[ad_1]

McClellan 1-Day OB/OS Oscillators Overbought

The most important fairness indexes closed greater Monday with optimistic internals on the and as buying and selling volumes declined on each from the prior session. It was a outstanding session as all however one of many indexes managed to submit new closing highs with all closing at or close to their intraday highs, leaving all in near-term uptrends. As effectively, market breadth was robust sufficient to shift the cumulative advance/decline traces to optimistic from impartial.

The information finds insiders elevated their shopping for exercise as effectively. The one fly within the knowledge ointment is we now discover all of the McClellan 1-day OB/OS Oscillators in overbought territory submit the positive factors. Solely it and the detrended Rydex Ratio are actually suggesting we keep our near-term macro-outlook for equities at “impartial.”

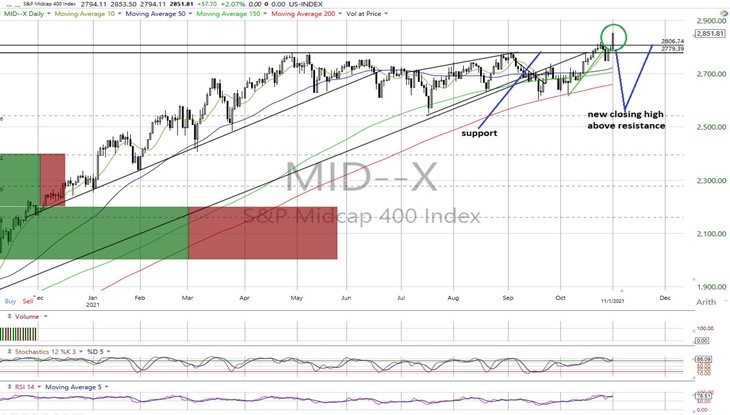

On the charts, all the foremost fairness indexes closed greater yesterday with solely the RTY unable to submit a brand new closing excessive. All of the index charts are actually in near-term uptrends.

- Internals had been optimistic on the NYSE and NASDAQ and powerful sufficient to shift the cumulative advance/decline traces for the All Change, NYSE and NASDAQ to optimistic from impartial.

- No stochastic alerts had been generated.

The information finds the McClellan 1-Day OB/OS Oscillators, nonetheless, had been pushed into overbought territory (All Change: +55.53 NYSE: +50.11 NASDAQ: +60.73). Whereas not at extremes, they do counsel some pause or partial retracement of current positive factors.

- The detrended Rydex Ratio (contrarian indicator) measuring the motion of the leveraged ETF merchants dipped to 1.26 and stays in bearish territory at 1.25. So now solely the OB/OS and detrended Rydex are cautionary.

- The Open Insider Purchase/Promote Ratio moved as much as 37.1 however stays impartial as insiders stepped up their shopping for exercise.

- This week’s contrarian AAII Bear/Bull Ratio (29.67/41.53) stays impartial with the rise in bulls as does The Buyers Intelligence Bear/Bull Ratio (23.8/48.9) (opposite indicator).

- Valuation finds the ahead 12-month consensus earnings estimate from Bloomberg dropping again to $214.14 for the SPX. As such, the SPX ahead a number of is 21.5 with the “rule of 20” discovering truthful worth at roughly 18.4.

- The SPX ahead earnings yield is 4.64%.

- The closed greater at 1.58%. Its uptrend stays intact with resistance at 1.70% and help at 1.47%.

In conclusion, we stay “impartial” in our near-term macro-outlook for equities primarily because of the OB/OS ranges as and detrended Rydex Ratio. All different indicators are actually optimistic.

: 4,540/NA : 35,485/NA COMPQX: 15,153/NA : 15,426/NA

: 15,302/15,945 : 2,779/NA : 2,331/2,360 VALUA: 9,707/NA

All charts courtesy of Worden

S&P 500

Dow Jones Industrials

NASDAQ Composite

NASDAQ 100

Dow Jones Transports

S&P Midcap 400

Russell 2000 Futures

Fusion Media or anybody concerned with Fusion Media won’t settle for any legal responsibility for loss or harm because of reliance on the data together with knowledge, quotes, charts and purchase/promote alerts contained inside this web site. Please be absolutely knowledgeable relating to the dangers and prices related to buying and selling the monetary markets, it is without doubt one of the riskiest funding types doable.

[ad_2]