[ad_1]

Many of us surprise why the Federal Reserve must be so aggressive with rate of interest hikes. In any case, 30-year mounted mortgages have topped 5%, making it practically inconceivable for homebuyers to qualify.

The first manner for a central financial institution to beat again inflation is to extend borrowing prices. Particularly, the Fed reduces demand by curbing the urge for food for credit score.

The danger? Demand is whacked so laborious that the nation finds its financial system shrinking.

Granted, Fed Chair Powell has explicitly said that the aim is to tame inflation with out inflicting a recession. But pressures might already be constructing.

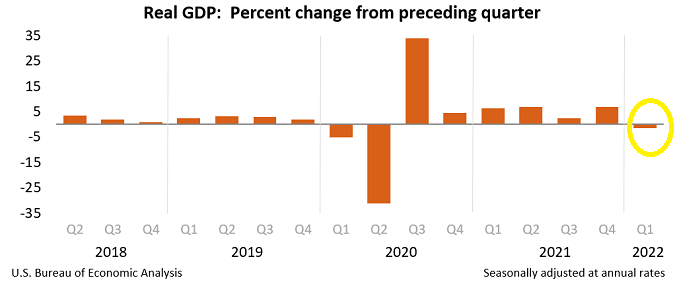

Take into account the primary quarter of 2022. Gross home product () registered -1.4%.

The concept that the Fed can engineer a “smooth financial touchdown” could also be fanciful. In line with Rosenberg Analysis, the central financial institution has solely achieved this goal in 3 out of 14 tightening cycles.

Tech shares within the have already hit 20% bearish declines. In the meantime, disruptor shares in funds like Cathie Wooden’s ARK Innovation ETF (NYSE:) (e.g., Zoom Video (NASDAQ:), Teladoc (NYSE:), Roku (NASDAQ:) and many others.) have plummeted like dot-com disasters from the 2000 inventory bubble.

There’s extra.

The complete bond market has already moved to the purpose the place the Fed intends to go. And which means yields throughout the whole Treasury market are flatter than the queen of spades from a poker deck.

