[ad_1]

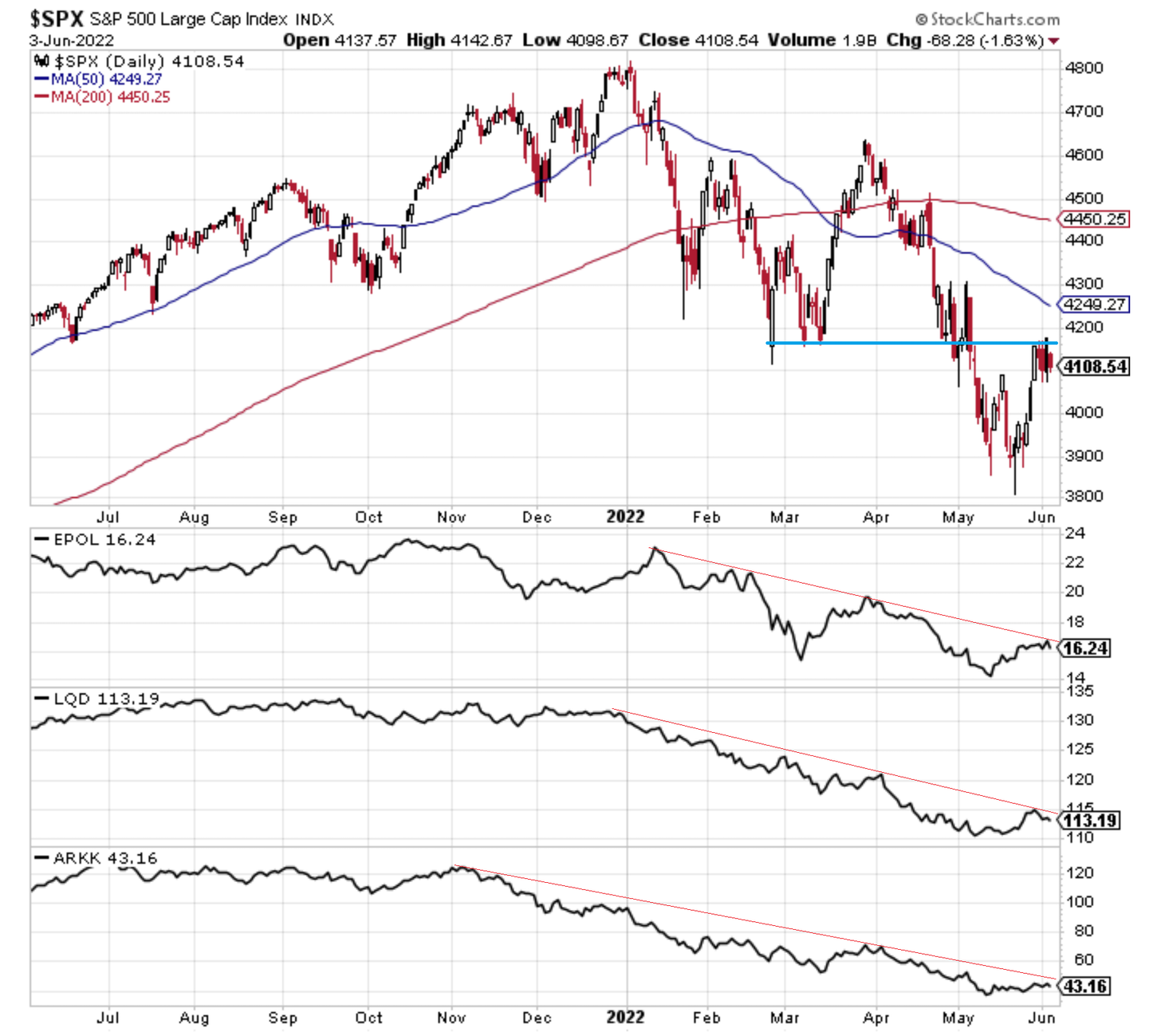

1. Strains within the sand…

The seems to be stalling at resistance after a brief sharp rebound. Trying on the “correction danger drivers“ I’ve talked about beforehand:

- (geopolitics) additionally stalling

- (charges/credit score) turning down once more

- (tech bust) bouncing alongside the underside

Total pretty unconvincing.

