[ad_1]

Singapore, Singapore, thirteenth August, 2022, Chainwire

TUSD has been endorsed by CryptoQuant, an information evaluation agency for cryptocurrencies, rating within the prime eight within the stablecoin efficacy report printed July 21.

The efficacy report supplied an in-depth evaluation of eight important stablecoins out there (USDT, USDC, BUSD, DAI, FRAX, TUSD, USDP, and GUSD) from 4 dimensions: peg robustness, worth premium, velocity, and accessibility.

By way of peg robustness, TUSD ranks among the many prime stablecoins. This dimension reveals how dependable a stablecoin is throughout a rise in provide, which happens when customers are redeeming their stablecoins. This is named a redemption run or higher often called a “bank-run.”

Robustness is essential for monetary merchandise because it represents stability. Stablecoins with excessive peg robustness permit customers to redeem their property securely, with out concern of a worth shock.

Measuring a stablecoin’s peg requires two metrics: worth deviation and redeemed provide movement. Stablecoins with lower cost deviation and better redeemed provide, have the next likelihood of sustaining their stability. Outcomes present that TUSD has one of many lowest ranges of worth deviation, marking larger peg robustness scores.

TUSD’s excessive robustness rating is well-deserved. Out there sources reveal that it is likely one of the most clear stablecoins, totally collateralized by U.S. {dollars} and attested stay on-chain. Additionally, TUSD is audited in real-time by Armanino, a number one U.S.-based accounting agency, to make sure a 100% collateral ratio.

(Completely different stablecoins’ peg robustness scores)

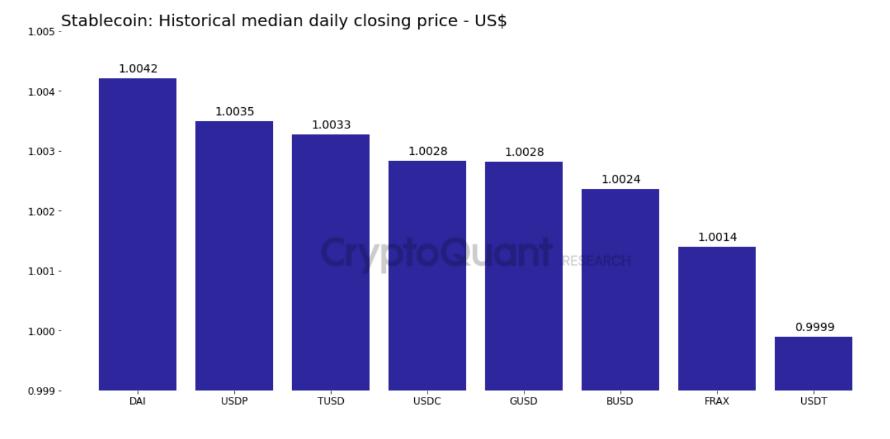

The value premium is used to research the historic costs of stablecoins to determine if a token has traded at a premium or a reduction. The report signifies that TUSD ranks someplace within the center. A worth premium permits stablecoin holders to revenue from promoting at a premium within the quick time period, versus losses from buying and selling at a reduction.

Velocity and accessibility are the opposite two dimensions examined within the report. TUSD scores low in velocity and medium in accessibility. Furthermore, the report additionally factors out that stablecoins’ availability on public chains is equally vital to their accessibility on exchanges. Whereas many stablecoins function on Ethereum, TUSD is likely one of the main stablecoins on TRON, whereas BUSD runs on BNB Chain.

(TUSD’s scores within the 4 dimensions)

TUSD rating within the prime eight for stablecoins, as proven within the TUSD weblog article and CryptoQuant efficacy report talked about earlier, reveals its all-around effectiveness within the 4 dimensions. The report expects TUSD to see additional development within the coming months.

About TUSD

TrueUSD is the primary digital asset with stay on-chain attestations by impartial third-party establishments and is backed 1:1 with the U.S. greenback. Up to now, it has been listed on greater than 100 buying and selling platforms reminiscent of Binance and Huobi, and is stay on 11 mainstream public chains together with Ethereum, TRON, Avalanche, BSC, Fantom, and Polygon. TrueUSD is attested to in real-time by Armanino, one of many largest U.S.-based accounting corporations, to make sure the 1:1 ratio of its USD reserve to the circulating token provide and the 100% collateral price. Customers can entry the publicly accessible audit outcomes by way of the official web site tusd.io at any time.

Contacts

Annabel Gan, [email protected]

[ad_2]