[ad_1]

Proper now, who can blame sellers for holding again? The choice is the problem of looking for prepared consumers in astock market down 20% this yr as surging inflation, aggressive central financial institution rate of interest hikes and the chance of a worldwide recession erode sentiment.

And any lingering hopes for apickup in IPO motion hold getting floor down. The Federal Reserve jacked up charges by essentially the most since 1994 on Wednesday, and even after a bounce on Friday, the S&P 500 suffered one more weekly loss. “Till comparatively lately, there was a well-balanced expectation for high-quality IPOs to come back to market in September,” mentioned James Palmer, Financial institution of America’s head of EMEA fairness capital markets. “However given market occasions over the past two weeks, that’s re-weighted the diploma of hope. ”

Amongst those who have lately thrown within the towel are Coca-Cola, which delayed the deliberate IPO of part of its stake in an African bottler, and Asian insurer FWD Group Holdings, mentioned to have postponed a $1-billion itemizing in Hong Kong.

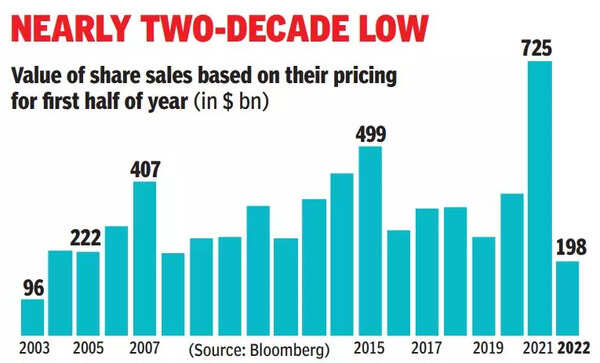

People who have cast forward needed to mood expectations. LIC, as soon as slated to quantity among the many largest fund-raisings of the yr, slashed the scale of its IPO by about 60%. The drop in volumes has been significantly pronounced within the US, the place simply $47 billion of fairness choices have been priced — an 85% fall from a yr in the past. Cross-border listings from China, as soon as a gradual supply of enterprise for New York’s funding bankers, have additionally stalled amid increased regulatory scrutiny within the aftermath of Didi International’s debacle.

A number of markets have bucked the pattern, most notably the Center East. IPOs there are heading for a report first half as excessive oil costs and fairness inflows protect the area. Power big Saudi Aramco is lining up numerous choices for the second half, looking for to make the most of elevated commodity costs.

Elsewhere, there’s no dearth of candidates ready for the precise second. They embrace chip designer Arm, whose proprietor Softbank Group goals to listing the corporate by subsequent March, Thai Beverage’s brewery enterprise, which is making its third try at going public, and Volkswagen’s deliberate share sale of Porsche. Market situations are additionally creating incentives for a second-half rebound in different transactions, equivalent to convertible bond gross sales and spinoffs.

[ad_2]