Supply: @Callum_Thomas

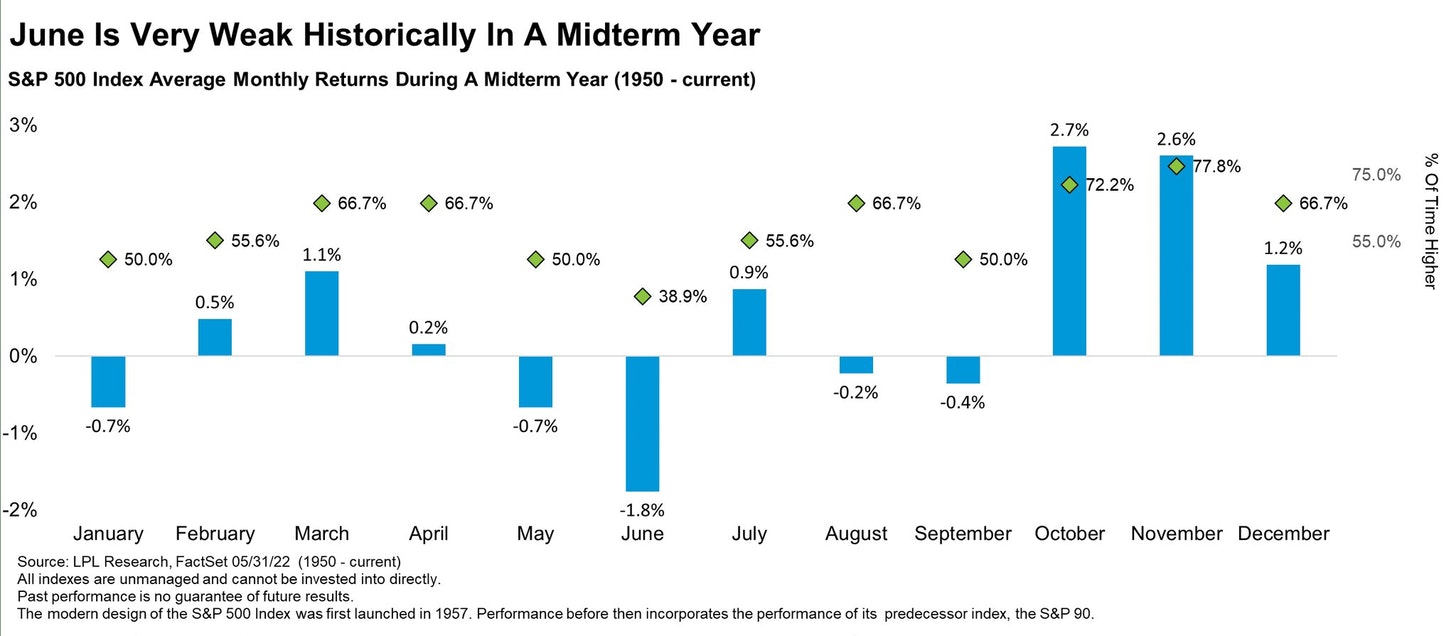

2. Seasonality Verify

June is traditionally the worst month of the 12 months for shares throughout a midterm 12 months. All the time exceptions to the typical, however fascinating to notice.

Supply: @RyanDetrick

3. Insider Timing

This “Insider Huge Block Buying and selling indicator” appears to be at or near a purchase sign… as all the time, notice the exceptions (watch out for early purchase indicators).

