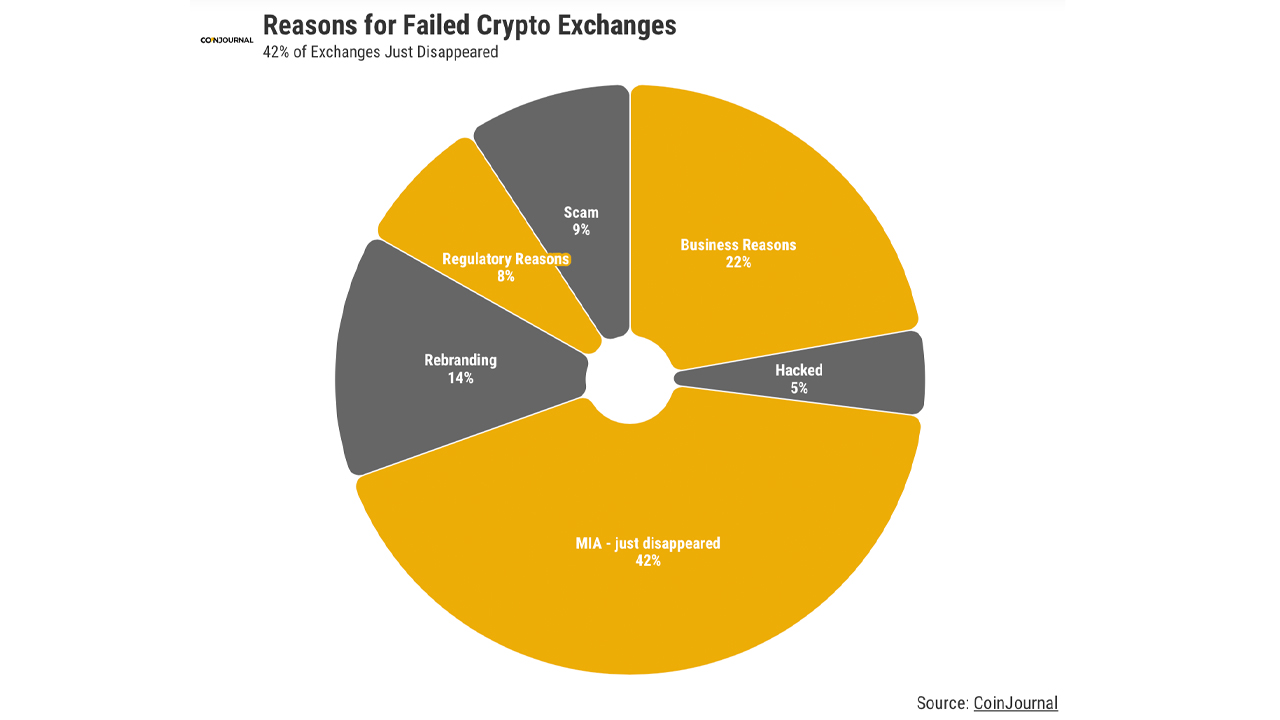

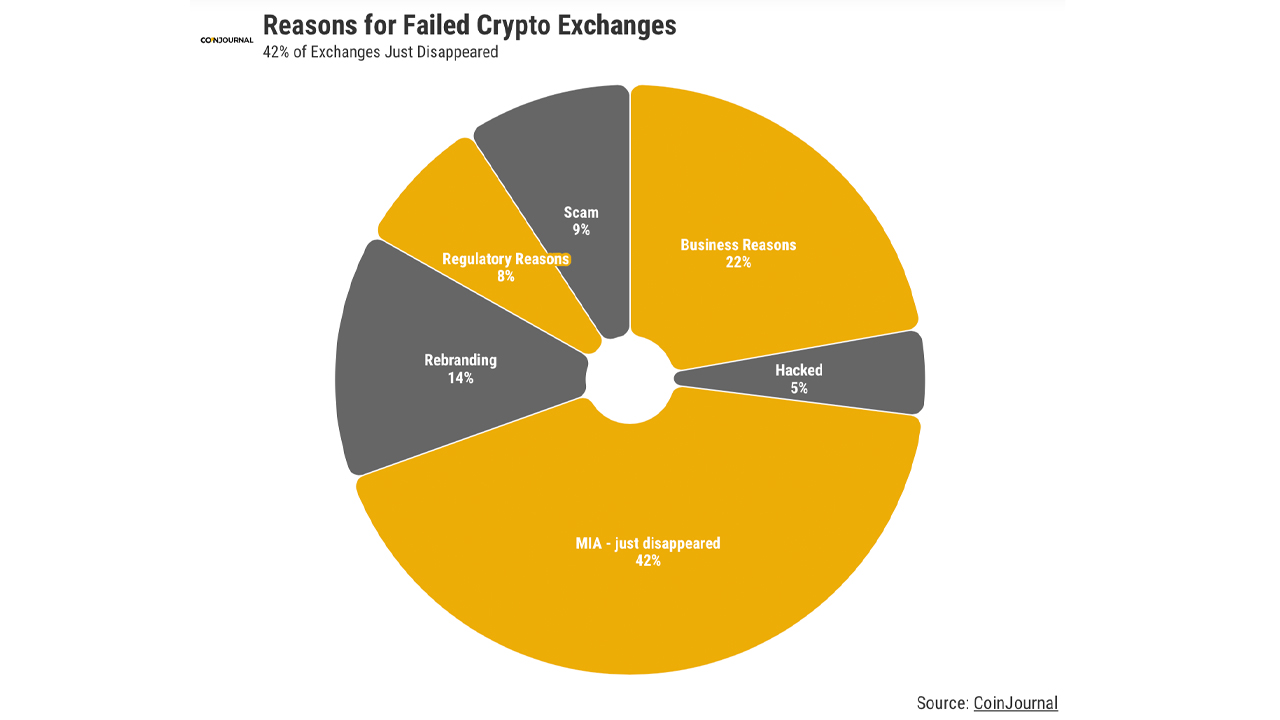

Only in the near past, coinjournal.internet revealed a report that reveals the variety of cryptocurrency exchanges which have failed over the past eight years. Curiously, the researcher’s information reveals that 42% of failed crypto asset buying and selling platforms disappeared and not using a hint, giving customers no clarification as to why the change shut down.

Through the Previous 8 Years, Analysis Exhibits Solely 22% of Failed Crypto Exchanges Have Left On account of Precise Enterprise-Associated Causes

- A report that covers failed digital forex exchanges signifies that 42% of all of the exchanges which have failed since 2014 have given no causes as to why the enterprise faltered and the buying and selling platforms principally disappeared from the business with out a lot discover.

- 22% of the failed crypto exchanges over the past eight years left as a result of precise business-related causes, in accordance with coinjournal.internet’s analysis. 9% of the buying and selling platforms turned out to be outright scams and fraudulent companies from the get-go.

- “Following 23 exchanges going underneath in 2018, this quantity exploded upwards by 252% in 2019, earlier than rising an additional 17% in 2020,” coinjournal.internet’s report explains. “Remaining on the identical stage in 2021, this 12 months there has lastly been enchancment, with a 55% discount in failures if the remainder of the 12 months follows the primary six months.”

- In a remark despatched to Bitcoin.com Information, Dan Ashmore, a CFA and cryptocurrency information analyst at coinjournal.internet, defined that metrics like these needs to be cleaned up. “If cryptocurrency is to be taken critically and totally set up itself, it must proceed to wash up its picture and depart damning statistics like these behind,” Ashmore remarked.

