[ad_1]

Properly there goes the primary half of the yr. Do not learn about you, and possibly I am simply getting outdated, however time appears to be slipping by sooner and sooner. Then once more, possibly it is simply the bizarre and difficult method that this yr is unfolding throughout almost all aspects of life.

I am going to tentatively depend myself among the many few who managed to get it principally proper to this point this yr on macro and markets (I say tentatively: you by no means need to get too happy with your self and pat your self on the again with this enterprise because it naturally results in hubris/conceitedness/complacency in what’s a really aggressive, complicated, and unforgiving dynamic puzzle fixing course of).

However this does deliver us to the purpose of this put up: reviewing my “charts to observe in 2022” piece to replace the considering and replicate on preliminary ideas in the beginning of the yr.

So let’s get on with it…this is a half-time progress verify on the Within the authentic article I shared what I believed could be the 12 most essential charts to observe for multi-asset buyers within the yr forward (and past).

On this article I’ve up to date these 12 charts, and offered some up to date feedback on the outlook—given the dramatic shifts seen through the first half of the yr.

[Note: I have included the original comments from back at the start of the year, so you can quickly compare what I’m thinking now vs what I said back then.]

Additionally n.b., these charts initially featured in our

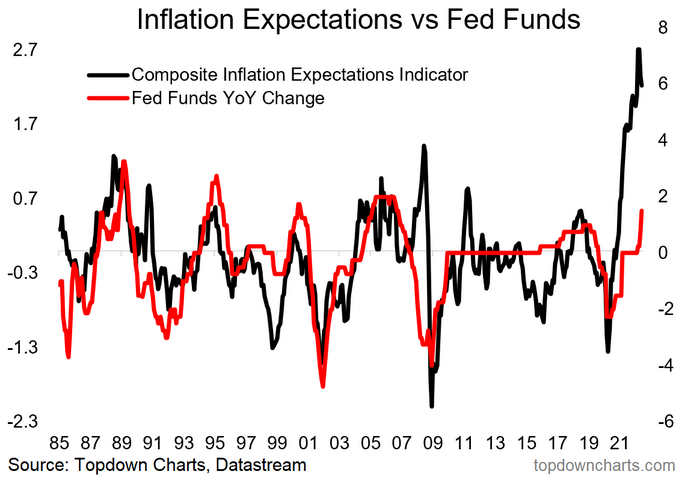

1. Fed Behind The Curve: Regardless of more and more aggressive strikes (+25bps in March, +50bps in Might, +75bps in June…and, sample recognizers: JP has stated 100bp strikes will not be off the desk!!), the Fed stays behind the curve on . When you may argue some and even many of the present inflation is right down to supply-side points there are 2 issues to recollect:

1. Provide points disappear if demand disappears; and a pair of. The dangers will not be a lot in right now’s inflation, however within the prospect {that a} surge in inflation triggers an inflation expectations spiral the place the expectation of upper inflation turns into a self-reinforcing, self-fulfilling suggestions loop.

However above all, as famous, the Fed made its mattress when it selected to keep away from the danger of tightening too early—and even perhaps in going too laborious on stimulus within the first place. In that respect, the forces set in movement in 2020 are merely coming full circle.

“Based mostly solely on this chart we may make an assertion that the Fed has fallen behind the curve. In opposition to that there is the argument that different components are essential too, and not to point out the level that the Fed mainly determined to place itself behind the curve to attempt and forestall the mistake of tightening too quickly. With the composite measure of inflation expectations at 40-year highs it’s truthful to counsel that the Fed could have some catching up to do as it kicks off the transition away from easing.”