Supply: @SethCL

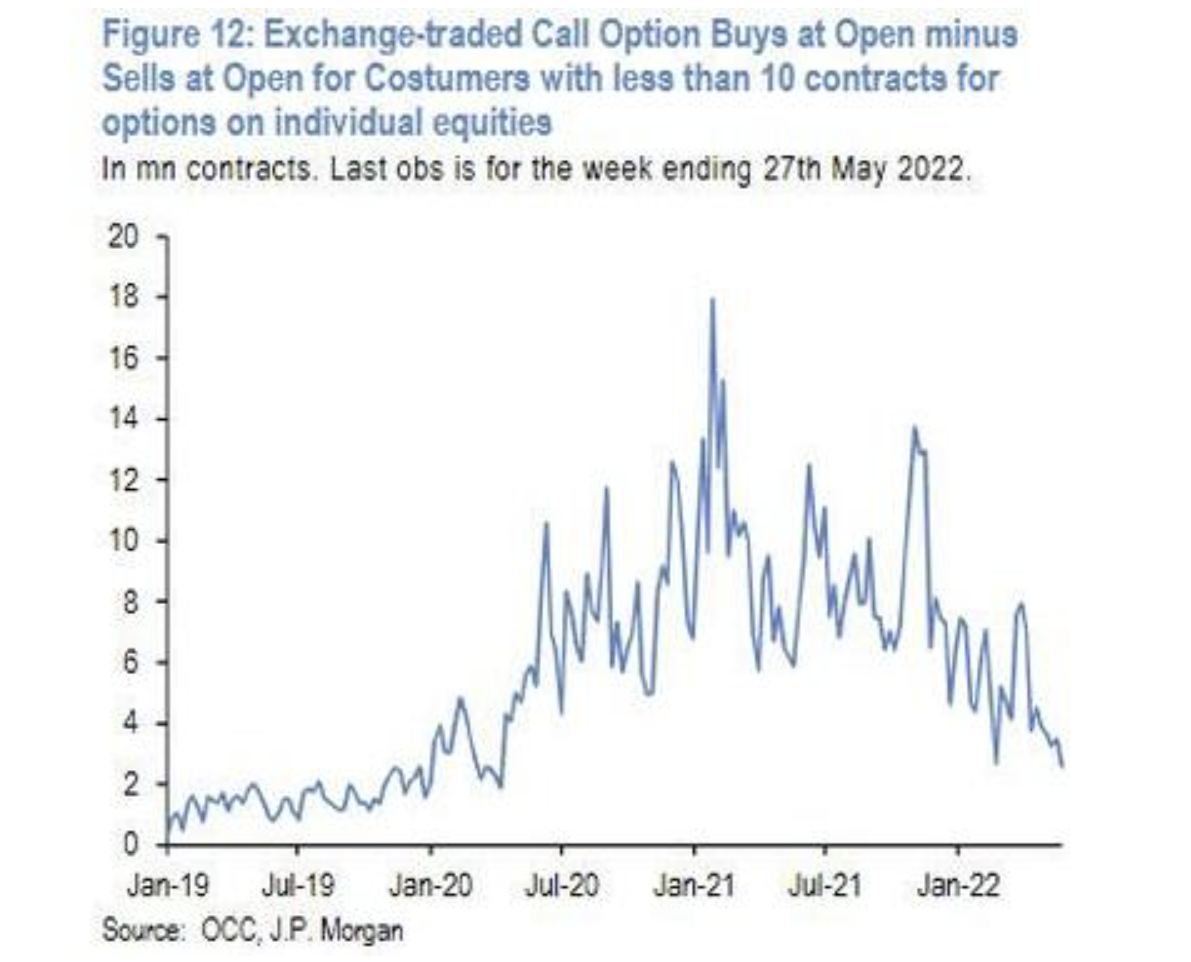

4. Giving up on Calls

Small dealer shopping for of name choices has close to evaporated — stark distinction to the frenzy of 2020/21.

Supply: @zerohedge

5. Bullish Hypothesis Evaporation

Equally, the diploma of buying and selling in leveraged lengthy vs brief US fairness ETFs places on clear show the bullish hypothesis evaporation. Seems like a shopping for/bouncing sign not too long ago although…

