[ad_1]

With in the present day’s earnings after hours, it’s time to assess if there’s extra ache saved for Netflix (NASDAQ:).

Utilizing the Elliott Wave Precept (EWP), I discovered in January (see ):

“I anticipate NFLX to say no and stall out round $330+/-30 for (blue) Main wave-A. This decline will imply an entire retrace of the rally because the COVID-19 low (March 2020). From there, I anticipated the B-wave (B for Bounce) to materialize and goal the prior “congestion zone,” i.e., round the place NFLX bottomed for (black) main wave-4 Might final 12 months.”

The response to earnings in the present day could be the catalyst to get issues going. Over the previous month, NFLX has bottomed twice at round $330 and inside the perfect (black) goal zone. Bingo!

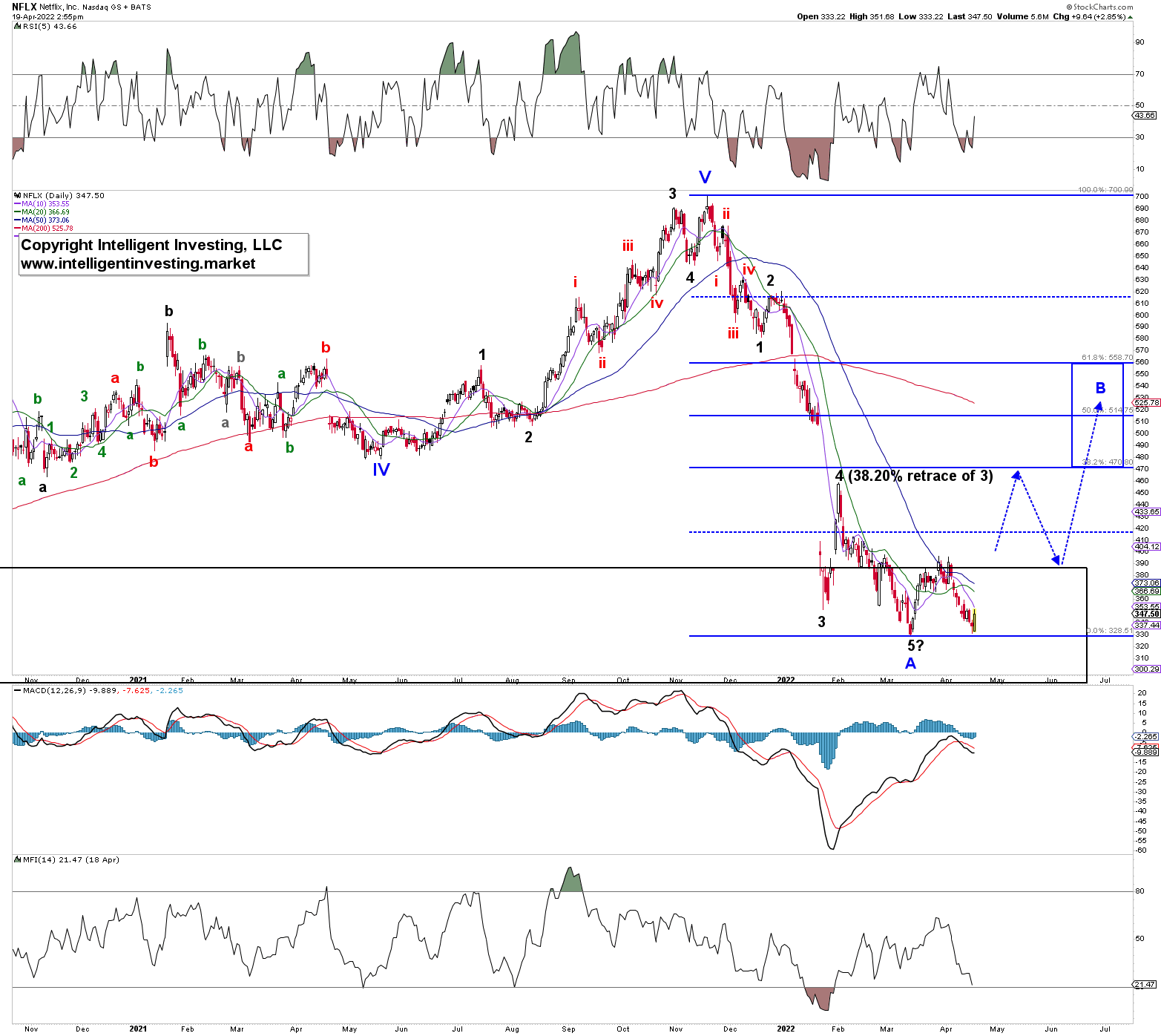

In addition to, utilizing the day by day chart (See Determine 1 beneath), the EWP depend exhibits the share value of NFLX has achieved sufficient waves (5) right down to recommend the anticipated blue Main wave-A has bottomed and wave-B ought to quickly be underway.

The blue arrows present the anticipated excellent path for wave-B, however please do not forget that B-waves are sometimes overlapping, tough patterns as they comprise three waves: a-b-c.

Determine 1 NETFLIX (NFLX) day by day candlestick chart with detailed EWP depend and technical indicators.

A breakout above the late March highs (~$390) can be a wonderful signal the bigger lifeless cat bounce is underway to ideally round $470-560. Why the vary? It’s at this stage not possible to understand how a lot this B-wave will retrace wave-A. It might even goal the 23.60% or 76.40% ranges ($420, $630, respectively). However we begin with a pleasant typical within the center stage. The anticipate.

Then we monitor the value motion to see what retrace stage would be the most probably goal and modify, if vital.

For now, the most probably path is greater, i.e., I, due to this fact, count on minimal draw back threat vs. upside reward. However please bear in mind:

“In bear markets, draw back surprises and upside disappoints.”

Why? As a result of promoting stress dominates.

Nevertheless, as mentioned in January, as soon as wave-B tops, wave-C (C is for Crash) should take maintain and produce Netflix’s share value right down to round $175-200.

However NFLX can revisit the double digits earlier than Cycle wave-2 is finished and dusted. Nevertheless, from my January replace, we knew from the EWP to count on three waves (A, B, C). And the way on the whole, every of those waves ought to behave and relate to one another. With sufficient sub-waves full for wave-A, it’s now essential to anticipate wave B in additional element.

[ad_2]