Inflation Expectations vs Fed Funds

Inflation Expectations vs Fed Funds

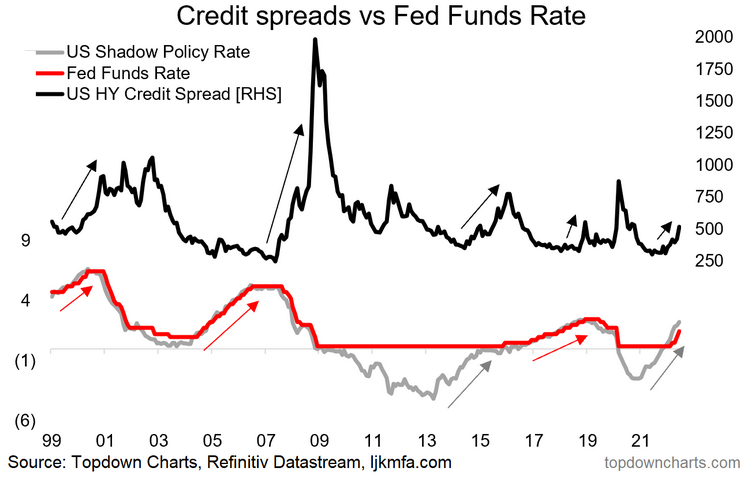

2. Fed Catch-Up Danger: Fed catch-up threat has develop into Fed catch-up actuality. The tougher they hike, the extra probably it’s that one thing will break. Within the excessive, the one method to very well and really get inflation underneath management is to set off a recession, and as I detailed in a latest webinar, recession is mainly now the bottom case.

“Naturally the Fed now faces one other threat – i.e. the threat of being dragged into a sport of catch-up in the context of a very complacent market that has arguably come to count on everlasting easing… “the Fed has my again”. Simply bear in mind, the outdated saying of ‘don’t battle the Fed’ means don’t battle towards the tides, and the tides are beginning to change.”

Credit score Spreads vs Fed Funds Charge

Credit score Spreads vs Fed Funds Charge

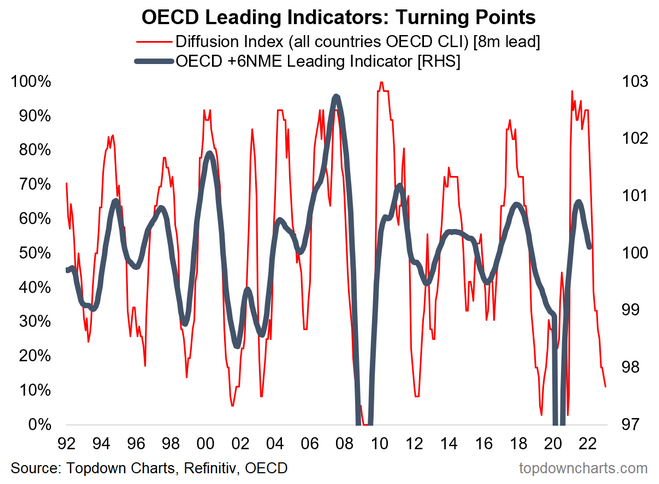

3. Development Scare 2022: Change that to “Recession 2022″—value pressures (vitality costs, normal value of dwelling will increase), , tightening lending requirements and credit score markets, falling asset costs, charge hikes, fiscal drag, COVID resurgence, conflict, and the kitchen sink…all indicators now level squarely in a single course. The majority of my main indicators now say recession is near-certain, prone to kick-off in H2 and carryover into 2023.

“However then once more, possibly the Fed received’t even get a probability to get a charge hike out the door if the chart beneath proves wherever close to correct. This and a few different main indicators are pointing to a attainable progress scare in 2022. Perhaps it will be one-and-done for the Fed? Or possibly any such progress scare solely serves to lengthen the financial growth additional by triggering renewed stimulus. Definitely a threat and a key chart to preserve on the radar.”

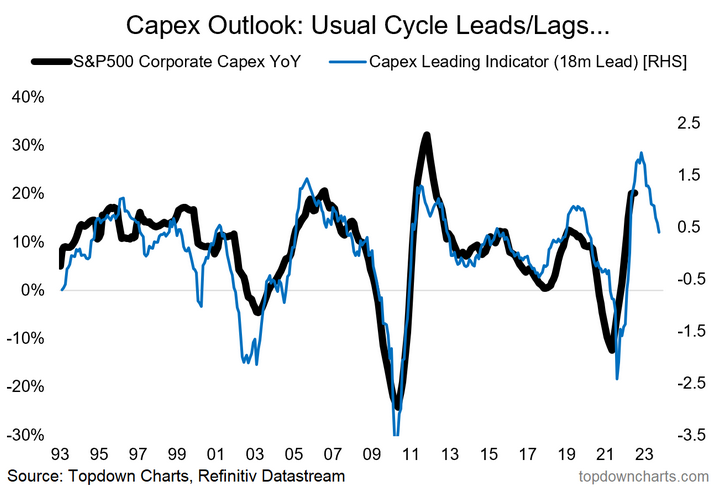

4. Company Capex: Even capex cannot save the day, an preliminary cyclical rebound seems to be set to cap-out and rollover primarily based on the capex main indicator.