Supply: @topdowncharts

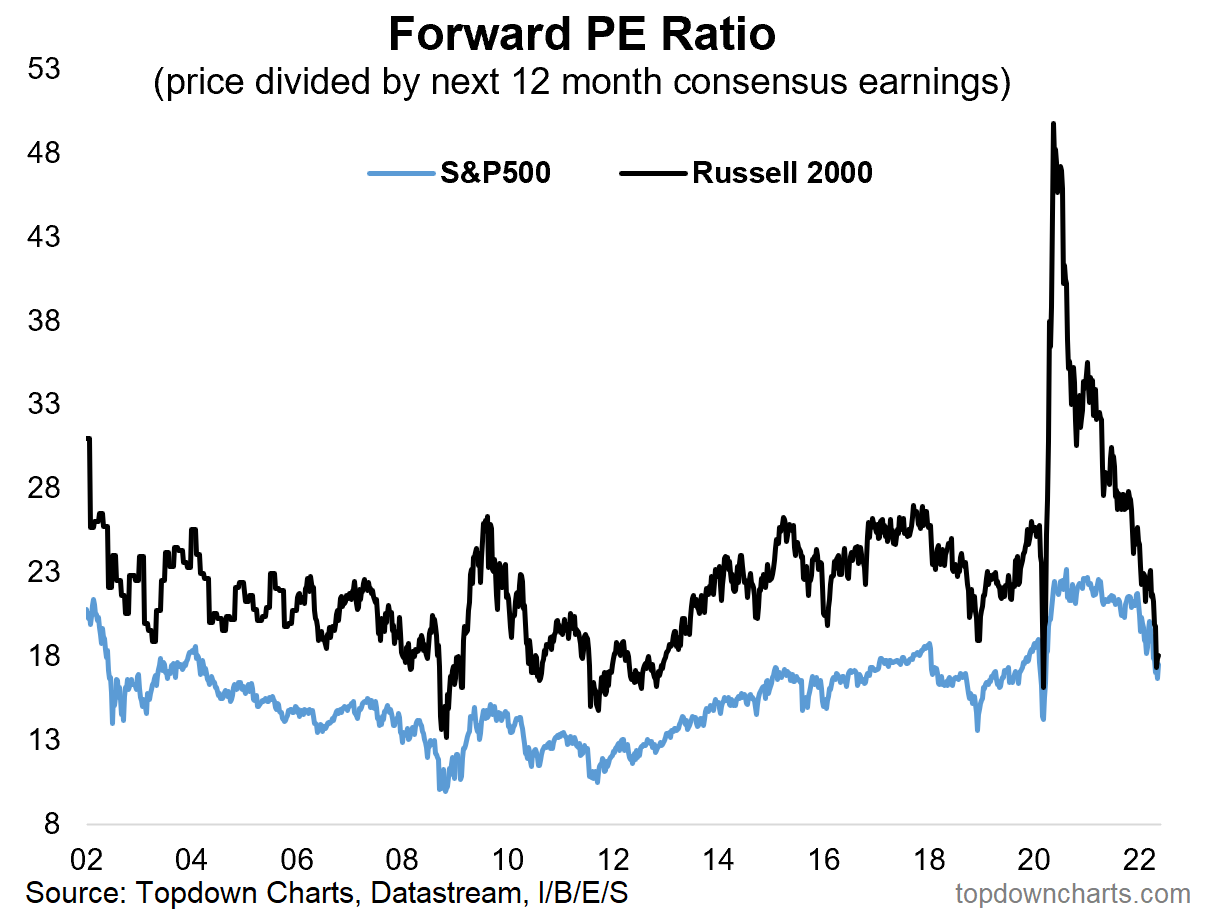

6. Ahead PE Ratio

Small Cap ahead PE ratio again all the way down to earth.

(albeit n.b. small cap consensus ahead EPS crashed -57% in 2020, and have surged +15% this 12 months, and up ~250% off the low level. All good if EPS ship on analyst expectations — and assuming earnings are sustainable within the face of a possible international recession… )

Supply: @topdowncharts

7. Worth to Gross sales Ratio

Excellent news everybody!

After a giant reset, the S&P 500 value to gross sales ratio is now solely as costly as through the peak of the dot com bubble!

