[ad_1]

T. Rowe Value Group (NASDAQ:) is likely one of the largest asset managers on the planet, with about $1.5 trillion in property below administration. The asset administration enterprise is booming, particularly because the financial system has rebounded from COVID-19 and fairness markets rally.

Authorities intervention has performed no small half in protecting markets buoyant, as low rates of interest encourage traders to put money into riskier property resembling equities. T. Rowe faces challenges from the large low-cost asset managers, notably BlackRock (NYSE:) and Vanguard, however the agency has delivered sturdy and constant progress for a few years.

Supply: Investing.com

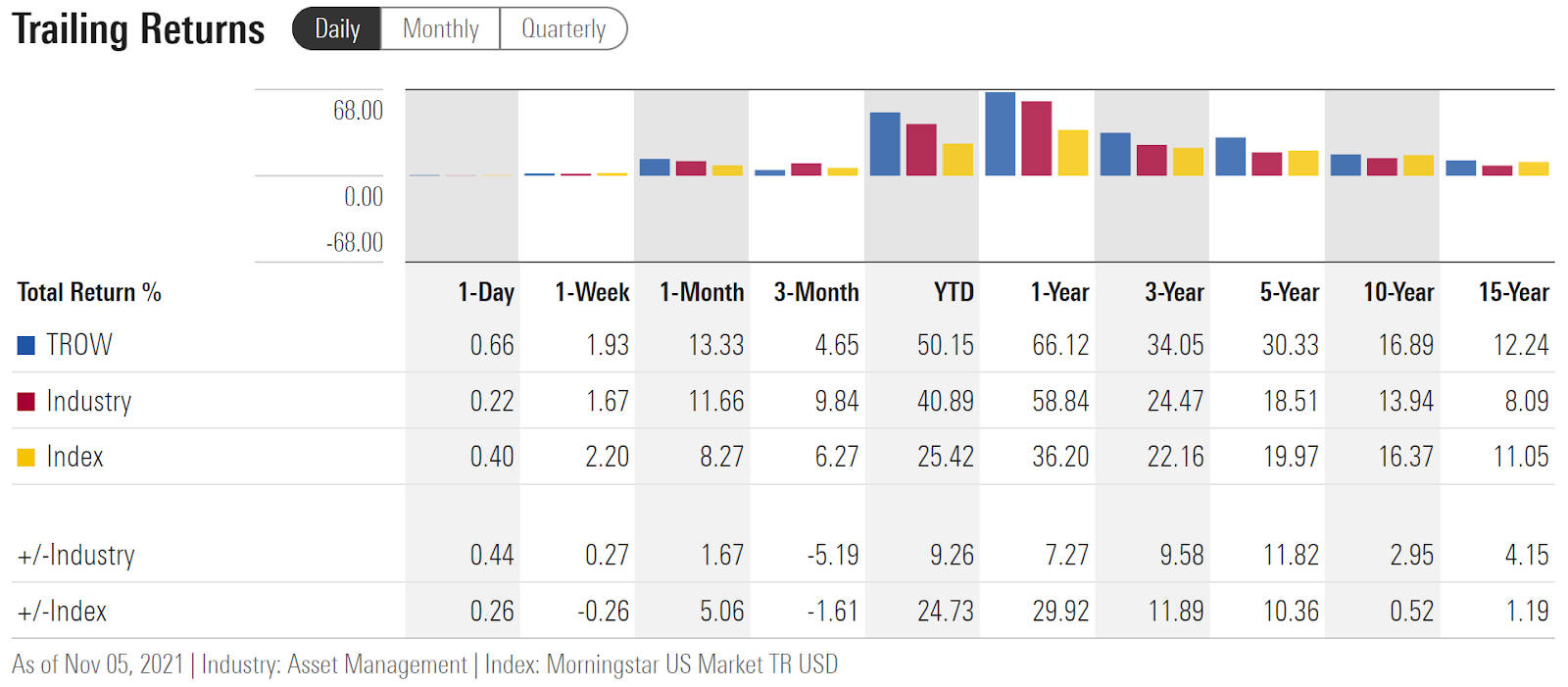

TROW has returned a complete of fifty.15% for the YTD, though the shares are barely under their YTD excessive shut of $223.87 on Aug. 31. TROW has considerably outperformed the Asset Administration trade for the previous 1-, 3-, 5-, 10-, and 15-year durations.

