[ad_1]

“I can’t say I don’t agree with what my predecessor agreed to. Governments don’t work like that,” mentioned a senior authorities official, stating how the empowered group of state finance ministers was all the time led by a member from one of many Opposition events.

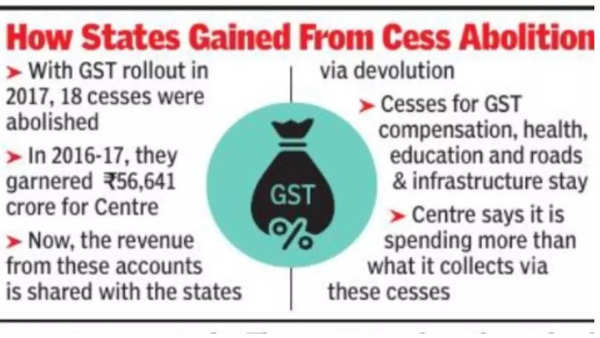

A supply additionally mentioned that not one of the states had been disadvantaged of the powers to levy tax as GST labored on a precept of the Centre and the states coming collectively for higher implementation in order that the cascading impact of taxes was eliminated. The high-ranking official additionally mentioned simply because the states, the Centre had additionally given up a number of the rights to tax and 18 cesses levied by it have been abolished for the implementation of GST 5 years in the past.

Whereas sustaining that the latest Supreme Courtroom judgment on GST had solely upheld the present regime and GST Council’s powers being recommendatory, officers on the Centre mentioned that a number of the state finance ministers had sought to politicise the problem by issuing statements when the order had not even been launched. Tamil Nadu FM P Thiaga Rajan was among the many ministers to be the primary to remark and had argued how the state’s place had been upheld by the apex court docket. Kerala FM Ok N Balagopal had additionally issued an announcement, citing experiences.

The Centre additionally flagged its concern over a number of the accounting practices associated to GST that a number of the states have been following. Authorities officers mentioned in a number of circumstances the spending had been greater than the gathering. For example, final 12 months, the Centre had collected slightly over Rs 2 lakh crore through highway and infrastructure cess however had utilised round Rs 2.5 lakh crore. Equally, throughout the present monetary 12 months, towards projected collections of Rs 1.4 lakh crore, the spending is budgeted at near Rs 3 lakh crore. Following the most recent spherical of discount in levies on petrol and diesel, which is able to consequence within the Centre forgoing Rs 85,000 crore, budgetary assist should be elevated additional.

Equally, towards an estimated assortment of Rs 81,500 crore by well being and schooling cess, the spending was over Rs 86,000 crore, in line with Centre’s knowledge. In case of GST, compensation of Rs 1.2 lakh crore was paid, whereas the cess collected was to the tune of Rs 1.1 lakh crore, officers mentioned.

[ad_2]