(albeit, margins are additionally larger, charges decrease, and so forth)

Supply: @TaviCosta

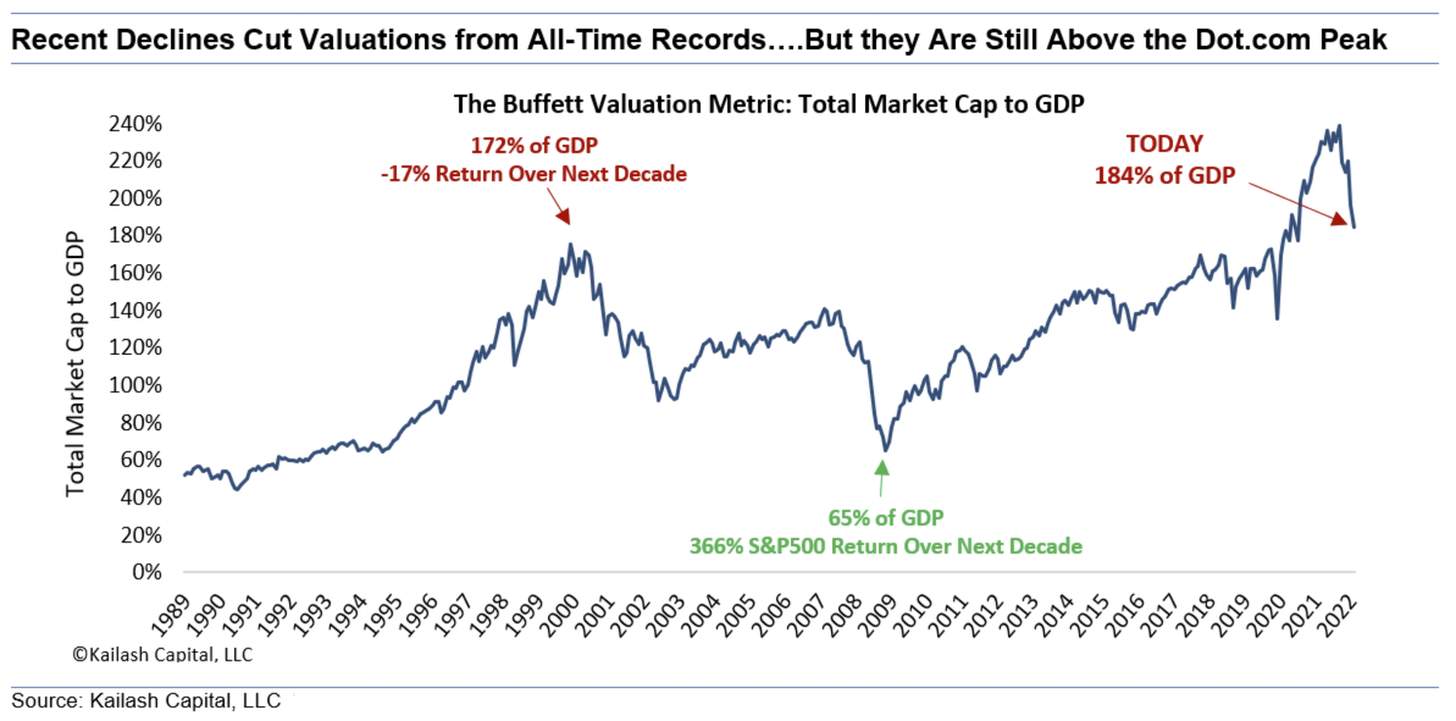

8. Worth?

“Buffett Indicator” additionally now all the way in which all the way down to dot-com bubble ranges.

Supply: @KailashConcepts

9. Variety of Cash-Shedding Corporations

No income, no downside?

(or: no income, no, downside!)

Supply: @LizAnnSonders

10. aka, The Price of Recency Bias

“If 2008 hit once more” (you all the time hear some consideration seekers claiming that is going to be the following 2008 each time markets get a bit unstable… watch out who you take heed to!!)