Supply: Morningstar

The present dividend yield for TROW is 1.97%, with 3-, 5-, and 10-year annualized dividend progress charges of 15.7%, 14.1%, and 13.2%, respectively. The corporate has 35 consecutive years of dividend progress and the present payout ratio is a low 33.9%. On the premise of the Gordon Development Mannequin, it will not be unreasonable to anticipate future annualized returns of 15%. The consensus anticipated EPS progress for the subsequent 3-5 years is 13.9% per 12 months, which might assist dividend progress charges according to the previous decade.

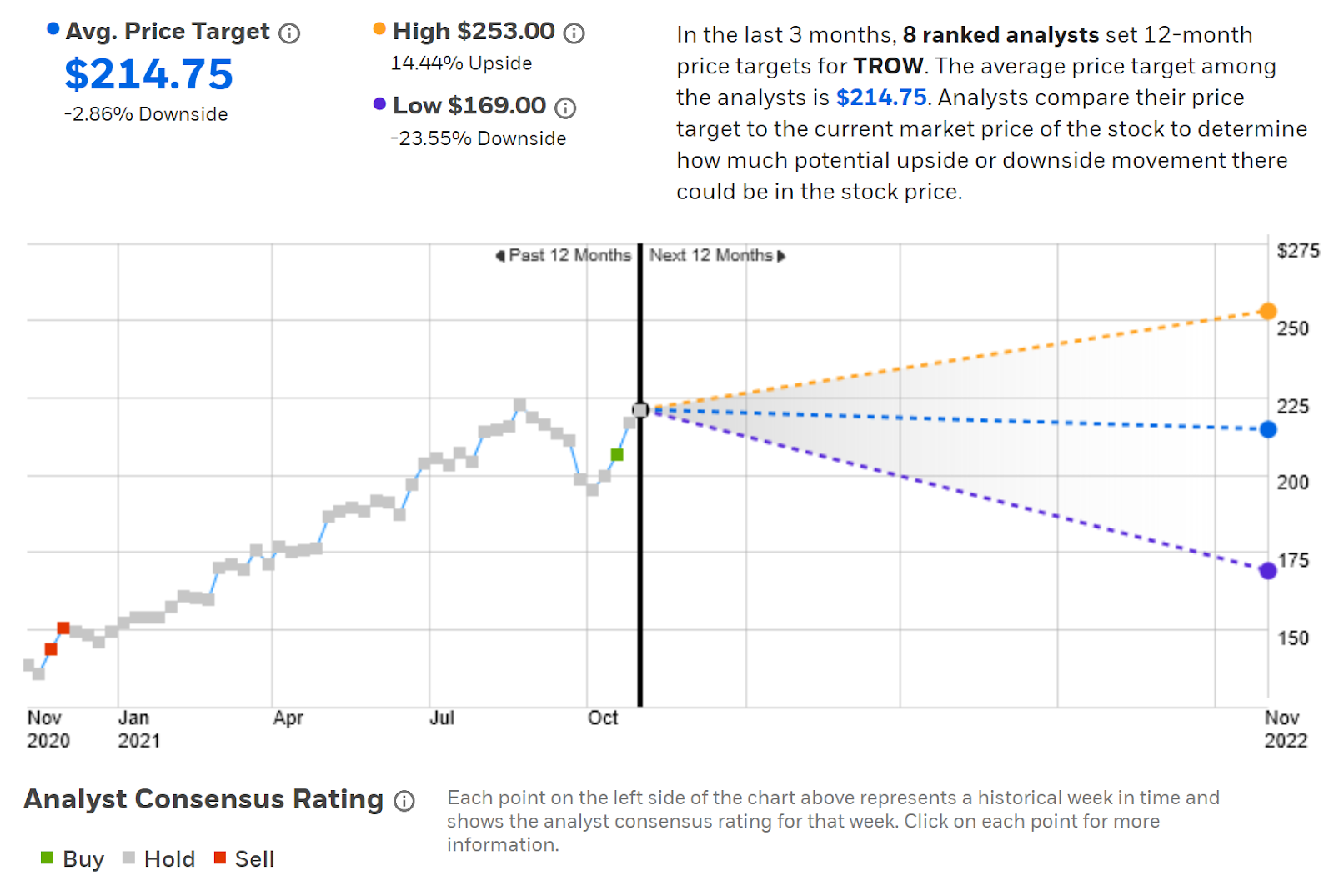

I final wrote about TROW on Mar. 27, 2021, just a little over 7 months in the past. The article was titled T. Rowe Value Delivers Impressively Constant Development. At the moment, the shares have been above the Wall Avenue consensus 12-month worth goal. The consensus score from the Wall Avenue analysts was both bullish or impartial, relying on the supply.

Given TROW’s sturdy fundamentals and document as a dependable dividend progress inventory, the consensus expectation for damaging worth returns for the subsequent 12 months was considerably stunning. I assigned TROW a bullish score on the premise of the basics and since the market-implied outlook (derived from choices costs as defined within the subsequent part) was modestly bullish. Since my article, TROW has considerably outperformed the .

The value of an choice on a inventory represents the market’s consensus estimate of the likelihood that the inventory worth will rise above (name choice) or fall under (put choice) a particular stage between now and when the choice expires. By analyzing the costs of put and name choices at a variety of strike costs and the identical expiration date, it’s doable to calculate a probabilistic worth return forecast for the inventory that reconciles the choices costs. That is known as the market-implied outlook. In late March, the market-implied outlook for TROW to the tip of 2021 was barely bullish.

With greater than 7 months, and three quarterly earnings stories, since my final evaluation, I’ve up to date the market-implied outlook for TROW and focus on this within the context of the Wall Avenue consensus outlook and the basics.

Wall Avenue Consensus Outlook for TROW

E-Commerce calculates the Wall Avenue consensus outlook for TROW by combining the views of 8 ranked analysts who’ve revealed rankings and worth targets throughout the previous 90 days. The consensus score is impartial and the consensus 12-month worth goal is 2.86% under the present worth. Again in late March, E-Commerce’s consensus score was bullish and the consensus 12-month worth goal was $170.43, 2.33% under the share worth at the moment.

The Wall Avenue consensus outlook is that all the subsequent 12 months’s anticipated progress is already mirrored within the inventory worth—however that was additionally the case in late March.

