[ad_1]

The U.S. fund enterprise added 689 distinctive new funds (together with ETFs, however excluding share lessons) in 2021. And regardless of the recognition of passively managed funds, 536 of those funds had been actively managed.

Collectively, these new funds attracted some $149.7 billion in internet inflows for 2021, with passively managed funds attracting some $104.4 billion and actively managed funds taking in $45.3 billion.

On the Accountable Funding (RI) funds facet—which embrace funds with conventional socially accountable investing methods, ESG funding methods, influence investing methods, and the like—fund households added 148 distinctive (once more ignoring share lessons) RI funds to their lineup. Of those, 103 had been actively managed whereas 45 had been passively managed. For the one-year interval ended Dec. 31, 2021, passively managed new RI funds attracted $4.6 billion, whereas their actively managed counterparts took in $10.8 billion.

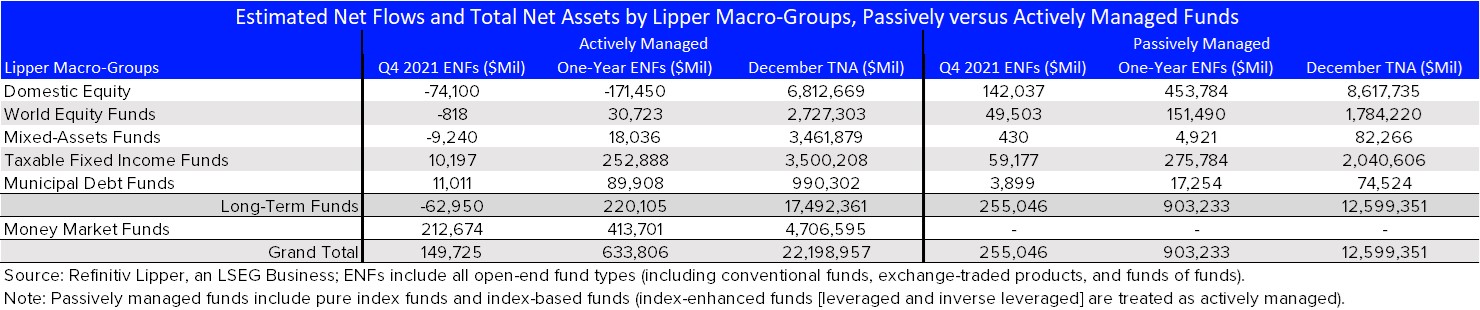

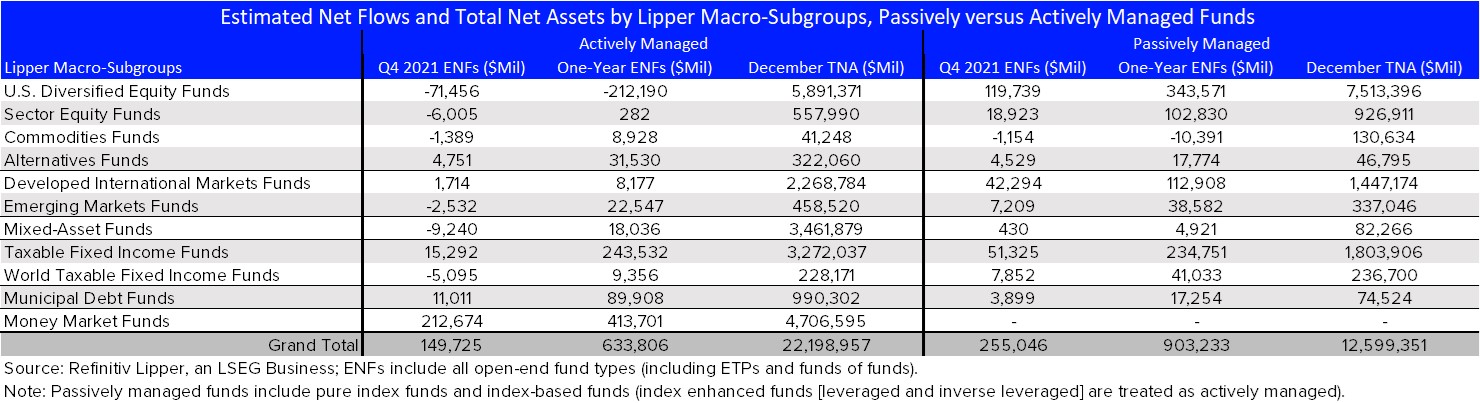

These new fund traits, nevertheless, don’t match the movement patterns seen for all funds (which embrace the brand new funds cited above). Within the desk beneath, we see that actively managed funds, together with cash market funds, took in $633.8 billion for 2021 [with money market funds (+$413.7 billion]) accounting for almost all of internet inflows], whereas their passively managed counterparts attracted $903.2 billion.

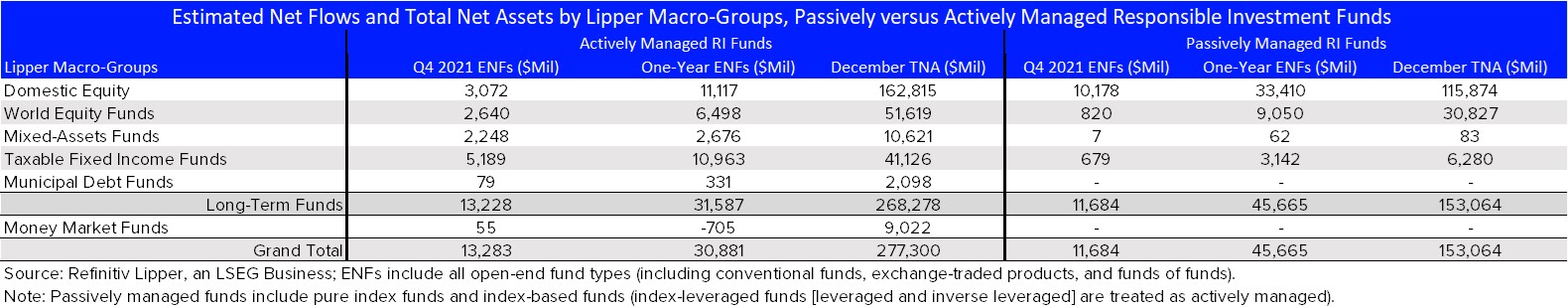

On the Accountable Funding facet, we see comparable movement traits with actively managed RI funds taking in $30.9 billion for 2021, whereas their passively managed RI counterparts attracted $45.7 billion, regardless of actively managed RI funds’ belongings beneath administration (+$277.3 billion) being considerably larger than the passively managed RI fund belongings beneath administration (+$153.1 billion) on Dec. 31, 2021.

