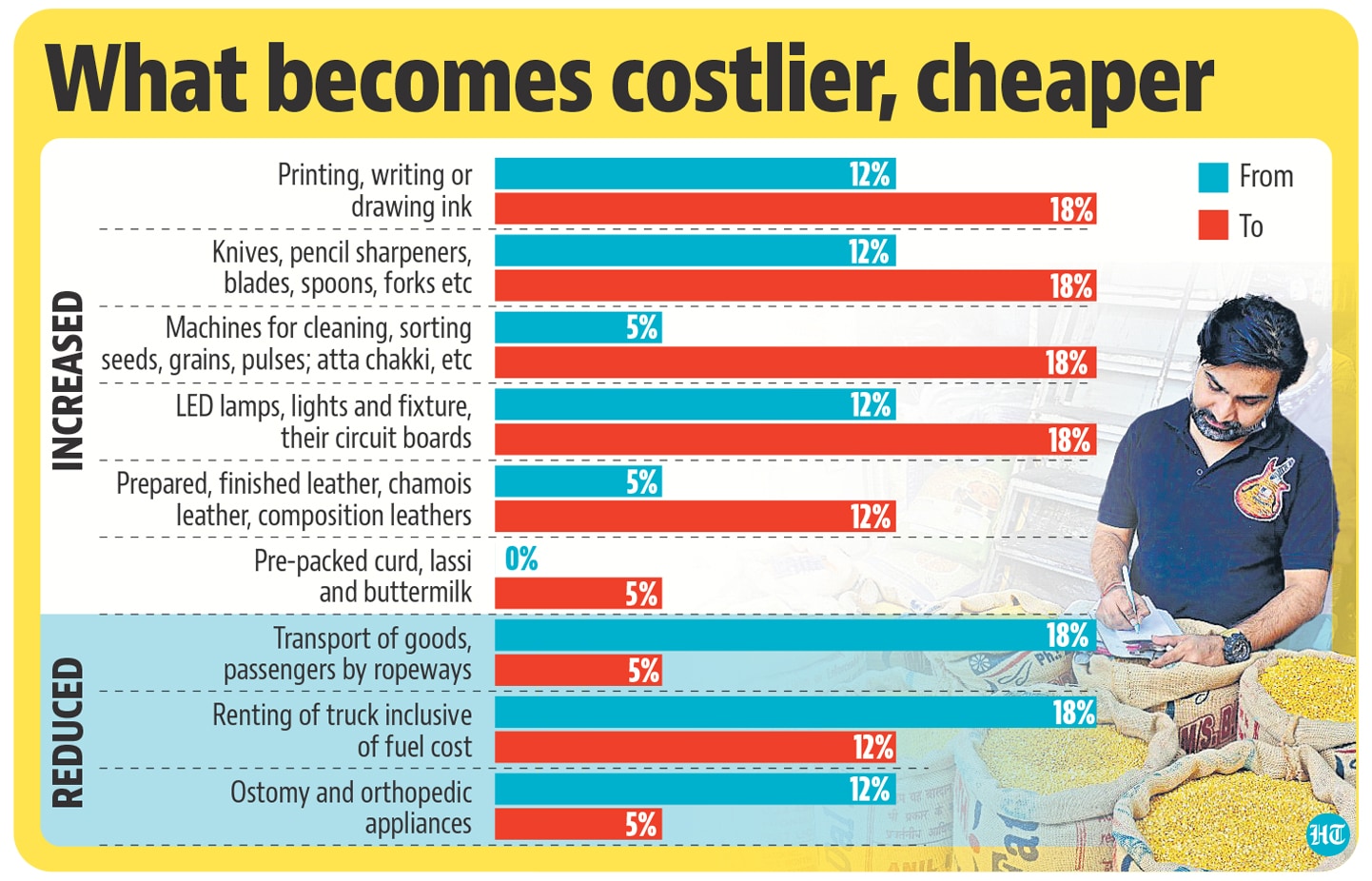

The Items and Companies Tax was hiked for quite a few objects after the GST Council took up the suggestions geared toward “ironing out inconsistencies” within the construction. The GST Council determined to boost levies on a bunch of things, together with ink, pencil sharpeners, cutlery, LED lamps, power-driven pumps, and dairy, poultry and horticulture equipment.

The GST on ink, LED lamps, lights and fixtures and their steel printed circuit board has been hiked to 18% from earlier 12%. The GST charge on photo voltaic water heaters and techniques has been hiked to 12% from 5%.

Charge on job work associated to manufacturing of leather-based items and footwear has been raised to 12% and charge on works contract for roads, bridges, railways, metro, effluent remedy plant, crematorium being elevated to 18%.

The speed modifications advisable by the GST Council shall be efficient from July 18, 2022.

Pre-packed curd, paneer, makhana, wheat to draw 5% GST: See full record

Nevertheless, a proposal to levy 28% GST on casinos, on-line gaming, horse racing and lottery was deferred, Union finance minister Nirmala Sitharaman mentioned after the two-day assembly of the council.

“Following Goa’s request for particular remedy for casinos, it was determined that GoM will give yet another listening to for on-line video games and horseracing as nicely; the GoM will submit the report by July 15 and GST Council will therefore meet once more on this GoM’s agenda in 1st week of August”, mentioned the finance minister.

States searching for an extension of the assured compensation interval had been unable to make any headway on the assembly. Sitharaman mentioned that states needed compensation to be continued for just a few years, if not for 5 extra years. She added {that a} Group of Ministers shall be constituted to deal with varied issues raised by the States on GST Appellate Tribunal and amendments in CGST Act.