[ad_1]

You’ve in all probability heard this already, however in case you haven’t began your Christmas procuring, it is likely to be a good suggestion to take action as quickly as doable. Transport bottlenecks are anticipated to persist properly into 2022, pushed by slow-capacity progress, a scarcity of containers and truckers and the continued semiconductor chip crunch, which has restricted new truck manufacturing for final mile supply.

These “excellent storm” disruptions have created quite a few complications for delivery and logistics corporations. However as is commonly the case, unhealthy information is nice information, particularly for traders who’ve seen shares of container strains surge within the 18 months for the reason that pandemic started.

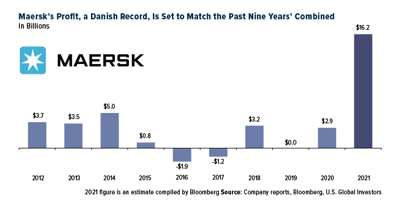

AP Moeller Maersk (CSE:), the world’s largest service, has sailed up near 190% in Copenhagen buying and selling. In September, Bloomberg analysts forecast that Maersk’s 2021 internet revenue will find yourself someplace within the neighborhood of $16 billion, which might be a document for not simply the corporate however for any Denmark-listed firm. (Danish pharmaceutical firm Novo Nordisk (NYSE:) holds the present document after having reported greater than $6.5 billion in income in 2020.)

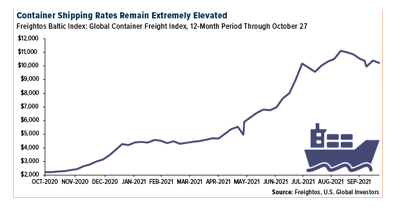

That is all thanks, in fact, to unheard-of delivery charges. The Freightos Baltic Index, which measures world container costs, presently stands at a mean $10,321 per 40-foot container. A 12 months in the past, the identical container price exporters solely $2,231, or about four-and-a-half instances much less, to ship. To ship only one container from Shanghai to Los Angeles, corporations should now cough up a jaw-dropping $17,478, in line with Freightos.

Trying on the chart above, you in all probability discover that charges are rolling over, and so you might infer that the market is within the technique of normalizing. As a lot as that would supply customers with some reduction, we may very well be taking a look at a number of extra months of world supply-chain disruptions.

Morgan Stanley: Greater For Longer

That’s in line with analysis by Morgan Stanley, which stated in a report final week that “the market might keep peaked for longer.” The funding financial institution expects delivery revenues to remain elevated not less than by the second quarter of 2022. Quarterly earnings, then, might not have peaked but, leaving loads of upside potential for traders who search to take part.

After which there’s the chip scarcity. Like almost all the things manufactured at present, new vans don’t work with out chips. This has hampered manufacturing.

President Joe Biden lately brokered a cope with ports in Los Angeles and Lengthy Seashore to stay working 24 hours a day to assist alleviate the delivery bottleneck, but when there aren’t sufficient vans and truck drivers to maneuver containers, then it doesn’t matter how late the ports keep open. At one level prior to now week, as many as 100 ships—an all-time document—had been ready to unload their cargo outdoors Los Angeles and Lengthy Seashore, which collectively account for 40% of all containers getting into the U.S.

Lengthy story brief, supply-chain disruptions stands out as the new regular for not less than the subsequent six to 12 months.

This can trigger logistics corporations all kinds of complications, nevertheless it may find yourself being very worthwhile for traders.

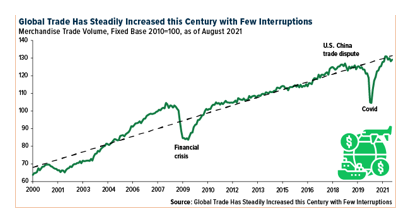

Transport Is A Lengthy-Time period Development Story

It’s essential for traders to remember, although, that all the things I’ve stated up up to now offers strictly with the brief time period. International commerce and delivery are a part of a long-term secular story, on the heart of which is the worldwide center class. Thus far this century, commerce has steadily elevated with few interruptions because the variety of individuals categorised as center class has continued to develop, notably in China and India. Though the pandemic has stalled family revenue progress in some areas, an unimaginable 1 billion Asians are forecast to affix the center class by 2030, in line with the World Information Lab. Most of those 1 billion individuals will search a middle-class life-style stuffed with middle-class furnishings, home equipment, devices and extra, all of which ought to assist delivery and logistics corporations years into the longer term.

Air Cargo Up Practically 8% In August In contrast To Pre-Pandemic Ranges

It’s not simply ocean freight that appears enticing proper now. Air cargo corporations are additionally benefiting from elevated client demand, with cargo volumes up 7.7% in August in contrast with the identical month in 2019, in line with the Worldwide Air Transport Affiliation (IATA). That is down barely from 8.8% progress in July, however nonetheless a really strong report.

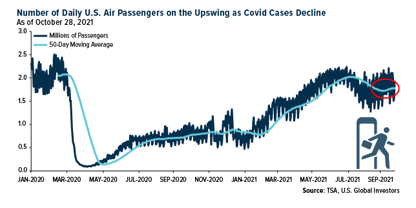

As for industrial air passenger quantity, I’m happy to see day by day visitors as reported by the Transportation Safety Administration (TSA) start to get well following the Delta-impacted summer time months. We’re nonetheless down some half 1,000,000 day by day passengers from 2019 ranges, however the 50-day shifting common suggests we’re in a progress stage.

We consider the subsequent catalyst for progress shall be Nov. 8. That’s when sure restrictions shall be lifted for travellers from China, India and most of Europe. These restrictions have been in place for the reason that starting of the pandemic in 2020, so it wouldn’t shock me to see an enormous inflow of people that have been keen to go to the U.S.

Disclosure: All opinions expressed and knowledge supplied are topic to alter with out discover. A few of these opinions is probably not acceptable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all data provided by this/these web site(s) and isn’t answerable for its/their content material.

The Freightos Baltic Every day Index measures the day by day value actions of 40-foot containers in 12 main maritime lanes. It’s expressed as a mean value per 40-foot container.

Holdings might change day by day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Buyers as of (09/30/2021): AP Moller-Maersk A/S

[ad_2]