[ad_1]

Fascinated with organising a belief for your loved ones? Study the variations between revocable and irrevocable trusts and which stands out as the proper match for you.

We now have all heard the cliché that the one assured issues in life are demise and taxes. Whereas neither of those are nice to consider, most of us share an analogous sentiment: if something have been to occur to us, we wish to make our household’s life simpler.

One of the difficult parts of demise is the monetary implications that include it. That would embody paying for a funeral or figuring out the place and the way to entry property, to not point out the typically prolonged strategy of probate.

Luckily, there’s a useful resolution: trusts. (And a life insurance coverage coverage, however that’s a subject for an additional time.)

Trusts are available in many sorts, however for the sake of this text, we’re going to give attention to two of the extra fashionable selections — revocable and irrevocable trusts. These two choices will be beneficial monetary instruments for streamlining (or eliminating altogether) the probate course of and guaranteeing your property are distributed appropriately. The legal guidelines governing trusts differ from state to state, and it’s best to verify with a licensed lawyer or monetary skilled for particular details about your state’s legal guidelines, however right here is a few useful data to get you began.

On this article:

What’s a belief?

A belief settlement is a monetary entity, legally separated out of your property, that’s established in an effort to defend, develop, and distribute the property you might have collected. Your belief can maintain property — like your property, life insurance coverage, funding accounts — and distribute them in keeping with your needs whenever you die.

While you put cash right into a belief, you might be known as a grantor. Because the cash within the belief will not be legally yours, the belief should have a supervisor — known as a trustee — whose job is to handle the belief property and distribution course of.

A belief settlement is designed to legally separate you from the wealth you want to go away behind. Relying on the kind of belief you create, there are quite a few potential benefits that include having a belief and a residing will. These benefits embody management over your wealth, safety of your legacy, elimination or streamlining of the probate course of and property tax financial savings.

Doesn’t a will cowl all this?

Briefly, no. A will and a belief serve two distinctly completely different functions. Whereas everybody actually ought to have a will, not everybody wants a belief. Nonetheless, many individuals may discover each useful.

A will takes impact after you die and contains indications on who ought to be the guardian of your youngsters, particulars of your property, funeral association preferences, and designations for objects which might be your property solely. Moreover, a will all the time passes by means of probate, which suggests a courtroom will guarantee it’s legitimate and can oversee the administration.

A belief, alternatively, is in impact when you are alive. It isn’t a way of naming a guardian on your youngsters or specifying your funeral preferences. Its function is to function the holder for all of your property with clear directions for who receives what. Typically, a belief won’t must undergo probate, which, relying on the complexity, can save your loved ones plenty of money and time. Property inside a belief doc are generally issues like a home, life insurance coverage, retirement plans and extra.

A belief doesn’t supersede your life insurance coverage designations. The beneficiary named in your life insurance coverage coverage will stay the beneficiary even when you specify in any other case in your belief. You’ll be able to, in fact, title the belief as your beneficiary after which assign your property in keeping with your desire.

What’s an irrevocable belief?

Because the title implies, an irrevocable belief is one that you just (the grantor) can’t revoke in complete or partly. One of these belief doc can solely be modified or terminated with the permission of the beneficiary. The second a grantor transfers all property into the belief, the grantor removes his or her rights to entry or possession. For that reason, an irrevocable belief will not be thought-about to be a part of your property for authorized and tax functions.

Chances are you’ll surprise why anyone would select to create a belief that can’t be revoked, even whereas they’re nonetheless alive. In any case, what incentive is there for placing your hard-earned cash into a spot the place you possibly can’t attain it?

The principle causes for organising an irrevocable belief are for property and tax concerns. The advantage of such a belief for property asset safety is that it successfully removes the belief property from the grantor’s taxable property. It can also take away these property from private legal responsibility. For the typical particular person, it is a non-issue, which is why a revocable residing belief is commonly the extra frequent selection.

What’s a revocable belief?