Whereas a number of the medium/longer-term themes probably proceed (e.g., commodity capex, delivery capex, local weather/EV associated, house age 2.0, and so forth.), the cyclical outlook for capex is clearly much less sure, and it appears unlikely that any elevate in capex can be sufficient to offset the looming financial headwinds.

“This chart hints at maybe one of the most essential themes I’ve been speaking about over the previous yr – the prospect of a attainable multi-pronged, multi-year funding growth. The chart beneath highlights the typical cycle leads and lags in phrases of capex progress, and with simpler funding situations, booming company earnings, and a rebounding financial system it’s probably that we see a generalized uplift in capital expenditure.

However as I’ve been highlighting within the reviews there are just a few specific sectors which can be prone to see a surge in funding in response to surging costs – for instance, the worldwide delivery sector, and commodity producers. Each of which have seen capex languish for the previous decade, and each of which have seen an efficient windfall from the pandemic (i.e. surging delivery charges and commodity costs).”

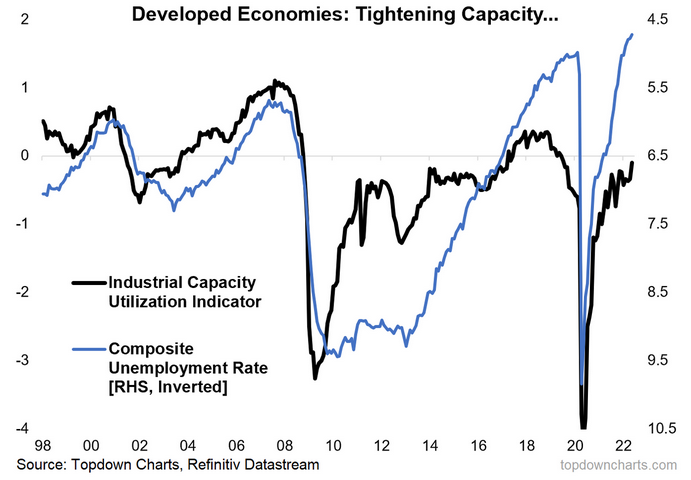

5. Capability Utilization: Oh and again on inflation, here’s a elementary, non-transitory cause why inflation pressures are critical and why central banks must be taking it severely. Labor market capability utilization is mainly document tight.

Even industrial capability utilization is tight…and doubtless could be tighter if supply-chain points have been utterly resolved. Both method, this goes to point out the actual underlying impetus on inflation (and maybe one cause for corporations to push on with capex).

“One other key impetus to resurgent capex is tightening of capability e.g. measures of labor market capability utilization are shut to pre-pandemic ranges. This will put upward stress on pricing and current an incentive or sign to corporations to elevate funding.

However it additionally speaks to the inflation theme. Whereas some of the short-term upward pressures on inflation are probably to move (e.g. backlogs, base results, the preliminary bounce-back), ought to we see additional and sustained tightening of capability utilization it will put upward stress on the extra core or underlying inflation pulse.”