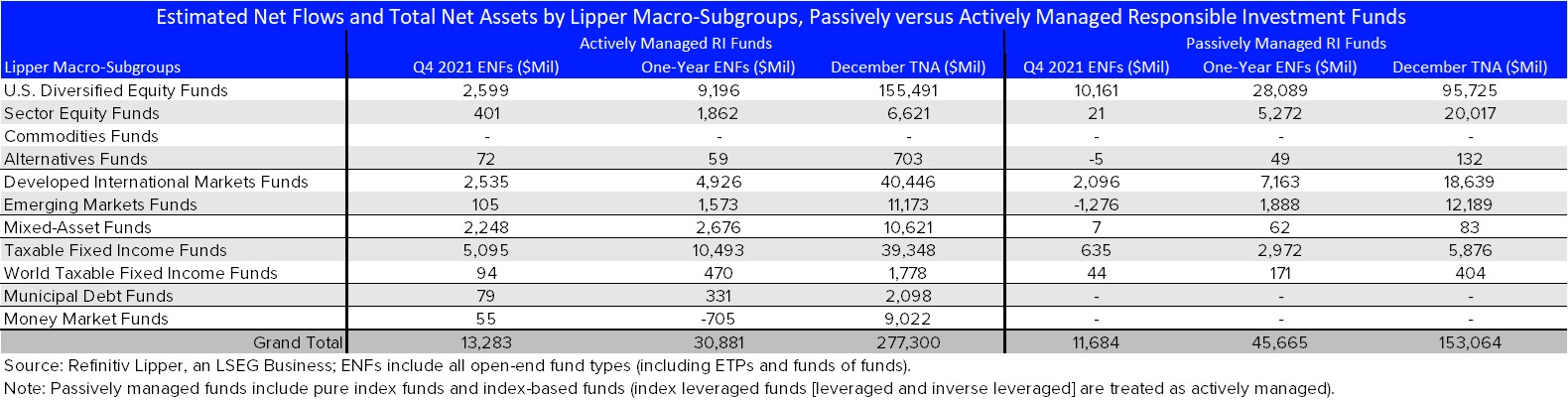

Diving a bit deeper into our macro-classification subgroups for RI funds, we see that estimated internet flows into each home fairness and world fairness macro-groups favor passively managed merchandise, just like the broader fund universe, with flows into passively managed RI U.S. diversified fairness funds (+$28.1 billion), sector fairness funds (+$5.3 billion), developed worldwide markets funds (+$7.2 billion), and rising markets funds (+$1.9 billion) eclipsing these into their actively managed RI counterparts (+$9.2 billion, +$1.9 billion, +$4.9 billion, and $1.6 billion, respectively).

Nevertheless, the stickiness of RI fund flows, which now we have cited a number of instances earlier than, breaks away from what we’re seeing within the general universe (which incorporates each RI and non-RI funds), the place actively managed USDE funds proceed to see main internet outflows, handing again $212.2 billion in 2021, whereas their passively managed counterparts attracted an eyepopping $343.6 billion for a similar interval, highlighting buyers’ general continued curiosity in passively managed funds.

It’s price noting that simply 4 ETFs and one typical fund accounted for greater than half of these broader-market passively managed inflows into USDE funds, with Vanguard 500 Index ETF (VOO, +$46.8 billion), Vanguard Complete Inventory Market Index Fund ETF Shares (NYSE:) (VTI, +$44.0 billion), SPDR® S&P 500 (NYSE:) (SPY, +$36.9 billion), iShares Core S&P 500 ETF (NYSE:) (IVV, +$27.9 billion), and (FXAIX, +$26.8 billion) attracting the lion’s share of internet new cash for 2021.

In the meantime, actively managed developed worldwide markets funds (+$8.2 billion) attracted considerably lower than their passively managed counterparts (+$112.9 billion).

Turning our consideration again to RI funds, we word that just like the broader universe of funds, actively managed RI mixed-assets funds (+$2.7 billion), taxable mounted revenue funds (+$10.5 billion), and municipal debt funds (+$331 million) outdrew their passively managed counterparts, which took in $62 million, $3.0 billion, and $0, respectively, for 2021.

So, on the accountable funding facet of the ledger, buyers are nonetheless extra possible to make use of actively managed funds. This makes intuitive sense, being that almost all of those funds take an lively method to securities choice, through the use of detrimental screening; best-in-class sustainable apply screens that target environmental, social, and governance practices, insurance policies, and efficiency; and even targeted social or environmental end result practices, sometimes called influence investing.

All, usually, lend themselves to extra lively administration, though rules-based and quantitative methodologies do enable for passively managed RI methods.

For 2021, the first particular person attractors of buyers’ belongings on the accountable funding facet of the equation had been iShares ESG Conscious MSCI USA ETF (NASDAQ:) (ESGU, +$8.1 billion), Catholic Accountable Investments Fairness Index Fund, Institutional Shares (CRQSX, +$3.5 billion), iShares ESG Conscious MSCI EAFE ETF (NASDAQ:) (ESGD, +$3.2 billion), iShares World Clear Power ETF (NASDAQ:) (ICLN, +$2.6 billion), and Vanguard ESG US Inventory (NYSE:) (ESGV, +$2.5 billion).

[ad_2]