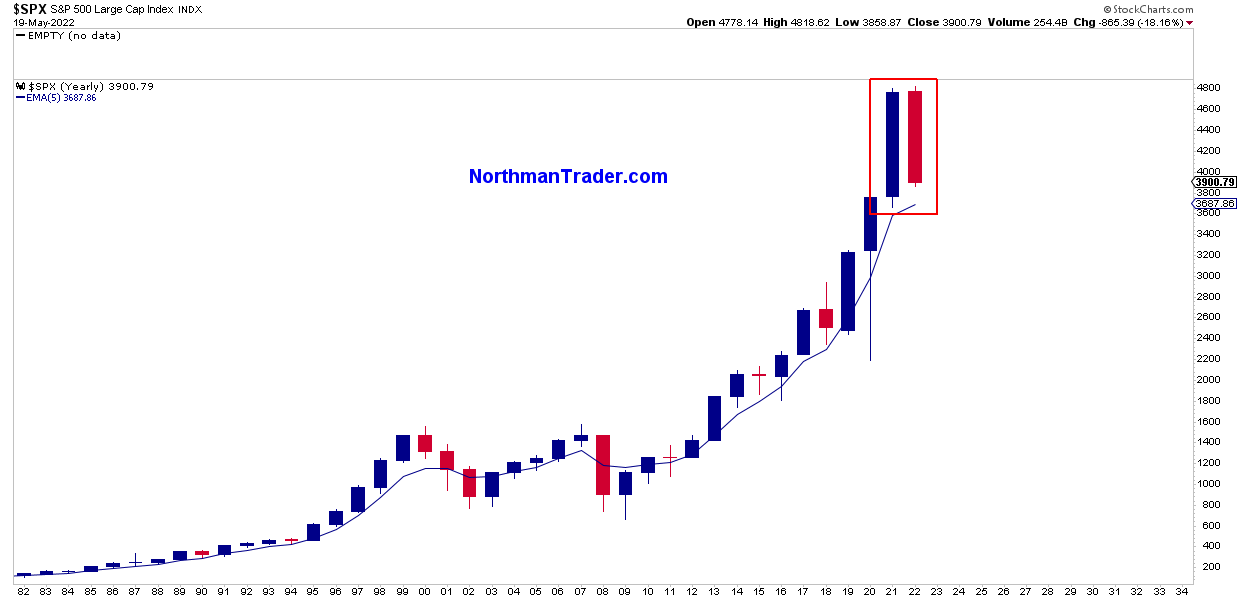

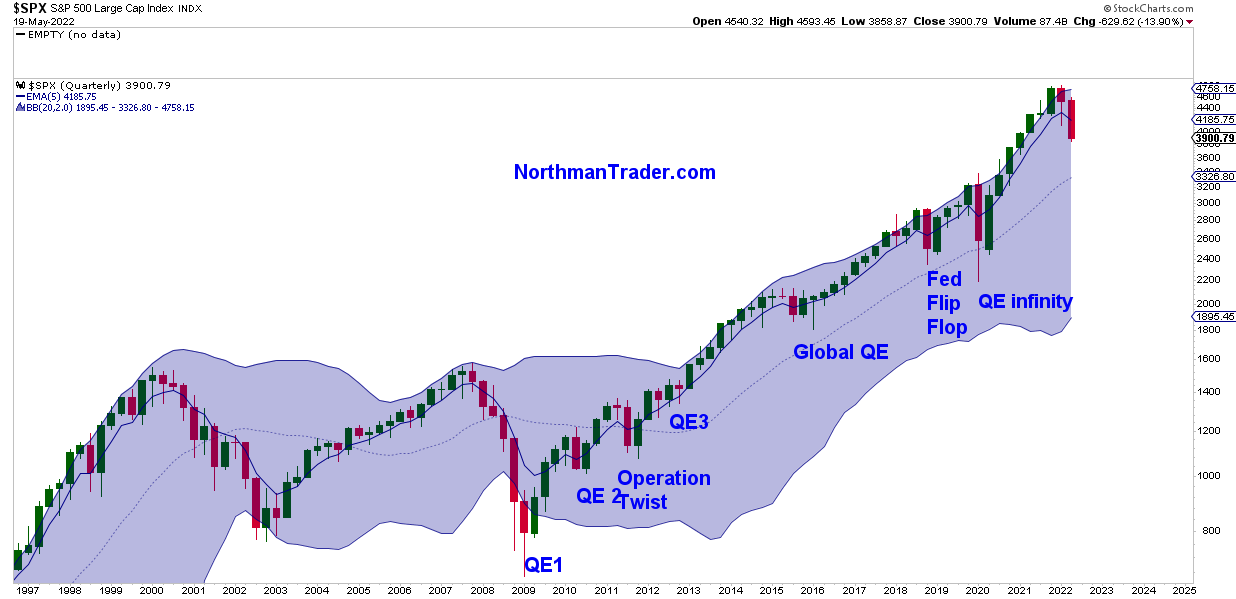

For one, on the identical time when the lofty worth targets have been printed I supplied a quite simple chart, that of the yearly 5 EMA on SPX and it confirmed a large technical disconnect suggesting a reconnect of backfilling of the disconnect to come back:

Sven Henrich Tweet

Properly, right here we’re:

We don’t have full reconnect because the 5 EMA has dropped together with worth and that full reconnect might nicely nonetheless come this yr, all the time potential, however frankly a giant rally from right here might additionally increase the 5 EMA and reconnect it after the actual fact for it was at 3985 in the beginning of the yr.

However as I’ve acknowledged above, the additional bear case has deserves and it might get loads worse within the years to come back in fact with a primary cease on the weekly 200MA which has been a market pivot a number of instances over time:

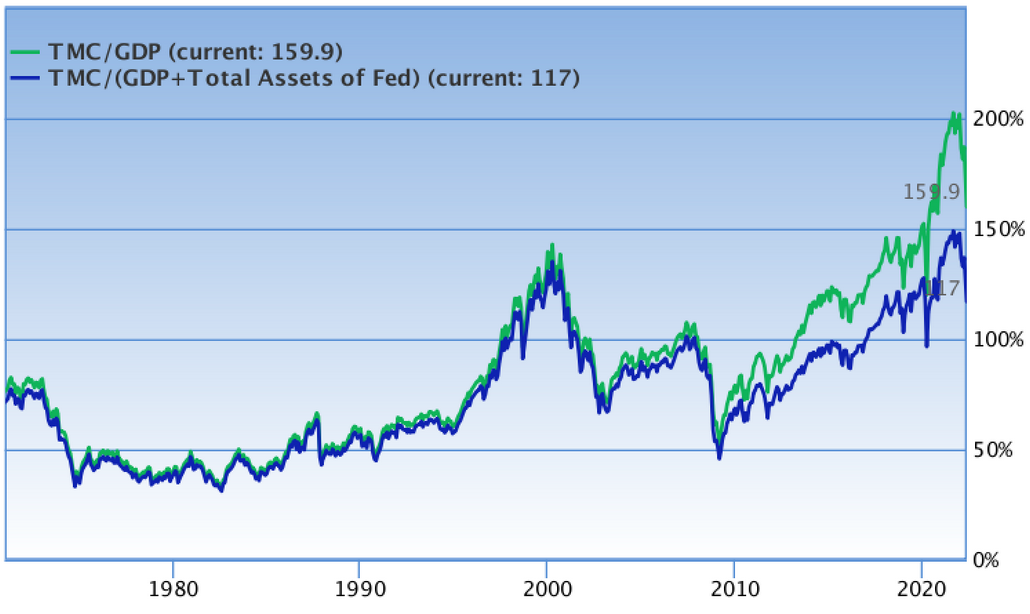

And if the present bear market is just the start of what’s to come back, then issues might worsen, a lot worse. In any case, markets stay vastly prolonged by way of historic valuations, specifically market cap to GDP:

The 2000 and 2007 bubbles bursting didn’t backside till that ratio hit 75% and 50%, respectively, and we’re nonetheless at 160% coming from over 200% in January, a difficulty I had once more highlighted on Jan. 2 in “Handicapping the 2022 On line casino”

In that article I supplied a central premise:

“What can be honest market worth? Who’s to say, reality is the 4 largest central banks have stability sheets of over $32 trillion mixed, the worldwide monetary system is already solely distorted and these stability sheet can’t be lowered with out collapsing markets so that they received’t normalize their stability sheets. Utilizing liquidity normalized P/Es, earnings & historic market cap to GDP ratios I could make the case from wherever between $SPX 2500 to $SPX 3,800 relying on what issue dominates. As we’ve seen up to now few years honest market worth presently doesn’t apply. Possibly some day it should, however it might require central banks to both lose management or be out of the market.