Developed Economies Capability Utilization – No Output Hole

Developed Economies Capability Utilization – No Output Hole

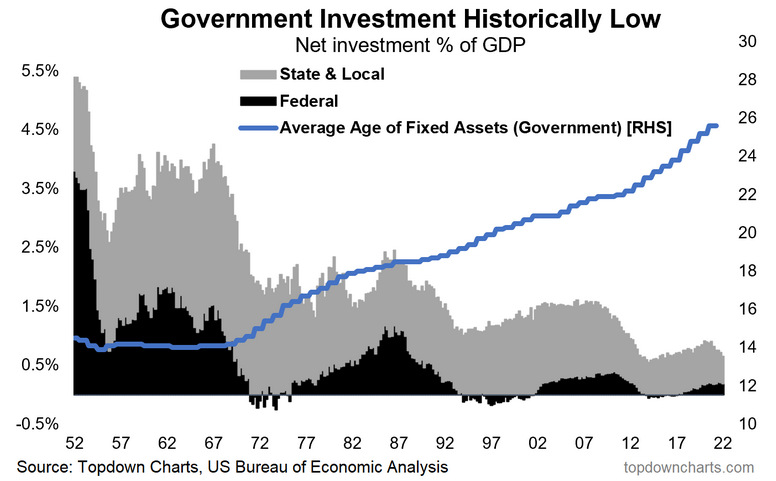

6. Authorities (and Inexperienced) Capex: If this yr has taught us one factor it’s the price of low cost speak from governments and activists about going to zero carbon. You’ll be able to’t dash right into a post-fossil-fuel world with out taking huge motion; with out investing on an unprecedented scale…nothing wanting a brand new Manhattan Challenge model mobilization is required in case you *actually* truly need to get it achieved.

There’s a nice leap, a grand chasm, between the place we’re and the place the grand vitality utopia promised lands lie. For what it is value, I believe we most likely ought to throw the whole lot at it, make it occur, absolutely mobilize.

However the important thing level is that each one this speak and advantage signaling—which is now a well-liked and mainstream factor that requires no braveness and represents zero uniqueness—must be backed by precise motion. This is the reason cheap-talk is dear, and one of some causes for ache on the pump.

However anyway, the unique thought right here and with this chart was that governments would embark on local weather associated (*and infrastructure*) funding. And there may be actually some stuff within the pipe—particularly globally, however clearly authentic plans within the US failed, and now distractions and disarray imply this one is a wash.

“To actually drive it residence, the capex/funding theme is not simply about firms responding to financial forces, it’s additionally about governments responding to the pandemic as effectively as social/political forces.

Particularly in phrases of restoration/rebuilding fiscal packages which in many nations have been focused at infrastructure. However additionally local weather associated infrastructure and funding – one thing that is positively half of fiscal packages, however additionally half of shifting investor preferences. We’ve noticed a clear development of rising monetary funding into clear vitality sectors being adopted by uplift in actual funding. So altogether it’s fairly fascinating.”

US Authorities Fastened Asset Funding Infrastructure Capex

US Authorities Fastened Asset Funding Infrastructure Capex

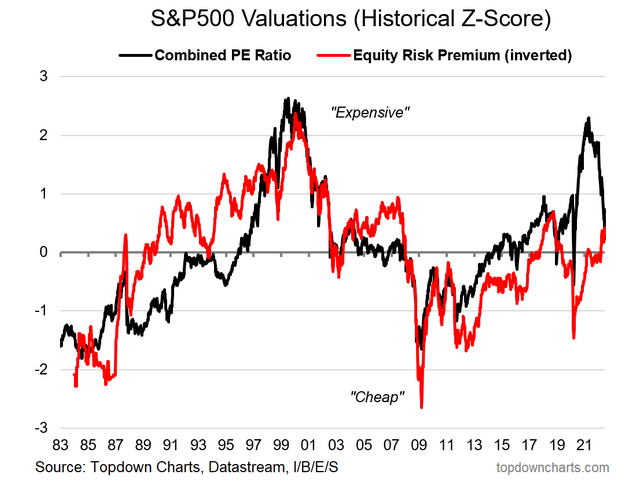

7. US Absolute vs Relative Valuations: Over to markets, this chart has modified loads—absolute valuations have come down considerably but-1: nonetheless not low cost; and but-2: the ERP remains to be costly as bond yields have drifted larger.

Certainly, at this level I take a look at treasuries and on my mannequin they appear barely low cost, whereas equities nonetheless look barely costly…TINA [there is no alternative (to stocks)] >>> TADA! (there are positively alternate options).

“Ought to all this speak of capex and funding booms come to move, we’d probably begin to see upward stress on bond yields, and that will put a squeeze on the US fairness threat premium.

The chart beneath is one of my favourites for considering about US fairness valuations. It factors out what most of us already know: US equities are costly in absolute phrases …i.e. the PE ratio is actually very excessive. However if we issue in low bond yields then possibly it’s not so dangerous. At current the chart says absolute valuations are wildly costly, however relative valuations are okay (for now). That will change if/when bond yields rise – and in that sense it additionally goes to spotlight the curiosity charge sensitivity of the market if we settle for the assertion that equities solely provide affordable worth in a low yield setting.”