A revocable belief, additionally known as a residing belief, is one which’s in impact whilst you’re alive however you possibly can entry at any level throughout your lifetime. The “residing” and “revocable” on this belief’s title confer with the truth that you possibly can change them as your circumstances or needs change, and this distinction is what makes it clearly completely different from an irrevocable belief.

While you’re alive, you preserve management over the property within the belief. Upon your demise, the property in your belief go to the beneficiaries you named.

Like several residing belief, a revocable belief is legally separate from you and comes with particular provisions for the way the wealth throughout the belief ought to be distributed. Which means that the property throughout the belief will probably be handled in keeping with your needs, and normally with out the necessity for courtroom help.

On the identical time, you possibly can amend or get rid of a revocable belief, which suggests that you would be able to nonetheless entry the cash throughout the belief if you actually need or need it. For that reason, a revocable belief continues to be thought-about to be a part of your property for authorized and tax functions.

Whereas a residing belief is an property planning device like a will, it provides you extra flexibility to resolve what occurs to your cash and different property throughout your lifetime and afterward.

A revocable belief could also be a more sensible choice in conditions the place having some management over entrusted property is extra essential than the tax benefits and asset safety that include irrevocable trusts.

“A very powerful factor to consider whenever you’re organising a belief is the aim of it,” explains Shannah Sport, CERTIFIED FINANCIAL PLANNER™ skilled and host of the Millennial Cash Podcast. “Sometimes, revocable trusts, or residing trusts, are created to take possession of your property to maintain them protected by the belief throughout your lifetime and will be modified as usually as you want. Irrevocable trusts work to guard your property from property tax and may work as a mechanism to depart cash to your beneficiaries, however simply because the title implies, are irrevocable and may’t be modified. I discover with my shoppers that, generally, a revocable belief satisfies their wants.”

Which belief is best for you?

A revocable belief could be a more sensible choice if you wish to:

- Keep away from probate whereas sustaining most management. Probate is the method courts use to supervise the disposition of an individual’s property after the grantor’s demise. A revocable belief will assist maintain your property out of probate courtroom simply as an irrevocable belief would. Nonetheless, it provides you elevated flexibility to take care of management over the property whilst you’re alive and to make modifications as you see match.

An irrevocable belief could be a more sensible choice for:

- Property tax discount. An irrevocable belief completely provides the grantor’s property (or a portion of the property) to another person, particularly to the trustee and the beneficiaries of the belief. Which means that no matter you place into an irrevocable belief can’t be taxed as a part of your property, as a result of it isn’t a part of your property.

- Asset Safety. Since it isn’t legally yours, an irrevocable belief will not be topic to your private liabilities. Nonetheless, when you make your youngsters and/or your partner the beneficiaries of the belief, you possibly can nonetheless maintain your wealth inside your loved ones, even whereas defending it from private legal responsibility.

Choosing the proper belief

Trusts are a complicated property planning device that may present added advantages {that a} will can’t supply. The fact is that demise will be not solely emotionally draining but in addition very difficult. Trusts present a approach to make it rather less difficult by means of their elimination of the probate course of and doubtlessly any tax implications that may include demise. However, remember that the typical particular person doesn’t want to fret about property taxes because of the excessive thresholds (hundreds of thousands of {dollars}.)

In the event you’re trying to get rid of or uncomplicate the probate course of, then a residing, revocable belief could also be a sound selection for you. In the event you’re looking for a tax-advantaged choice, then you could wish to go together with an irrevocable belief. Both method, by organising a belief you’re serving to to make another person’s life simpler when the time comes that you just’re not round. Your deliberate advance monetary planning is a present to your trustees and beneficiaries.