Therefore you possibly can firmly odor the script for 2022 can’t you? Whereas now we have preliminary tailwinds of nonetheless liquidity coming in and nice preliminary earnings reviews in February for This autumn 2021 the celebration is quickly coming to an finish and the Fed will wish to curb inflation with out inflicting a recession which shall be an actual activity. Learn how to accomplish it?

Simple, let markets drop, however not a lot that it causes a systemic occasion however sufficient that yr over yr inflation numbers drop, declare victory after which flip flop coverage once more to forestall any main harm to markets by the point mid phrases are on everyone’s thoughts.”

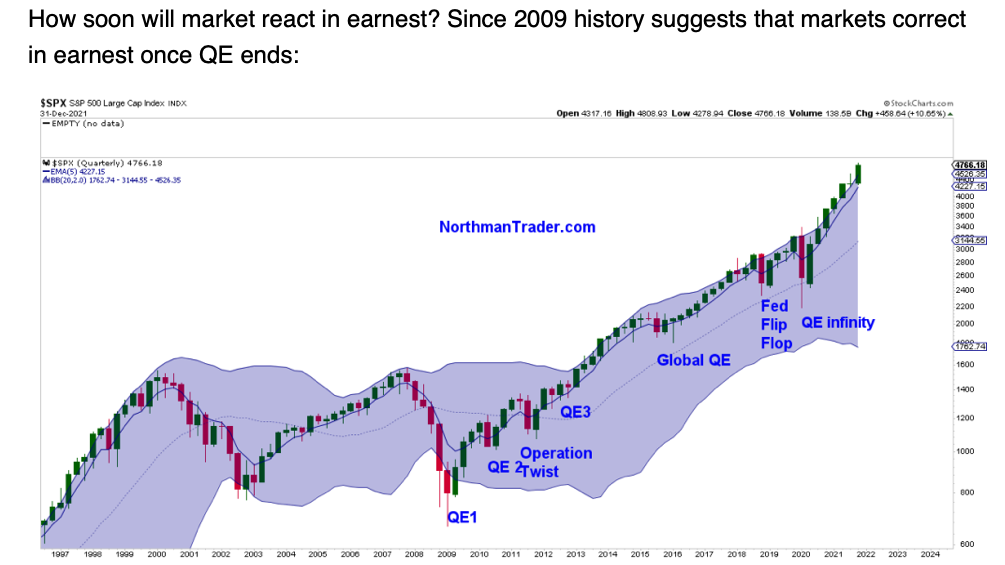

Properly, they’ve let markets drop, with the tip of QE once more being a key set off. Certainly as posed within the January article:

And lo and behold:

Go determine:

S&P 500 After Fed Tapering

It’s all the time the Fed liquidity silly.

On this context the correction primed charts I supplied in “Handicapping the 2022 On line casino” additionally make sense:

January chart:

Now:

NDX January chart:

:

So I submit the script I supplied in January that of “letting markets drop” has certainly performed out.

However they haven’t began decreasing their stability sheets but, a mere 75bp fee hikes in complete to this point with the stability sheet roll off to simply start in June. Yeah, I get all of the chatter of rather more draw back threat. However I am going again to the unique script: “let markets drop, however not a lot that it causes a systemic occasion however sufficient that yr over yr inflation numbers drop.”

Provide chain points they don’t management and demand is already dropping off quickly as customers are pressured into bank card spending to maintain up with inflationary costs.

Asset costs and path of the identical are ever extra intertwined with financial spending, therefore the Fed is once more taking part in with fireplace for a bear market can rapidly push the economic system right into a recession of dimension. Not a well-liked proposition simply forward of midterm elections.