S&P 500 Valuations Vs Historical past

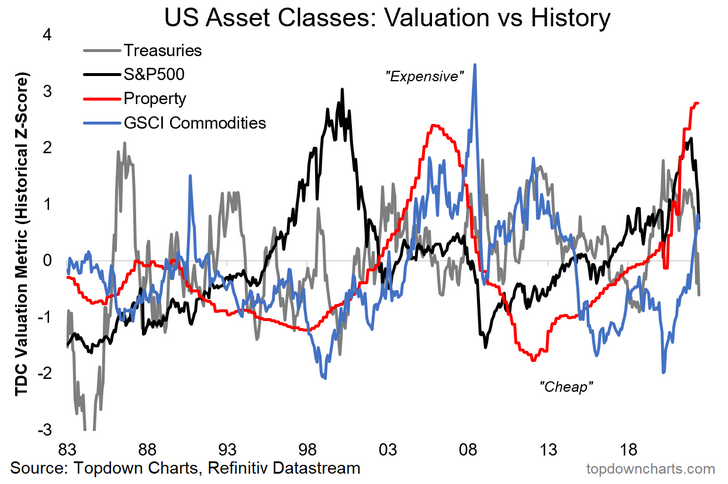

8. US Asset Class Valuations: This one has additionally modified fairly a bit, of most intrigue is that my commodities valuation indicator has simply edged out equities for second place on the pantheon of preposterous costs (I… apologize for these phrases.).

However once more, as alluded above, bonds are actually barely low cost, however in the meantime on P’s…property is off to Pluto.

“To complicate issues barely, my valuation metrics present bonds costly vs historical past as effectively – so: “equities look affordable vs costly bonds??”. To make issues worse, property costs are additionally crusing into rarefied air. Commodities on the different hand, whereas not low cost, at least look affordable by comparability and may profit from elevated capex.”

Asset Class Valuations vs Historical past

Asset Class Valuations vs Historical past

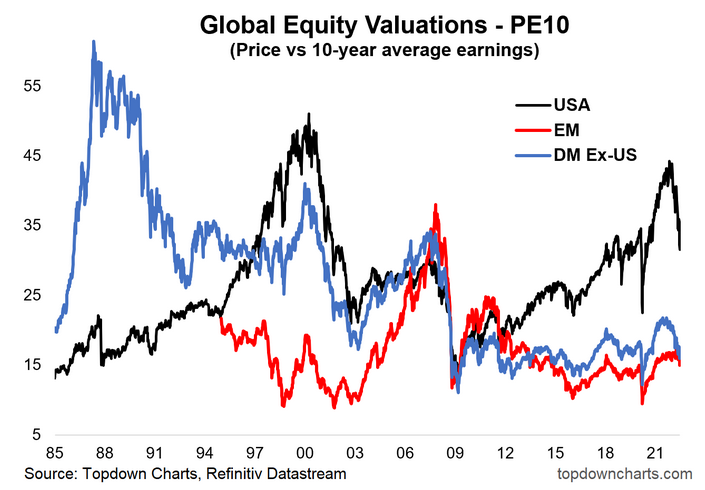

9. US vs International Fairness Valuations: Again on equities, issues change, issues identical…the US stays in one other echelon of valuations regardless of some convergence and reset in absolute phrases. Remainder of world—particularly developed markets ex-US—are trying additionally a bit higher vs latest historical past (and nonetheless at a steep low cost vs US).

Earnings clarify a big a part of the hole right here, however you may marvel how repeatable the massive disruptive positive aspects of tech of the previous decade are going into the longer term…i.e., tech has eaten the world, maybe must relaxation some time to digest what it simply ate.

“One other chart that makes US equities look costly by comparability is when you look at PE10 (or actually simply about any different valuation metric) for the US vs the relaxation of world equities. It is true that Rising Markets and Developed Markets excluding the US have seen a respectable rebound in valuations since the March 2020 lows, however there is a clear and compelling relative worth case right here.”