One choice: Belief & Will

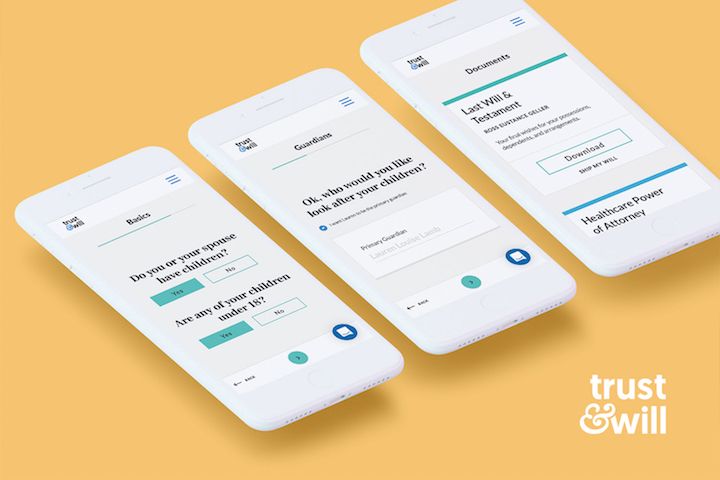

Which reminds us: In the event you’re an eligible Haven Time period policyholder (or when you lucked out and are partnered with one), you possibly can create a no-cost single or joint revocable residing belief with Belief & Will—a service that will usually price as much as $699.

Who’s Belief & Will? They’re a web based resolution for making a belief (and, as you may need guessed, a authorized will) completely over the web. Talking of wills, when you’re questioning whether or not you want one or the opposite or each, the reply is… it relies upon. However when you’re making a will, eligible Haven Life clients also can achieve this for free of charge with Belief & Will.

Anyway, now that you just’re an skilled in revocable trusts, you could be pondering of taking the subsequent step. In that case, Belief & Will is a good place to start out.

Our editorial coverage

Haven Life is a customer-centric life insurance coverage company that’s backed and wholly owned by Massachusetts Mutual Life Insurance coverage Firm (MassMutual). We imagine navigating choices about life insurance coverage, your private funds and general wellness will be refreshingly easy.

Our editorial coverage

Haven Life is a buyer centric life insurance coverage company that’s backed and wholly owned by Massachusetts Mutual Life Insurance coverage Firm (MassMutual). We imagine navigating choices about life insurance coverage, your private funds and general wellness will be refreshingly easy.

Our content material is created for academic functions solely. Haven Life doesn’t endorse the businesses, merchandise, companies or methods mentioned right here, however we hope they will make your life rather less arduous if they’re a match on your scenario.

Haven Life will not be approved to present tax, authorized or funding recommendation. This materials will not be meant to supply, and shouldn’t be relied on for tax, authorized, or funding recommendation. People are inspired to seed recommendation from their very own tax or authorized counsel.

Our disclosures

Haven Time period is a Time period Life Insurance coverage Coverage (DTC and ICC17DTC in sure states, together with NC) issued by Massachusetts Mutual Life Insurance coverage Firm (MassMutual), Springfield, MA 01111-0001 and provided solely by means of Haven Life Insurance coverage Company, LLC. In NY, Haven Time period is DTC-NY 1017. In CA, Haven Time period is DTC-CA 042017. Haven Time period Simplified is a Simplified Concern Time period Life Insurance coverage Coverage (ICC19PCM-SI 0819 in sure states, together with NC) issued by the C.M. Life Insurance coverage Firm, Enfield, CT 06082. Coverage and rider kind numbers and options could differ by state and might not be obtainable in all states. Our Company license quantity in California is OK71922 and in Arkansas 100139527.

MassMutual is rated by A.M. Greatest Firm as A++ (Superior; Prime class of 15). The score is as of Aril 1, 2020 and is topic to vary. MassMutual has obtained completely different scores from different score businesses.

Haven Life Plus (Plus) is the advertising title for the Plus rider, which is included as a part of the Haven Time period coverage and gives entry to further companies and advantages for free of charge or at a reduction. The rider will not be obtainable in each state and is topic to vary at any time. Neither Haven Life nor MassMutual are liable for the supply of the advantages and companies made accessible underneath the Plus Rider, that are supplied by third social gathering distributors (companions). For extra details about Haven Life Plus, please go to: https://havenlife.com/plus.html

[ad_2]