[ad_1]

- Shares of Pfizer are down over 12.5% because the begin of 2022.

- Plan to spend money generated from COVID-19 vaccine on M&As and share buybacks.

- Lengthy-term traders could take into account shopping for PFE inventory at present ranges.

- On the lookout for extra top-rated inventory concepts so as to add to your portfolio? Members of InvestingPro+ get unique entry to our analysis instruments, information, and pre-selected screeners. Study Extra »

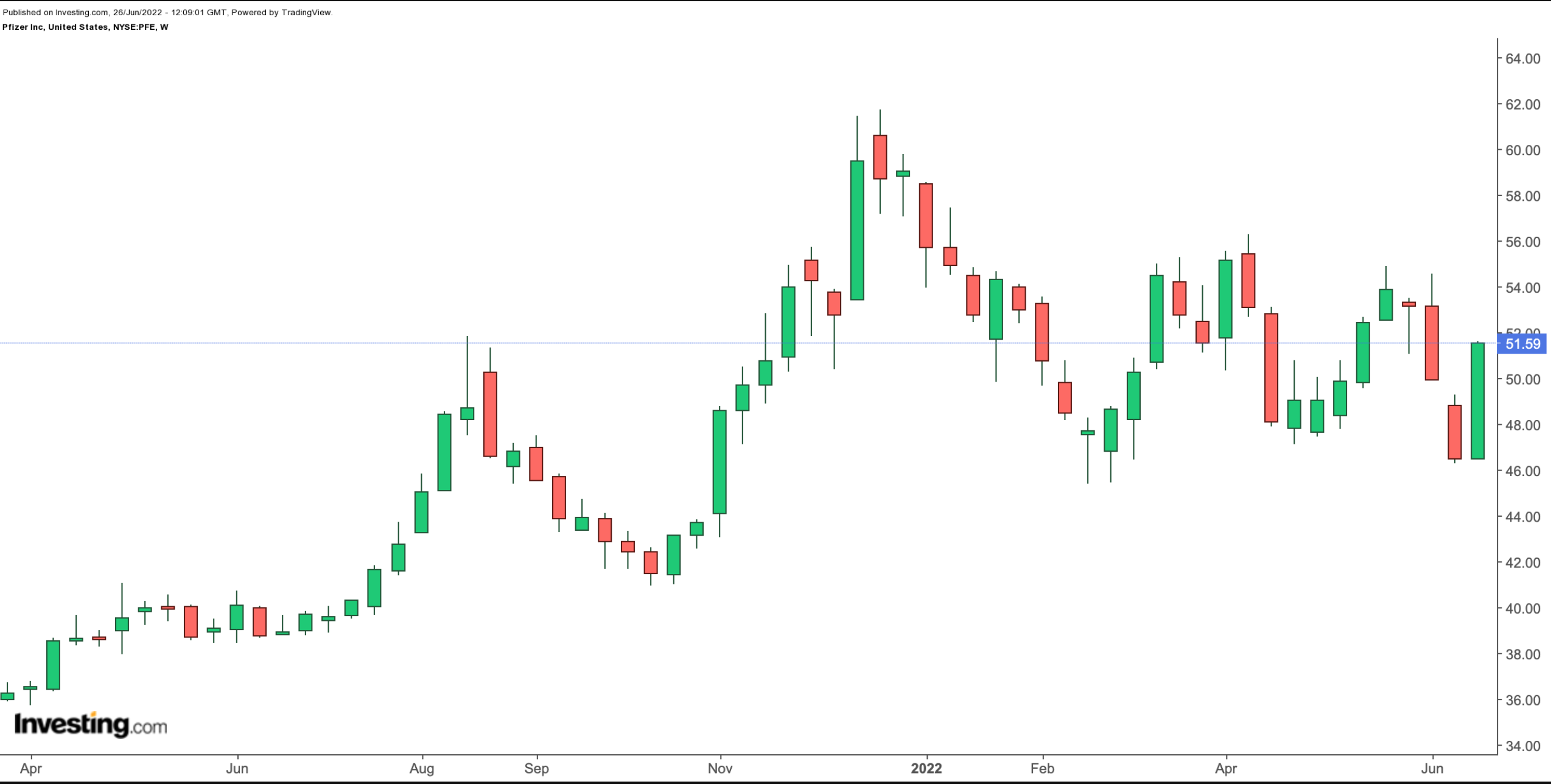

Shareholders in Pfizer (NYSE:) inventory have seen the worth of their funding enhance over 32% up to now 52 weeks. Nevertheless, PFE shares have declined 12.5% year-to-date (YTD).

