[ad_1]

Shares of the world’s largest electrical automotive maker, Tesla (NASDAQ:), have staged a exceptional turnaround in the course of the previous two weeks.

After surging greater than 35% since Mar. 14, the Austin, Texas-based EV maker worn out all year-to-date losses and rejoined the choose trillion-dollar-valuation membership. It closed Thursday at $1,077.01.

This sharp rebound has left many traders questioning how far this rally may go, particularly when the macro setting stays hostile to high-growth names comparable to Tesla. Nonetheless, tlisted below are many elements behind the corporate’s present upward transfer.

First, the EV maker has been rather more environment friendly in coping with provide chain disruptions than different conventional automotive firms. Whereas most rivals wrestle to search out chips amid world shortages, Tesla restricted its manufacturing to the Mannequin 3 and Y fashions, securing excessive productiveness ranges.

Tesla delivered greater than 936,000 autos worldwide in 2021, up 87% from the 12 months earlier than and exceeding the 50% common annual enlargement projected over a number of years. The corporate expects to exceed that progress in 2022 comfortably.

One other issue is the soar in fuel costs amid the Russian invasion of Ukraine. Tight provides of oil are making electrical vehicles extra engaging, and even President Biden is looking for better adoption of EVs.

Report Gross sales And Revenue

Tesla, which report income and revenue within the fourth quarter, is the one worthwhile EV firm for risk-averse traders. Rivian Automotive (NASDAQ:) and Lucid (NASDAQ:), two startups making an attempt to achieve the Tesla scale, delivered about 1,000 autos final 12 months mixed. In the meantime, Tesla offered practically one million vehicles in the identical interval.

Credit score Suisse this week reiterated Tesla as an outperform, saying that regardless of provide chain challenges, the case for Tesla is “amplified.” The agency added that it was bullish heading into Tesla’s first quarter automotive supply numbers. Nonetheless, the funding financial institution famous that it was waiting for any affect of the COVID state of affairs in China, the place manufacturing at Tesla’s Gigafactory is at present suspended as a result of a lockdown in Shanghai.

Moreover, Elon Musk goes for one more inventory break up to make it simpler for retail traders to purchase its shares. In a regulatory submitting, the corporate stated growing the variety of widespread shares will permit for a break up by means of a dividend. The break up ratio continues to be unclear.

The corporate’s final inventory break up, in August 2020, helped propel its share worth to a staggering 743% achieve that 12 months.

Daniel Ives, a Wedbush Securities analyst, who charges Tesla’s shares the equal of a purchase with a $1,400 goal worth, stated in a be aware:

“We view Tesla’s transfer following the likes of Amazon, Google, Apple and initiating its second inventory break up in two years as a sensible strategic transfer that can be a constructive catalyst for shares going ahead.”

A Unstable Inventory

Regardless of these bullish calls, traders should additionally do not forget that Tesla is a extremely risky inventory, and it is laborious to foretell the following transfer in its shares. Whereas Tesla undoubtedly dominates the electric-vehicle market, its inventory is buying and selling at extraordinarily elevated multiples.

In line with InvestingPro evaluation, Tesla inventory is buying and selling at a 12-month price-to-earnings a number of of 205, a degree that has set the efficiency bar so excessive that there isn’t a house for the carmaker to make any error in relation to monetary efficiency.

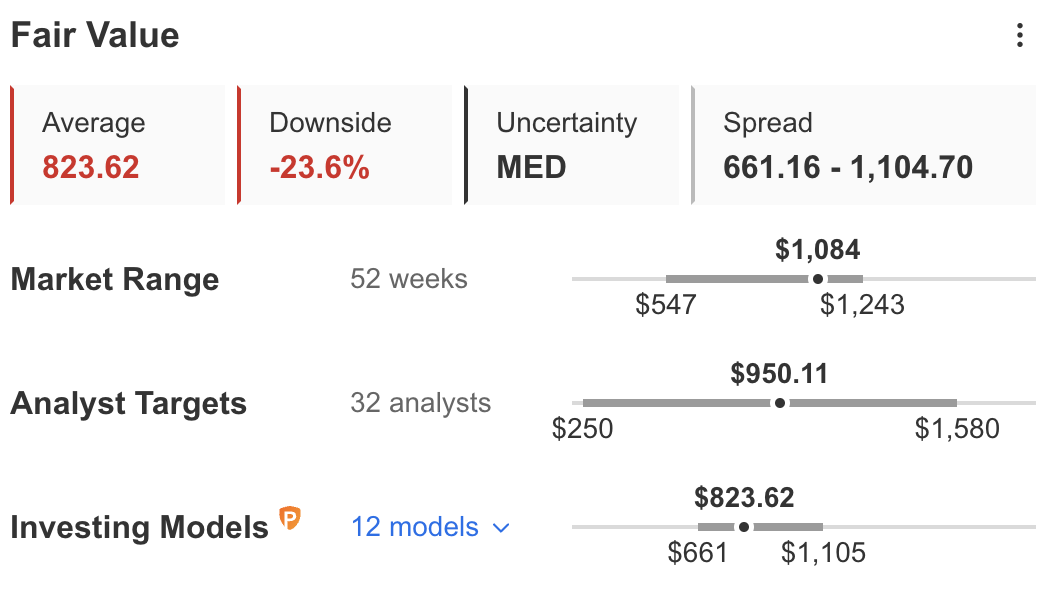

As a consequence of this extraordinarily wealthy valuation, Tesla’s inventory might be a dangerous guess primarily based on InvestingPro’s mannequin, assigning Tesla $823.62 a justifiable share worth, 23.6% draw back threat from the present degree.

Supply: InvestingPro

That being stated, any pullback in Tesla shares has confirmed to be a profitable commerce for patrons on a dip. In line with Morgan Stanley’s Adam Jonas, Tesla will stay the chief in EV manufacturing, batteries, and autonomy within the foreseeable future, making it an appropriate candidate for long-term traders.

His latest be aware acknowledged:

“So the place does Tesla slot in? We’re not going to inform you that Tesla is a automotive firm. Or a tech firm. It is each. But it surely’s additionally an power firm. And what we’re seeing emerge over the course of this 12 months is Tesla as a renewable power on-shore infrastructure firm. We imagine Tesla’s position in developing the EV provide chain (upstream) and EV infrastructure (downstream) will develop into more and more evident to the funding neighborhood over the following few weeks/months.”

Backside Line

Tesla inventory has many catalysts that assist a chronic rally. However after its most up-to-date soar, traders ought to commerce this identify with warning and watch for the following alternative to enter at a a lot better pricing level, just like the one calculated by InvestingPro fashions.

[ad_2]