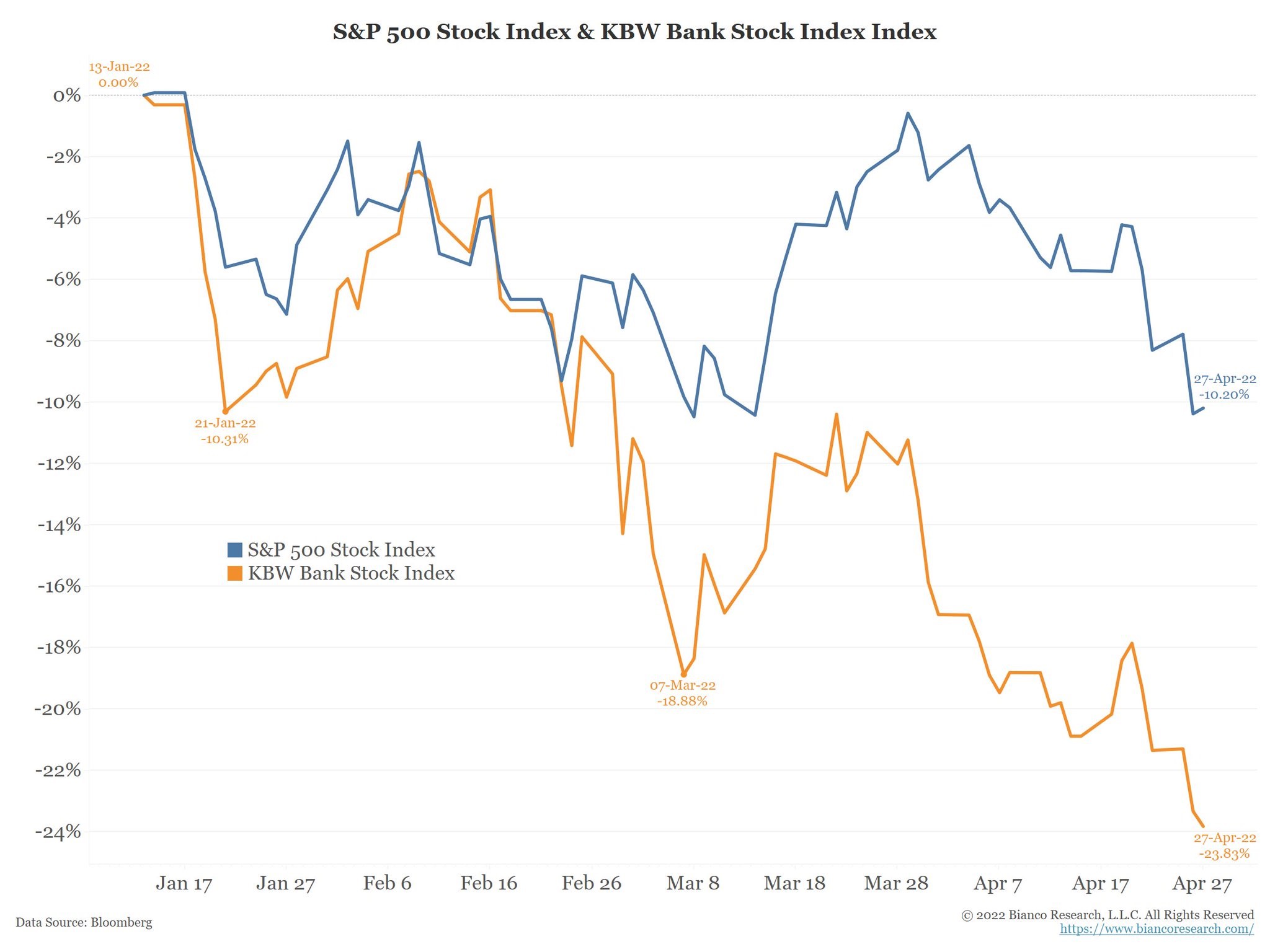

The implication for banks? There’s little to no cash to be made when there’s no distinction between borrowing for 0-1 years and lending for 5-30.

Financial institution shares have been getting slammed.

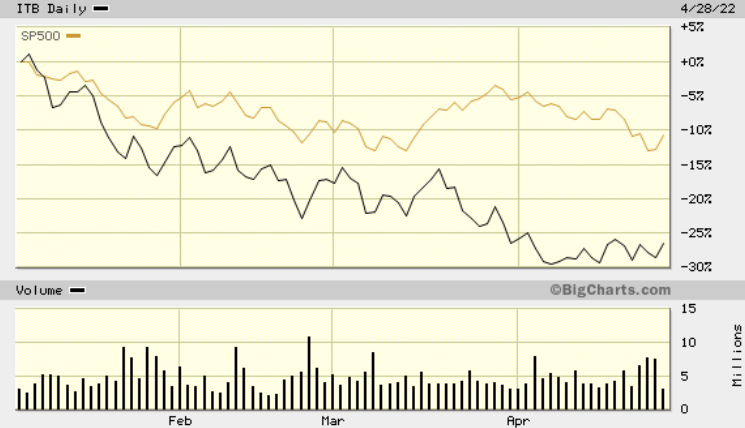

In an identical vein, rate-sensitive homebuilders have been eviscerated.

All through the 2010s and for the higher a part of the 2020s, Wall Road bulls enthusiastically exclaimed that shares have been the one recreation on the town. With rates of interest so low, they mentioned, “There isn’t a various!” (TINA).

In the present day? The Treasury bond offers a far superior yield to the ’s dividend.

It’s not that buyers must be salivating over a risk-free 3% return. Alternatively, the Fed will inevitably revisit zero-percent price coverage in a recession. When it does, the iShares 7-10 12 months Treasury Bond ETF (NYSE:) might very effectively garner 25%-plus in whole return.

[ad_2]