[ad_1]

New low slightly below 0.6800 right this moment.

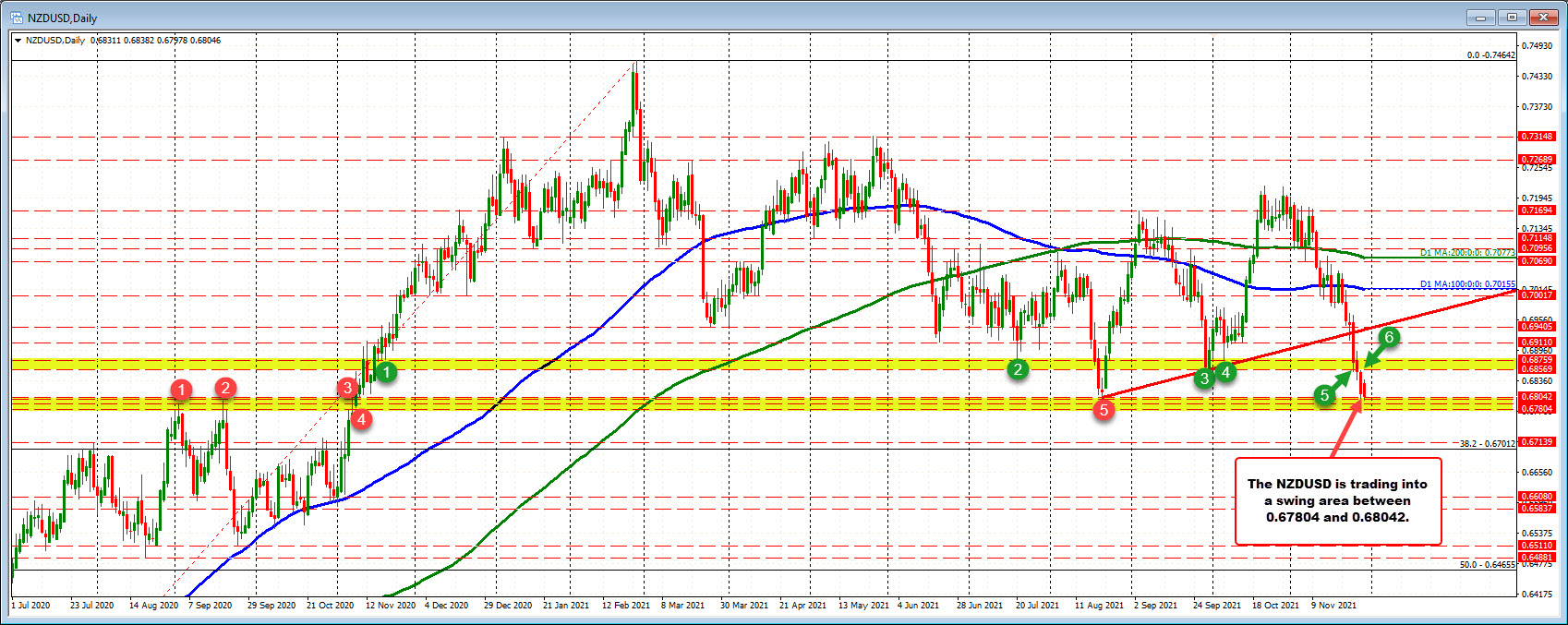

The NZDUSD transfer to the bottom degree since November 2020 right this moment on a dip to 0.67978. That took out the low value from Friday at 0.68016 which took out the low from August and the low for the 12 months at 0.68042.

The transfer took the worth right into a swing space all the way down to 0.67804. That degree goes again to September 2020 (see pink numbered circles). These ranges had been damaged in November 2020 with the worth returning to the extent in August this 12 months the place help consumers leaned.

With the worth returning to the swing space, merchants have caught a toe within the water as soon as once more in opposition to help each Friday and once more right this moment. It might take a transfer under the 0.67804 now to enhance the bearish bias and shake out the dip consumers.

Having stated that, the consumers are simply looking for a cyber Monday deal. General, the sellers stay in agency management.

Trying on the hourly chart under, the worth excessive every week in the past stalled proper in opposition to its 100 hour transferring common and closed decrease on every day final week. The value is at the moment decrease on the day could be the sixth down day in a row (closed at 0.68106).

So dip consumers have a purpose from the day by day chart all the way down to 0.67804, however do not actually have any upside momentum suggesting they’re taking management from the sellers.

What would assist the consumers from a technical perspective?

The first degree to get to and thru could be close to the excessive value from right this moment at 0.68374. That prime stalled close to the low from final Thursday’s commerce.

Above that and the falling 100 hour transferring common at 0.68622 could be the second upside goal that might should be damaged to offer consumers extra management (and a “win”). As talked about above, the excessive from final Monday, stalled close to that 100 hour transferring common and located sellers which began the six the day run to the draw back. Getting above the 100 hour transferring common could be paramount for any hope for the consumers of a continued upside corrective probe.

Till then, there may be help from the day by day, however the sellers stay in management.

Put money into your self. See our foreign exchange schooling hub.

[ad_2]