Supply: E-Commerce

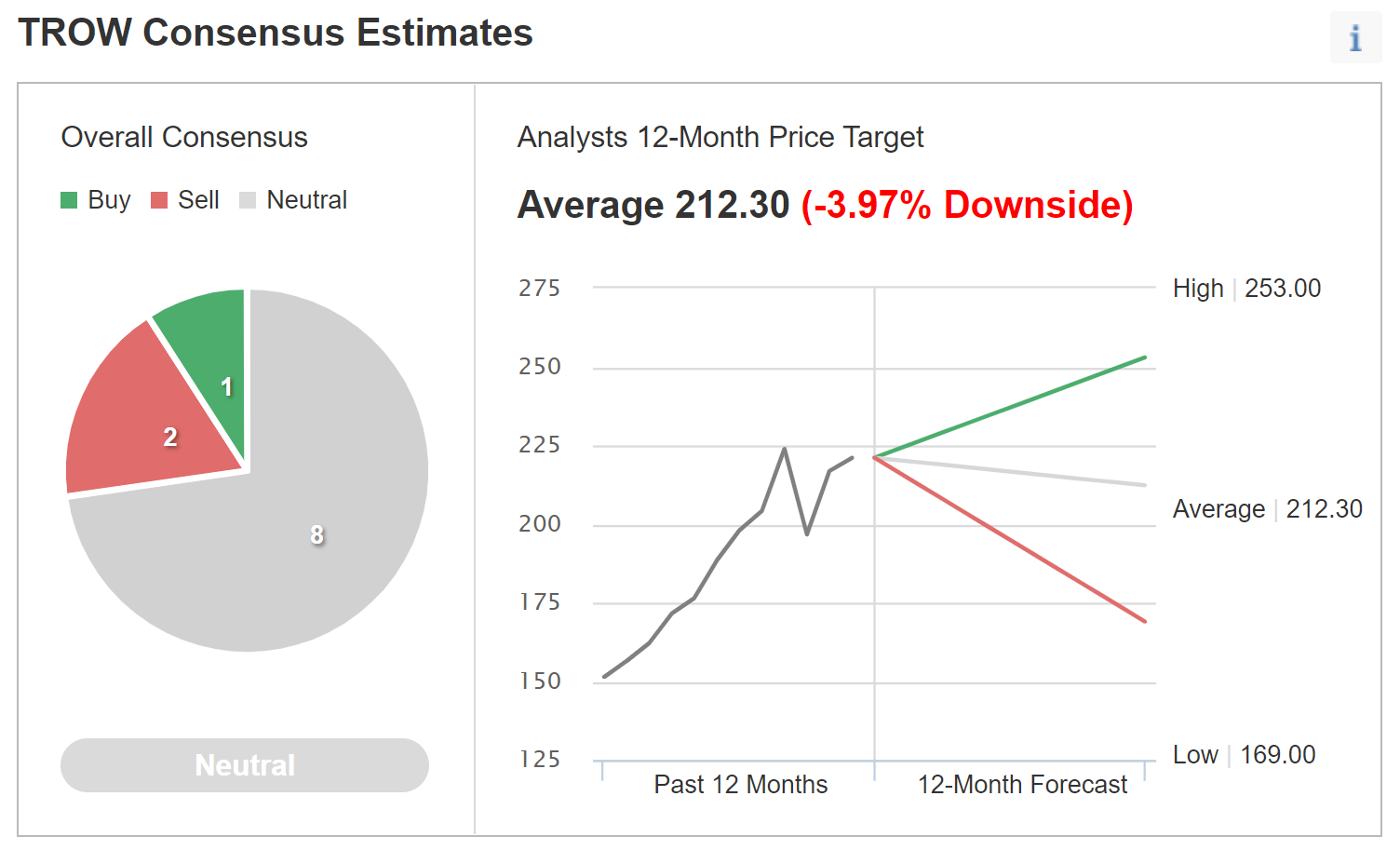

Investing.com calculates the Wall Avenue consensus from a cohort of 11 analysts. The consensus score is impartial and the consensus 12-month worth goal is 3.97% under the present share worth.

Supply: Investing.com

The consensus outlook from the Wall Avenue analysts is impartial, with worth targets that suggest that the subsequent 12 months’s progress is already priced into the shares. Again in late March, the 12-month worth targets urged that the shares had no upside, as nicely, however the shares have rallied since then. The market, in different phrases, seems to be viewing TROW in a extra optimistic gentle than the analysts.

Market-Implied Outlook for TROW

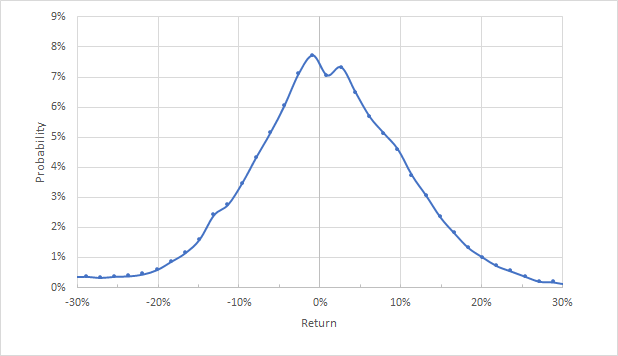

Although TROW has a market cap of virtually $50 billion, the choices buying and selling on the shares is pretty skinny. Which means the market-implied outlook could also be much less reflective of precise market sentiment. I’ve analyzed choices on TROW that expire on Jan. 21, 2022 to generate the market-implied outlook for the subsequent 2.45 months (from now till that expiration date). I’ve additionally calculated the market-implied outlook for the subsequent 5.2 months from the costs of choices that expire on Apr. 14, 2022. The buying and selling in choices for this later expiration date is very gentle, so I give little weight to this longer outlook.

