[ad_1]

Fearing that final result, buyers have despatched Nike shares tumbling greater than 30% this 12 months. That efficiency is way worse than that of the benchmark Index which is down about 20% for a similar interval. Nike shares closed on Friday at $112.91.

Whereas the maker of Air Jordan and Air Pressure 1 sneakers navigates provide chain snarls and works to get its Asian suppliers again to full manufacturing, there are additionally robust indicators that these issues are short-term in nature making the inventory’s present weak spot a superb shopping for alternative.

Executives informed buyers in March that factories making the corporate’s items in Vietnam had been operational and that footwear and attire manufacturing had returned to volumes seen earlier than pandemic-related closures late in 2021. Through the first quarter, the corporate’s container delivery charges have additionally begun to normalize.

Nonetheless, persistent inflation and the Russia-Ukraine disaster pose challenges to gross sales in upcoming quarters. The corporate introduced in March that it plans to shut its shops in Russia, citing growing problem managing its enterprise after the Ukraine invasion. It has about 116 places in Russia, and the corporate stated it will nonetheless pay its workers within the area.

Direct-To-Shopper Shift

Whereas these challenges linger, Nike’s accelerated shift to direct-to-consumer promoting helps to chop prices and enhance margins.

Beneath Chief Govt Officer John Donahoe, direct-to-consumer gross sales have been the main target for Nike. This initiative has pulled the model again from many wholesale companions in favor of Nike’s personal web site. in its direct enterprise grew 17% in Q2 and accounted for about 42% of complete gross sales.

Chief Monetary Officer Matt Buddy stated Nike is “now shifting into the following part” of that technique, having reduce wholesale accounts worldwide by over 50%. Nike will now spend money on the bodily shops that it determined to proceed partnering with and work on extra of its personal retail ideas.

Resulting from Nike’s robust model attraction, sturdy shopper spending, and the success of its direct-to-consumer technique, the vast majority of analysts charge Nike a purchase.

Supply: Investing.com

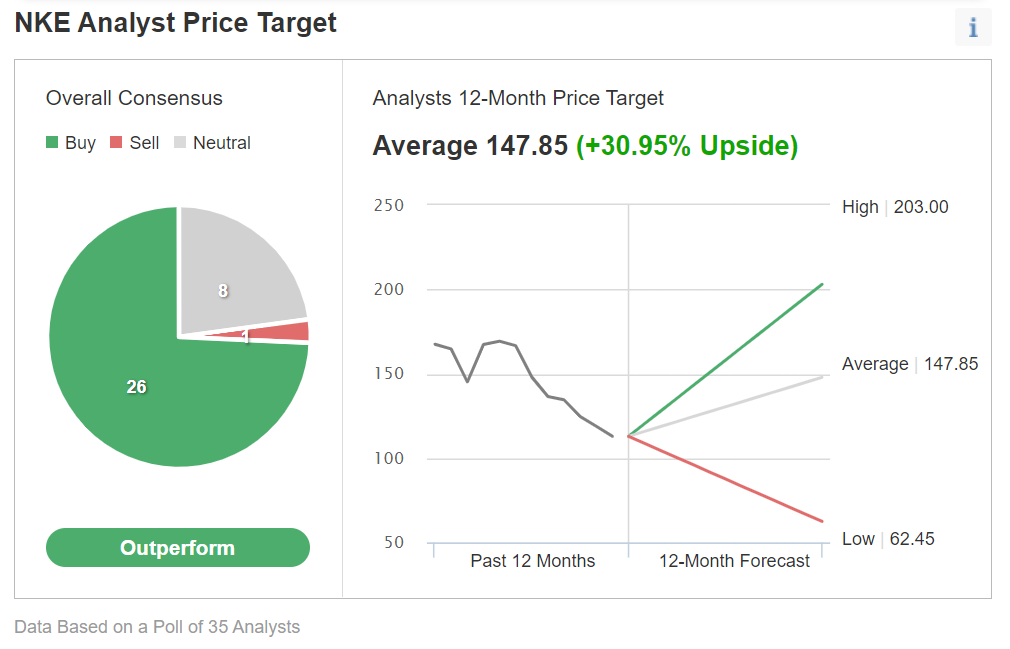

In an Investing.com ballot of 35 analysts, 26 advocate shopping for the inventory. Amongst these surveyed, there is a 12-month common value goal of $147.85 on shares, implying about 31% upside.

Whereas reiterating its ration on Nike as ‘outperform,’ Morgan Stanley stated in a latest observe that Nike’s long-term worth stays intact:

“The mkt expects a 4Q EPS miss & ’23e information under consensus. We don’t anticipate any decision on the China debate near-term, which implies buyers doubtless proceed to marvel when NKE will return to delivering its long-term targets.”

Guggenheim additionally reiterates the inventory as a purchase, saying Nike is dealing with transitory points and that buyers ought to keep on with the inventory.

“Whereas we don’t consider Nike is immune from the quite a few challenges introduced on by COVID-19, logistics, and different geopolitical uncertainties, we consider many of those points are transitory in nature. We stay BUY rated and consider this uncertainty offers a shopping for alternative.”

Backside Line

Nike might not present its full earnings potential so long as provide chain points usually are not resolved and demand doesn’t return to regular in China, the corporate’s second largest market. However the weak spot in its inventory, in our view, is non permanent as the worldwide attraction of Nike’s manufacturers stays robust as does its glorious execution capabilities.

[ad_2]