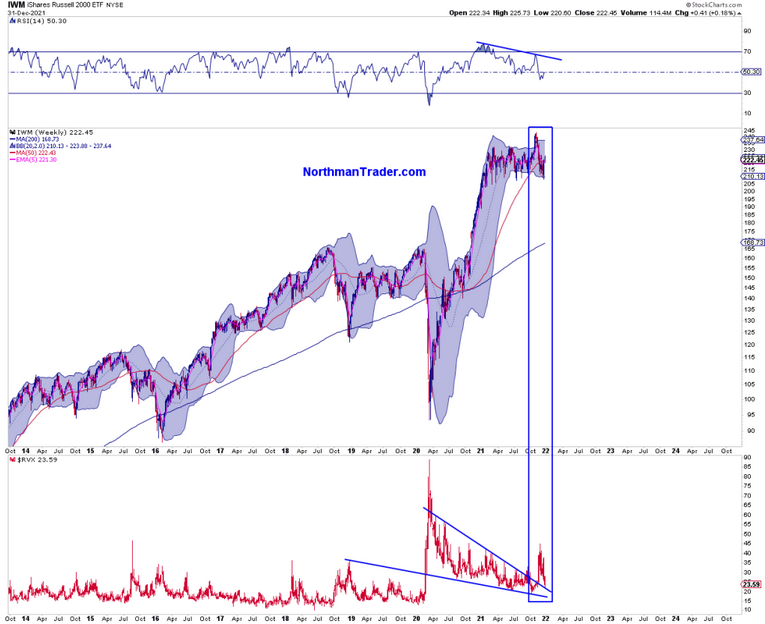

Which brings me to an replace on the trifecta which I highlighted not too long ago in The Unthinkable, specifically that the tightening cycle might have already peaked and laying the groundwork for a serious bear market rally to ensue.

The bear market rally continues to be excellent because the items are nonetheless in technique of falling into place, therefore an replace.

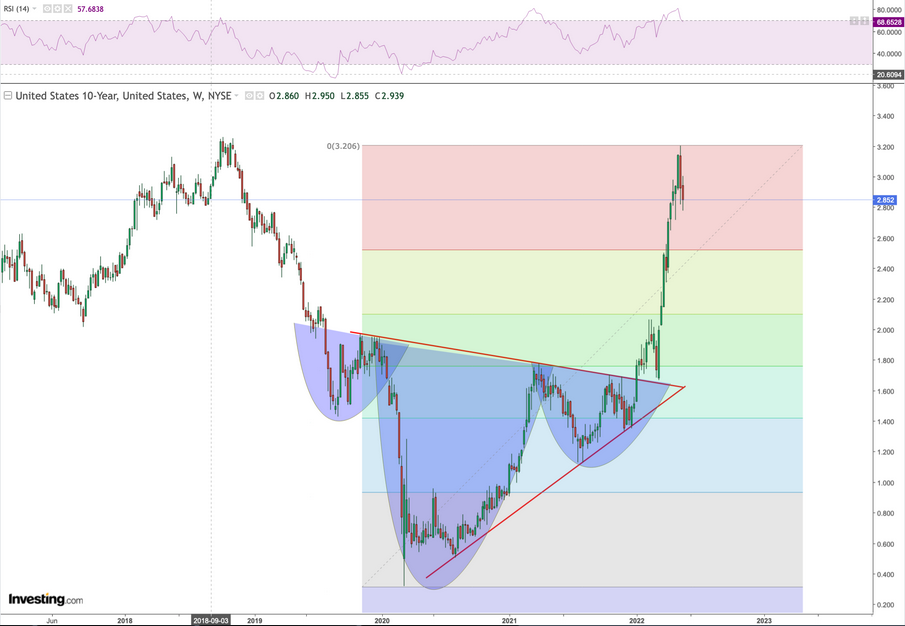

One of many key questions was regarding the with its authentic 3.2% goal I highlighted final yr on this thread:

Sven Henrich Tweet

Lo and behold the ten yr hit exactly 3.2% final week Monday and has since rejected laborious providing the prospect that it certainly has peaked for now:

The didn’t cooperate with a reversal final week till later within the week and that stored stress on equities final week prompting the query the place equities might discover assist if mid week lows weren’t holding and on this prolonged CNBC interview I supplied 3850 as one key assist degree:

Certainly, we hit 3857 shortly thereafter and the greenback peaked on the identical time and reversed providing a large reduction rally within the 5%-6% vary on equities from that 3850 zone. Now the greenback has reversed sizably:

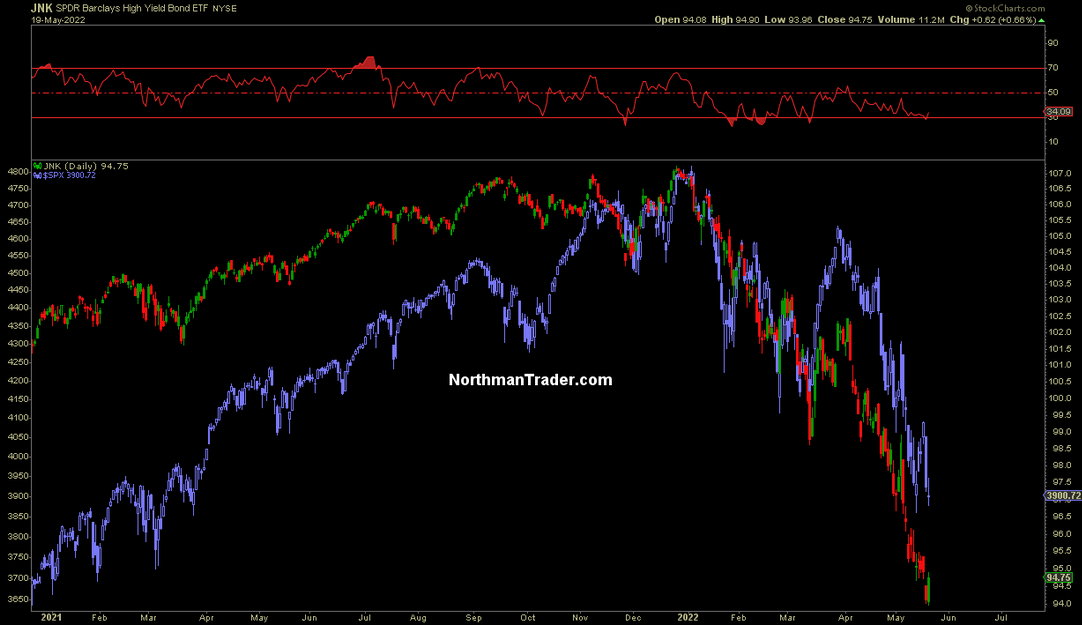

But one a part of the trifecta parts continues to not fall in place with a confirmed reversal and that’s excessive yield credit score, which certainly rolled over to a brand new low this week when a sudden inexperienced candle was supplied on SPDR® Bloomberg Excessive Yield Bond ETF (NYSE:):

This coincided with a retest in in a single day futures Wednesday of final week’s 3850 zone lows on SPX. I keep: If all components of the trifecta can present sustained reversals a large bear market rally can emerge much like what we noticed in bear markets previous.

However the ‘what if’ query presents one other nugget, that of historical past, the third a part of my story right here.

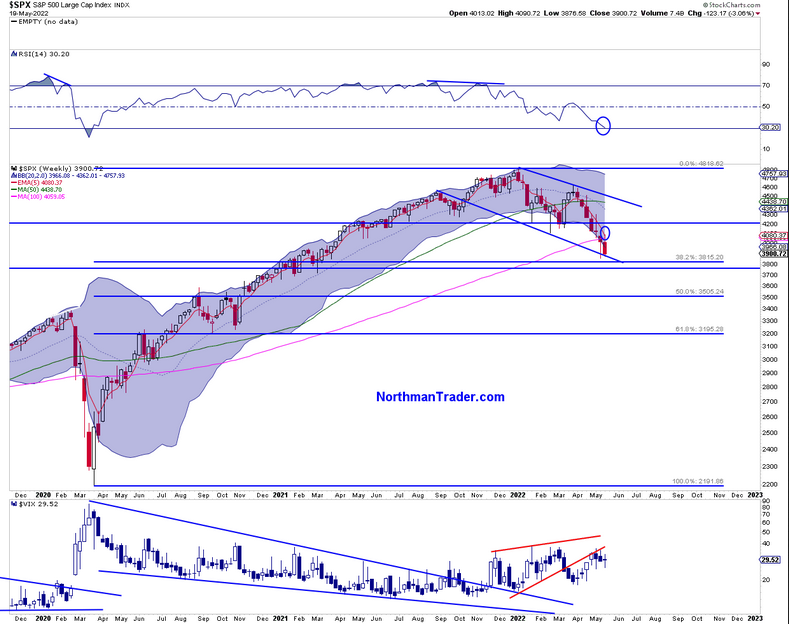

Except markets have been to expertise a weekly shut above SPX 4023.89 on Friday, SPX seems at 7 weekly down weeks in a row precariously near the .382 fib retrace:

How uncommon is that? This uncommon:

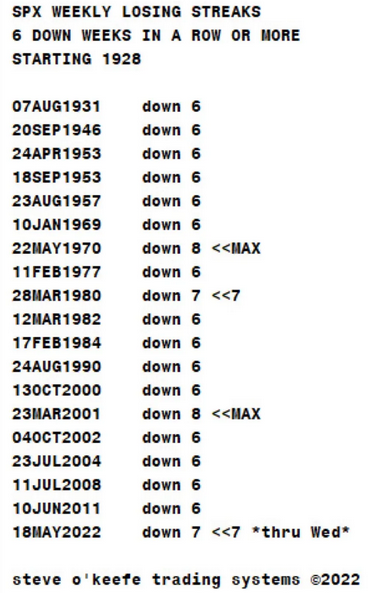

SPX Weekly Dropping Streaks

This has occurred precisely 3 instances. One time for 7 weeks, 2 instances for 8 weeks.