By comparability, the is down roughly 10% in 2022. In the meantime, two different main pharma shares, Eli Lilly (NYSE:) and Merck (NYSE:), have gained 17.9% and 21.5%, respectively.

On Dec. 20, 2021, PFE shares went over $61, hitting a file excessive. The inventory’s 52-week vary has been $38.82-$61.71. The market capitalization (cap) at present stands at $289.5 billion.

How Current Metrics Got here

Pfizer launched Q1 figures on Might 3. totaled $25.7 billion, up 77% year-over-year (YoY). Adjusted web earnings was $9.3 billion, or $1.62 per diluted share, in comparison with an adjusted web earnings of $5.4 billion, or 95 cents per diluted share, a 12 months in the past.

Given its main place within the coronavirus vaccine market, Pfizer is producing important money. Income and earnings have elevated, because of Comirnaty, the COVID-19 vaccine provided collectively with BioNTech (NASDAQ:).

In December 2021, the US Meals and Drug Administration (FDA) additionally approved Paxlovid “for the therapy of mild-to-moderate COVID-19.” The healthcare large generated $31.78 billion in free money circulate through the first quarter, representing a 50% enhance YoY.

On the outcomes, chief monetary officer Frank D’Amelio commented:

“We entered the open market to repurchase shares of our inventory for the primary time since 2019. We’ll proceed to thoughtfully deploy our capital in quite a lot of shareholder-friendly methods with the objective of maximizing the worth we offer to all of our stakeholders, together with sufferers and shareholders.”

Pfizer has not too long ago ramped up its M&A exercise, fueled by its rising pile of money. For instance, in March it purchased Enviornment Prescription drugs for $6.7 billion in money. This transaction provides plenty of pipeline candidates that concentrate on immuno-inflammatory illnesses.

Then, in early June, Pfizer additionally accomplished the acquisition of ReViral, a privately held clinical-stage biopharmaceutical firm centered on therapies for the respiratory syncytial virus. Whereas Pfizer at present depends on its coronavirus portfolio for development, these new names are primed to spice up long-term development.

After the discharge of Q1 outcomes, Pfizer stored its earlier income steering unchanged throughout the $98-$102 billion vary. However, diluted EPS steering was revised down from the earlier $6.35-$6.55 vary to $6.25-$6.45.

Previous to the discharge of the Q1 outcomes, PFE inventory was round $49.00. On June 24, it closed at $51.59, and gives a dividend yield of three.1%.

What To Anticipate From Pfizer Inventory

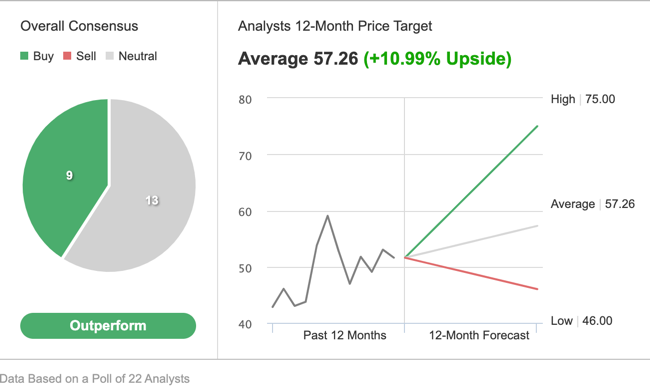

PFE inventory has an “outperform” ranking amongst 22 analysts polled by way of Investing.com. Wall Avenue has a 12-month median worth goal of $57.26 for the inventory, a rise of 11% from the present worth. The 12-month worth vary at present stands between $46 and $75.