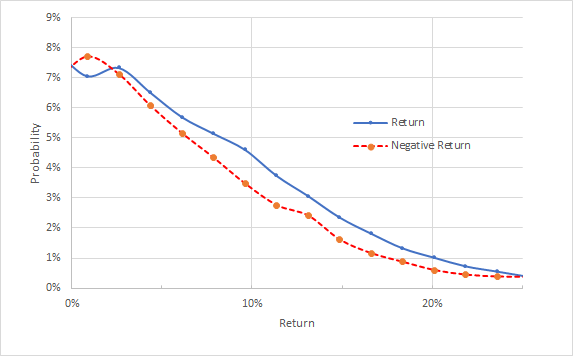

The usual presentation of the market-implied outlook is within the type of a likelihood distribution of worth returns, with likelihood on the vertical axis and return on the horizontal.

TROW Market-Implied Value Return Possibilities F From Right this moment Till Jan. 21, 2022

Supply: Creator’s calculations utilizing choices quotes from E-Commerce

The market-implied outlook for TROW to mid January of 2022 is mostly symmetric, with comparable chances of constructive and damaging returns of the identical magnitude, though the utmost likelihood outcomes are barely tilted in the direction of damaging returns. The height likelihood corresponds to a worth return of -0.9%. The annualized volatility derived from this distribution is 26.8%.

To make it simpler to straight examine the possibilities of constructive and damaging returns, I rotate the damaging return facet of the distribution in regards to the vertical axis (see chart under).

TROW Market-Implied Value Return Possibilities F From Right this moment Till Jan. 21, 2022

Supply: Creator’s calculations utilizing choices quotes from E-Commerce. The damaging return facet of the distribution has been rotated in regards to the vertical axis.

This view of the market-implied outlook reveals that the possibilities of constructive returns are constantly greater than for damaging returns throughout a variety of the most-probable outcomes (the stable blue line is above the dashed crimson line for nearly all the doable returns on the chart). It is a bullish indication for TROW.

Principle means that the market-implied outlook is anticipated to have a damaging bias as a result of traders, in mixture, are danger averse and have a tendency to over-pay for put choices. Contemplating the potential for this bias reinforces the bullish interpretation of the market-implied outlook for TROW.

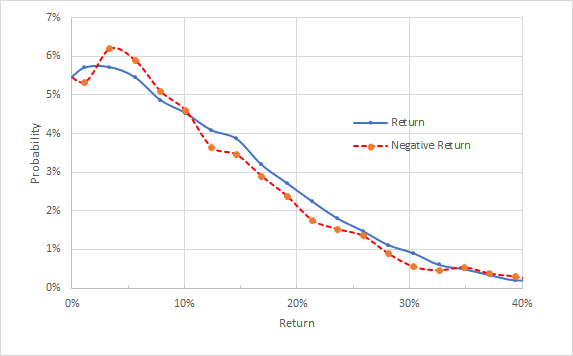

The market-implied outlook for the subsequent 5.2 months, from now till Apr. 14, 2022, is mostly in line with the shorter-term outlook though the height in likelihood at a small damaging return is extra pronounced (return of -3.5%) and the lean in the direction of constructive returns for the vary of different outcomes is much less pronounced. As famous beforehand, I’ve little confidence on this outlook as a result of lack of energetic buying and selling in choices with this expiration. I interpret this outlook as impartial.

TROW Market-Implied Value Return Possibilities F From Right this moment Till Apr. 14, 2022

Supply: Creator’s calculations utilizing choices quotes from E-Commerce. The damaging return facet of the distribution has been rotated in regards to the vertical axis.

Abstract

TROW has delivered spectacular returns to this point this 12 months, and since my final evaluation in March. The asset administration enterprise thrives when markets rally, in fact (and vice versa). The Wall Avenue consensus again in March was that the shares have been totally priced and the identical is true at this time. The basics are engaging and there’s no apparent obstacle to the corporate sustaining its long-term dividend progress trajectory.

Whereas the Wall Avenue consensus worth goal for the subsequent 12 months is under the present worth, the dividend yield and anticipated (continued) dividend progress charge can moderately assist a 15% whole annualized return. The market-implied outlook to early 2022 continues to be barely bullish, albeit much less bullish than the market-implied outlook for the steadiness of 2021 that I calculated in late March. I’m sustaining my bullish total score for TROW.

[ad_2]