[ad_1]

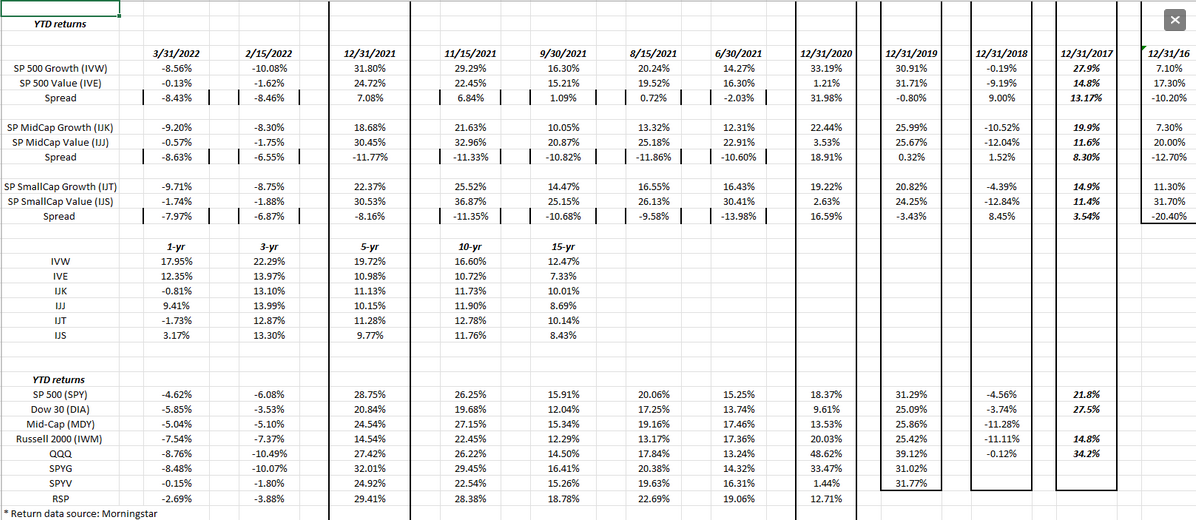

Updating style-box returns as of three/31/22, utilizing the iShares development and worth ETFs. “Worth” continues to outperform development this calendar 12 months (most likely not a shock given the Vitality sector’s efficiency) however development did slim the differential after the Feb. 15, replace.

Close to the lows of early March and simply previous to the beginning of the great March rally, S&P 500 development was down 12%, whereas worth was down 2% and I think that was the height of the efficiency differential. By 3/31/22, the S&PYG—SPDR® Portfolio S&P 500 Progress ETF (NYSE:)—was down 8.48%, whereas the SPDR® Portfolio S&P 500 Worth ETF (NYSE:) was down simply 15 foundation factors or virtually flat on the finish of the quarter.

Trying on the above spreadsheet (and like all my spreadsheets, this one is taking up a lifetime of it’s personal) readers can see how within the mid-cap and small-cap asset courses, worth began to outperform development in 2021, however the large-cap development asset class continued to indicate outperformance vs large-cap worth, and that’s largely because of the mega-cap area or prime 10 names within the S&P 500.

Beginning in 2022 although, worth has clearly outperformed throughout all market-cap asset courses.

Q1 ’22 was the largest efficiency differential between large-cap worth and development since 2016, with large-cap worth outperforming l/c development by over 800 bps this quarter.

The rolling multi-year returns are nonetheless fairly elevated. If 2022 provides us nothing greater than a flat fairness market throughout the board, it could go a good distance in taking the steam out of the all market caps. Trying on the rolling returns, large-cap development continues to be exhibiting a lot more healthy common, annual returns than it’s smaller asset courses.

Numbers and markets change rapidly. Take all this with a wholesome skepticism. I do that replace simply to remain abreast of the numbers and rolling returns in areas the place purchasers will not be invested.

Fusion Media or anybody concerned with Fusion Media won’t settle for any legal responsibility for loss or injury on account of reliance on the knowledge together with knowledge, quotes, charts and purchase/promote alerts contained inside this web site. Please be totally knowledgeable concerning the dangers and prices related to buying and selling the monetary markets, it is likely one of the riskiest funding types doable.

[ad_2]