- Moreover, the report notes that whereas 2022 has not ended, it’s anticipated that the 12 months will see a 55% fall in total crypto change failures. “Regarding the quantity merely vanishing into skinny air, one might anticipate this to decrease – regulation remains to be far behind, nevertheless it has at the very least made progress and may make it tougher for exchanges to fade and not using a hint,” the coinjournal.internet report provides.

- The report comes at a time when a myriad of crypto firms have been struggling financially from the crypto winter. Layoffs have been spreading throughout the crypto business throughout the previous couple of months as 1000’s of crypto workers have been let go.

- Furthermore, three important insolvencies have pushed Celsius, Three Arrows Capital (3AC), and Voyager Digital to file for chapter safety. Not less than half of a dozen digital forex platforms have frozen withdrawals.

- This previous Wednesday, the buying and selling platform Zipmex paused withdrawals and stated it was affected by “monetary difficulties [from] of our key enterprise companions” attributable to the crypto market downturn.

- Following the pause, the Thailand Securities and Change Fee (SEC) has requested Zipmex why it has paused withdrawals in a letter revealed on Wednesday.

Tags on this story

2014, 22, 42%, 8 years, bankruptcies, Celsius, crypto exchanges, Crypto Lenders, crypto buying and selling platforms, Crypto Winter, cryptocurrency information analyst, Dan Ashmore, Exchanges, failed crypto exchanges, frozen withdrawals, Percentages, Thailand SEC, Three Arrows Capital (3AC), Voyager Digital, Zipmex

What do you consider the analysis report revealed by coinjournal.internet? Tell us what you consider this topic within the feedback part beneath.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an lively member of the cryptocurrency neighborhood since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 5,700 articles for Bitcoin.com Information in regards to the disruptive protocols rising immediately.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, coinjournal.internet

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss brought about or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.