Supply: @FusionptCapital

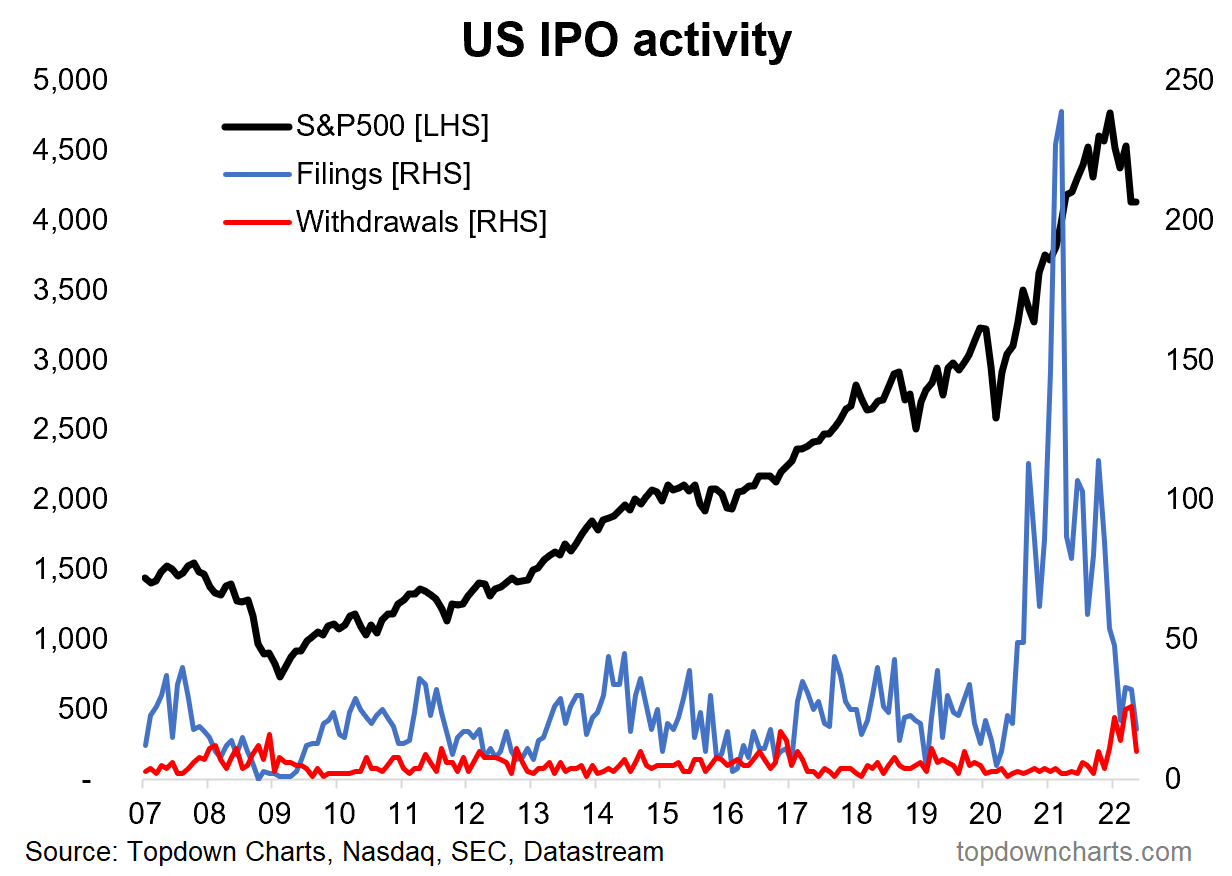

BONUS CHART

IPO Increase & Bust: Together with the SPAC craze, IPO markets kicked right into a uncommon state of frenzy over the previous couple years (helped by the liquidity tsunami of financial + fiscal coverage stimulus flooding throughout markets).

However that growth has given solution to bust as the identical forces retreat.

This 12 months 97 IPOs have been withdrawn as funding circumstances bitter, and filings are averaging a tempo of ~30 IPOs per 30 days vs 115/month final 12 months.

One other stark stat is the relative efficiency of the Renaissance ETF — in relative phrases (vs S&P500) up greater than 200% from the March 2020 low to the Feb 2021 peak …and now down -64% from the height.

Mainly this all represents a barometer of the comings and goings of liquidity and speculative fervor. After the social gathering, right here’s the hangover.

Till the following social gathering…

[ad_2]