Chart Of International PE10 Valuation Ratios

Chart Of International PE10 Valuation Ratios

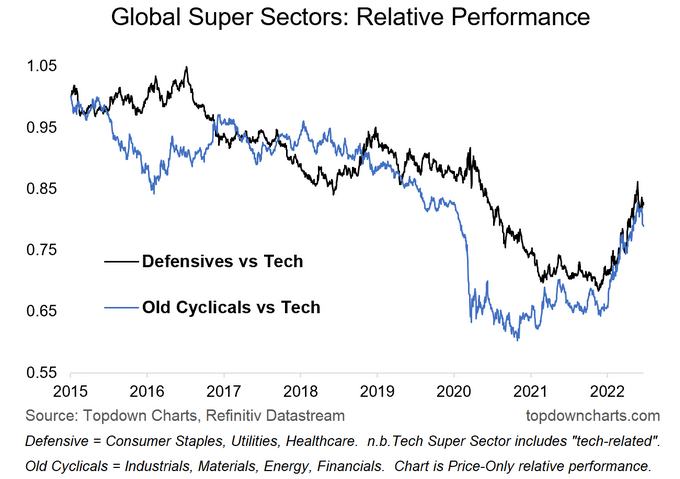

10. International Fairness Tremendous Sectors: Whereas Tech is simply resting, commodity shares and defensive sectors have charged out forward. Certainly, this yr one of many few belongings that turned in stable constructive returns was commodities and commodity shares.

But in addition on the defensive facet, these defensive sectors’ relative efficiency acted like a fairly respectable diversifier/draw back hedge…at a time when few issues labored on that entrance.

Trying ahead, it has been a solid-short-sharp run right here on this chart, and one can not help however marvel if a interval of consolidation or extra uneven tougher positive aspects is now due.

“The most logical pushback on the earlier chart is to be aware that we may have stated one thing related for a lot of the previous 5-10 years. So, the query is then what will it take for this hole to shut?

One avenue for a flip in relative efficiency of world vs US is the path of the “tremendous sectors”. A huge half of US outperforming the relaxation of the world has been the excessive hurdle set by tech and tech associated corporations. International ex-US has a huge skew to “outdated cyclicals”.

In that respect, the most essential technical clues to a rotation in efficiency between US and world will be the chart beneath. Particularly look for an upturn in the blue line to get a bounce on a ‘virtuous flip’ in US vs world relative efficiency (and worth vs progress for that matter, additionally smalls vs giant – it’s a pretty sprawling situation in equities!).”