PFE Consensus Estimates

Supply: Investing.com

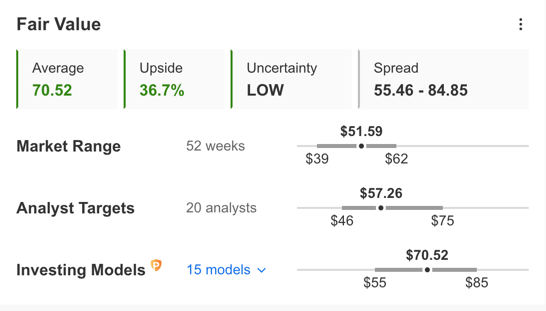

Equally, in response to plenty of valuation fashions together with P/E or P/S multiples or terminal values, the typical truthful worth for PFE inventory on InvestingPro stands at $70.52.

PFE Truthful Worth

Supply: InvestingPro

So basic valuation suggests shares may enhance 36.7%.

Inspecting PFE’s monetary well being by way of development, worth momentum, and revenue, it scores 4 out of 5. Its general rating of 4 factors is a superb efficiency rating.

At current, PFE’s P/E, P/B and P/S ratios are 11.4x, 3.5x and three.1x, respectively in comparison with 17.7x, 4.9x and three.9x respectively for friends which counsel that basically it seems undervalued in comparison with healthcare friends.

We anticipate PFE inventory to construct a base between $48 and $53 within the coming weeks after which doubtlessly begin a brand new leg up.

Including PFE Inventory To Portfolios

Pfizer bulls who usually are not involved about short-term volatility may take into account investing now with a goal of $57.26, as per Wall Avenue analysts.

Alternatively, traders may take into account shopping for an exchange-traded fund (ETF) that has PFE inventory as a holding. Examples embody:

- iShares U.S. Prescription drugs ETF (NYSE:)

- First Belief Morningstar Dividend Leaders Index Fund (NYSE:)

- Well being Care Choose Sector SPDR® Fund (NYSE:)

- Vanguard S&P 500 ETF (NYSE:)

- ETC 6 Meridian Hedged Fairness-Index Possibility Technique ETF (NYSE:)

Lastly, these skilled with choices may additionally take into account promoting a cash-secured put choice in PFE inventory—a method we frequently cowl. Such a bullish commerce may particularly attraction to those that need to obtain premiums (from put promoting) or to probably personal PFE shares for lower than their present market worth of $51.59.

Most choice methods usually are not appropriate for all retail traders. Subsequently, the next dialogue on PFE inventory is obtainable for instructional functions and never as an precise technique to be adopted by the typical retail investor.

So the dealer would usually write an at-the-money (ATM) or an out-of-the-money (OTM) put choice and concurrently put aside sufficient money to purchase 100 shares of the inventory.

Let’s assume the dealer is placing on this commerce till the choice expiry date of August 19. Because the inventory is $51.45 at time of writing, an OTM put choice would have a strike of $50.00. This put choice is at present provided at a worth (or premium) of $1.85.

An choice purchaser must pay $1.85 X 100, or $185, in premium to the choice vendor. This premium quantity belongs to the choice vendor it doesn’t matter what occurs sooner or later and in addition it’s the vendor’s most acquire. The put choice will cease buying and selling on Friday, August 19.

If the put choice is within the cash (which means the market worth of PFE inventory is decrease than the strike worth of $50.00) any time earlier than or at expiration on Aug. 19, this put choice might be assigned. The vendor would then be obligated to purchase 100 shares of PFE inventory on the put choice’s strike worth of $50.00 (i.e. at a complete of $4,750).

The break-even level for our instance is the strike worth ($50.00) much less the choice premium acquired ($1.85), i.e., $48.15. That is the value at which the vendor would begin to incur a loss.

Backside Line

Money-secured put promoting is a reasonably extra conservative technique than shopping for shares outright on the present market worth. It may very well be a strategy to capitalize on the choppiness in PFE inventory within the coming weeks.

Buyers who find yourself proudly owning Pfizer because of promoting places may additional take into account establishing lined calls to extend the potential returns on their shares. Thus, promoting cash-secured places may very well be considered step one in PFE inventory possession.

***

The present market makes it tougher than ever to make the suitable choices. Take into consideration the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive applied sciences

- Rate of interest hikes

To deal with them, you want good information, efficient instruments to kind by means of the info, and insights into what all of it means. It’s essential to take emotion out of investing and give attention to the basics.

For that, there’s InvestingPro+, with all of the skilled information and instruments it’s worthwhile to make higher investing choices. Study Extra »

[ad_2]