I checked these 3 years:

1970:

It poked decrease even initially for week 9 , however closed that week within the inexperienced and that was then the underside for the yr.

1980:

That was the underside for the yr as nicely.

2001:

That was not the lows for the yr, however ended up producing a 7 week bear market rally.

So the message? Sure maybe extra lows might come or not (i.e., the 3800 zone), but additionally with the view that the one historical past now we have suggests a large shopping for alternative is within the offing which can find yourself being a bear market rally of dimension that lasts for a number of weeks that then rolls over for brand spanking new lows.

However what if we’re seeing the unthinkable really taking part in out? The situation whereby the tightening cycle has certainly peaked, inflation will roll over and the Fed will increase charges by 50bp a pair or extra instances after which quickly slowing knowledge and a mid time period election will trigger the Fed to flip flop and pause?

After which out of the blue collapsed P/E ratios might gentle a shopping for fireplace below this market:

S&P 500 Valuation

Now, granted the flip flop might not occur till there may be extra harm obvious, however that doesn’t preclude a bear market rally first if the trifecta cooperates.

However what in the event that they flip flop following the bear market rally far above the lows? Properly, then we might look again in any respect this and word that the 1970 and 1980 priority eventualities have been certainly the related ones.

All that is too early to find out with any certainty, however in my opinion it’s no less than price asking the ‘what if’ query. Name it FUD for bears.

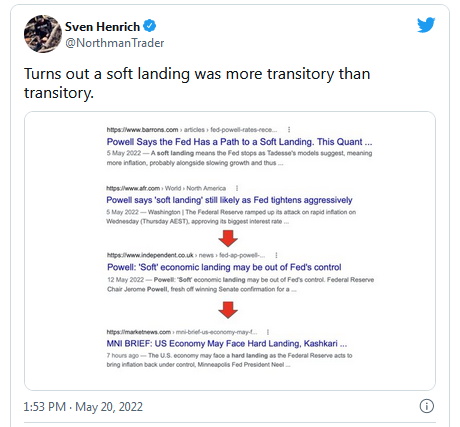

Given the broader macro backdrop for now, the bear rally situation with new lows to comply with stays a base case, however we’ll should additionally hold watching the extreme Fed speeches for his or her ever evolving and altering story strains:

Sven Henrich Tweet

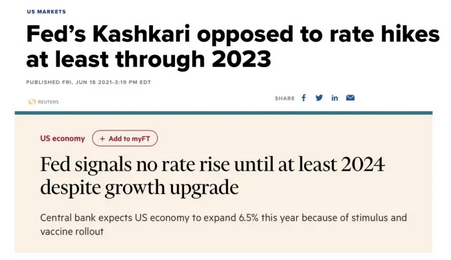

Simply bear in mind what the Fed says has completely no predictive which means about what they’ll really do. They discuss all robust now. However they discuss loads generally:

Fed Kashkari – Assertion On Charge HIkes

So don’t be shocked in the event that they’re secretly on the lookout for any excuse to pause fee hikes in just a few months. Primarily based on Fed, historical past that a part of the equation doesn’t look like price a ‘what if’ however somewhat a “when.’

Backside line: The trifecta charts stay on my radar for clues and historic priority means that present lows or the following bigger set of latest lows provide a bigger shopping for alternative for a large bear market rally to emerge that isn’t measured in hours or days, however somewhat in weeks. After which we re-assess.

QT begins in June. The Fed has an issue. Since 2009 they’ve intervened on any 20% SPX correction and rising bear market. This time they actually can’t with out completely blowing out their credibility and on account of inflation remaining very excessive.

But when markets don’t rally quickly and alleviate stress, the ache of a continued bear market proper sizing the asset bubble they’ve created will carry a couple of deep recession a lot ahead of the Fed is prepared to confess.

For now Powell, Yellen, and the same old suspects are nonetheless cheerleading the “sturdy US economic system.”

Let’s all hope that doesn’t show to be as transitory as their inflation name was final yr or hundreds of thousands can pay for one more Fed coverage error with their jobs and financial nicely being.

Authentic Put up

[ad_2]