International Tremendous Sector Relative Fairness Efficiency Chart

International Tremendous Sector Relative Fairness Efficiency Chart

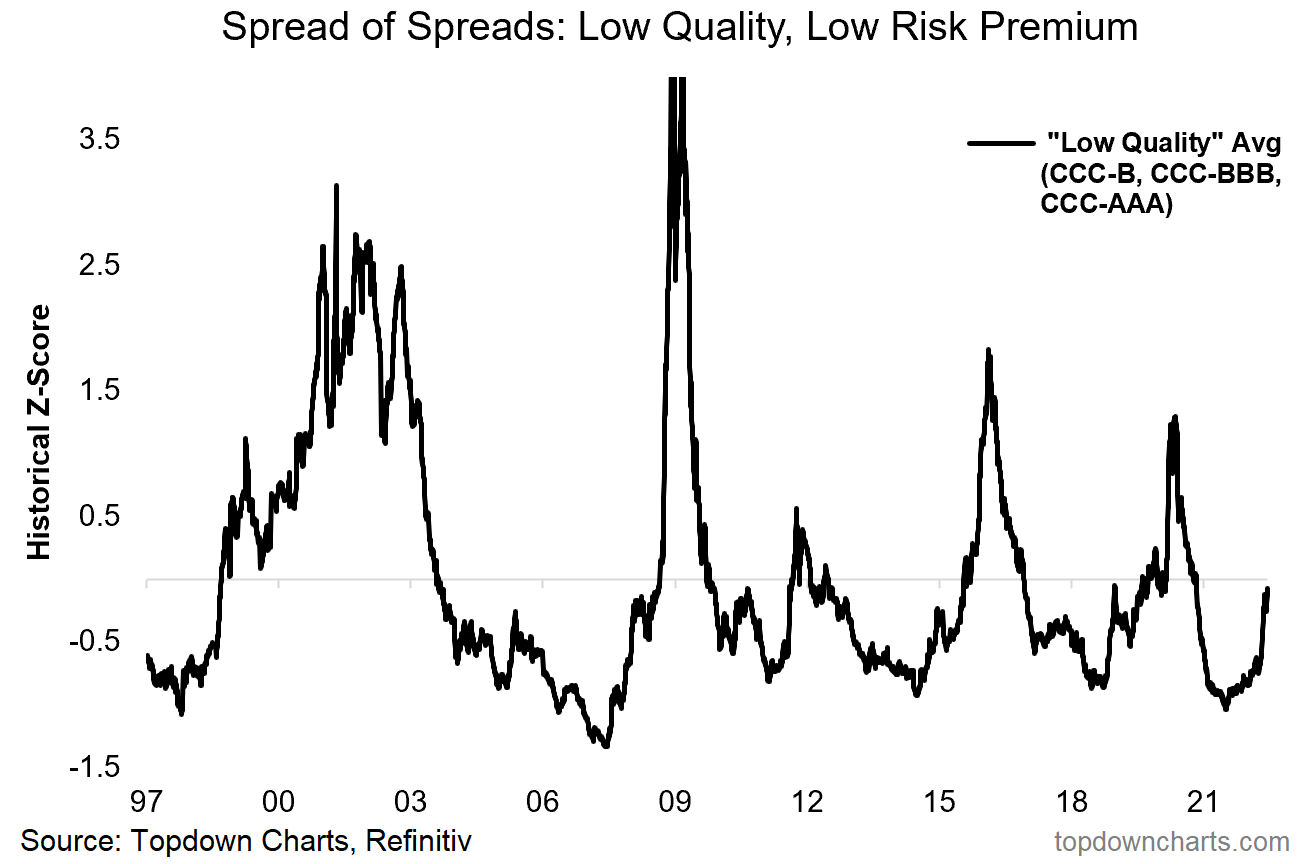

11. Low High quality Credit score – Low Danger Premium: One other space the place we have additionally seen an preliminary reset is in credit score threat premia—the unfold of spreads composite for the bottom high quality credit has spiked from beforehand excessive costly/complacent ranges. The fear right here with this one is that with recession probably incoming, relatively than revert to long-term common and simply keep there or return down…most likely extra prone to see overshooting.

Worst case could be a spherical of credit score stress if borrowing prices surge additional, revenue margins get squeezed on each ends, and one thing slightly unexpected dog-piles on. We’re nonetheless in the midst of this factor, no time to be a hero on threat publicity simply but.

“The valuation conundrum is not simply the area of equities – credit score additionally is trying more and more costly. The chart that hammers the level residence to me is this composite view of the place the decrease high quality credit are buying and selling relative to the larger high quality credit. Principally we see a decrease and decrease threat premium for decrease high quality credit score.

By itself this could not be an situation, significantly if the financial and financial backdrop are supportive of credit score situations. However if credit score situations deteriorate issues may flip sharply right here – and certainly, we could effectively even see early clues of any impending stress in this very indicator itself. So very a lot one to preserve checking in on.”

