[ad_1]

The choice to both enhance or introduce export obligation on some iron & metal merchandise was taken to assist home customers of those and rein in inflation. However most analysts see the event as a unfavourable for shares of iron & metal producers. The slicing of duties on petrol and diesel was additionally to tame inflation with out in any means impacting the revenues of OMCs. Since OMCs are unlikely to hike costs of petrol and diesel instantly, under-recoveries would proceed, which might impression their profitability, analysts stated.

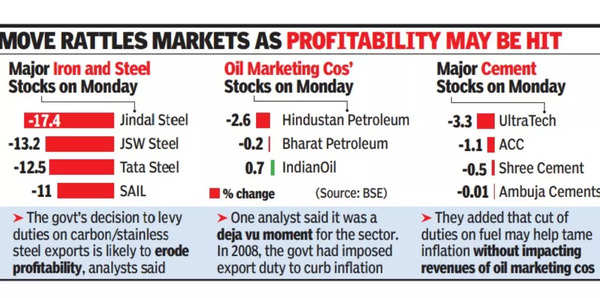

Among the many iron & metal makers, Jindal Metal crashed over 17%, whereas JSW Metal misplaced just a little over 13%, Tata Metal 12.5% and SAIL 11%. Consequently, BSE’s metallic index misplaced 8.3% to shut at a greater than one-year low stage. As for oil firms, IOCL, which has a bonus when it comes to refining, closed marginally increased, whereas HPCL, which has robust advertising and marketing leverage, closed 2.6% decrease.

Based on a report by home brokerage Edelweiss, the federal government’s choice to levy duties on carbon/chrome steel exports is more likely to erode the profitability of the sector considerably. “The transfer has throttled the current rise of the Indian metal trade within the international enviornment,” the report famous.

A report by Prabhudas Lilladher, one other home brokerage, described the state of affairs as deja vu second for the sector. “The occasion reminds of 2008 when the UPA authorities imposed export obligation to curb inflation as metal costs crossed $1,000/tonne within the wake of huge international liquidity and robust demand.” It admitted that it is probably not right to affix the dots by linking the previous occasion with the present one.

The response to the choice to vary duties and levies left bond gamers a divided lot. Based on a bond fund supervisor, no instant enhancement in authorities’s borrowing is predicted since any such enhance often comes nearer to the tip of the fiscal 12 months. And given that also 10 months are left within the 12 months, a number of variables would resolve the ultimate borrowing determine, the fund supervisor stated.

[ad_2]