Credit score Danger Premium, Low High quality Credit score Unfold Chart

Credit score Danger Premium, Low High quality Credit score Unfold Chart

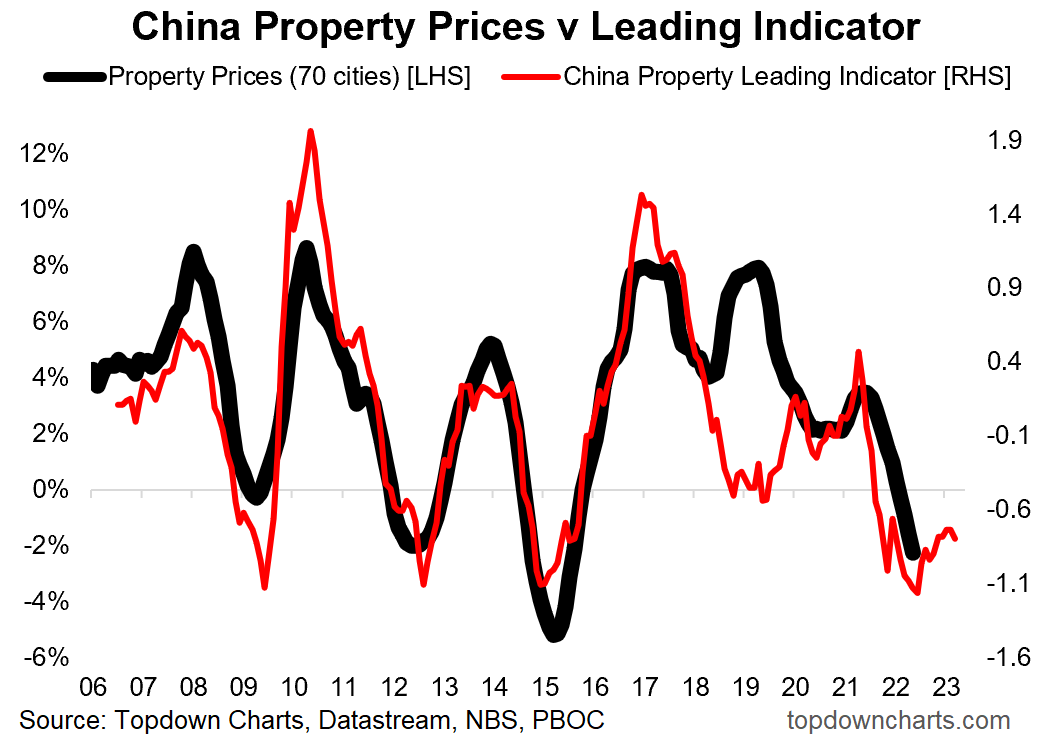

12. China Property Downturn: Lastly, the property downturn in China has solely intensified as COVID lockdowns complicate and coverage makers have nonetheless been comparatively sluggish to show the nook on stimulus settings.

Proper now it’s clear the primary focus is on controlling COVID, however I reckon the subsequent step can be a pivot to easing—particularly as and when it turns into clear the remainder of the world is in recession and because the property downturn seems to be set to linger for longer.

Maybe a case of dangerous information is nice information, however once more although, we do truly have to see issues flip the nook: it is one factor to anticipate a change in coverage—one other factor for that change to really come. In the meantime the equities there are trying slightly higher.

“I all the time say in my many years of masking China macro, if I may solely select one indicator it would be property costs, and maybe if I have been to choose solely one chart it may be the one beneath.

My composite main indicator for Chinese language property costs (cash provide, curiosity charges, funding) is pointing to an extension of the present downturn deeper and effectively into 2022. This is of essential significance in so far as the financial pulse and commodity demand is involved, however additionally – for the coverage outlook: the decrease that black line goes, the better the likelihood of financial stimulus (and you know what that means!).”

Chart Of China Property Costs And Main Indicator

Chart Of China Property Costs And Main Indicator

Abstract and Key Takeaways

- The Fed has pivoted aggressively and absolutely into catch-up mode as are at a fever pitch and threat anchoring larger; count on a probable additional string of charge hikes and development on steadiness sheet normalization (at the very least till progress dangers elbow out inflation dangers—and it’ll must be *apparent* to make the Fed pause not to mention pivot).

- The worldwide pivot from stimulus to stimulus elimination and outright tightening poses dangers to simply about each asset class, as we’ve clearly already seen this yr.

- By way of the expansion outlook, draw back dangers dominate over any upside dangers, and nearly all indicators level south for the worldwide financial system this yr and into subsequent.

- Geopolitics, COVID, and Fed catch-up have cemented the recession thesis.

- A key situation with reference to a progress slowdown and financial tightening is the truth of a number of main asset courses nonetheless trying costly regardless of an preliminary reset, however issues have shifted right here loads. That stated, property is probably going the subsequent shoe to drop given ever-loftier valuations.

- With many belongings nonetheless richly priced in absolute phrases, relative worth stays the final bastion, and certainly rotation probably stays a key theme this yr. However maybe one pocket of rising worth is in bonds, each treasuries and world ex-US.

- All in all, a defensive skew and eye on threat administration is the prudent path.

Total: Headed into H2 it is laborious roads forward as we’re clearly in the midst of a worldwide fairness bear market, and impending world recession. Valuation resets stay a piece in progress, however there are clear rising alternatives for lively asset allocators.

[ad_2]