[ad_1]

“India’s exterior balances are deteriorating,” economists at Goldman Sachs Group Inc. wrote in a observe Thursday, citing the terms-of-trade shock from larger commodities costs and weakening international development. “Going ahead, the trajectory of the rupee is more likely to be pushed weaker versus the greenback on account of the deteriorating exterior balances.”

Whereas the Reserve Financial institution of India has begun elevating charges, which normally helps currencies, the strikes additionally deflate the home inventory market, and might speed up rupee-weakening outflows. In the meantime, demand for {dollars} is rising, additional pressuring the forex and forcing the RBI to dip into its reserves pile to help it.

The central financial institution says the dangers are to date manageable and the exterior sector is “well-buffered to face up to the continuing terms-of-trade shocks and portfolio outflows.”

The next 4 charts take a deeper have a look at the challenges from India’s exterior funds:

Widening deficit

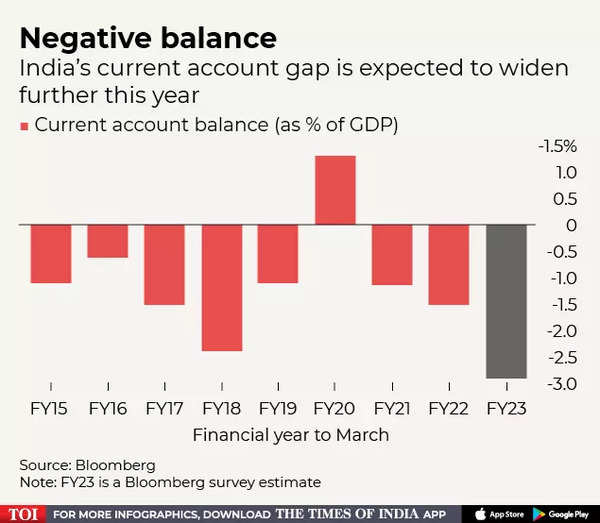

A shortfall in India’s present account — the broadest measure of commerce — will in all probability widen to 2.9% of gross home product within the fiscal yr ending March 31, based on a Bloomberg survey in late June, almost double the extent seen within the earlier yr.

“The present account deficit widening has been relentless,” stated Rahul Bajoira, an economist with Barclays Plc in Mumbai. “The broad-based enhance in commodity costs is more likely to preserve the deficit sticky within the close to time period and, together with capital outflows, exacerbate the exterior financing necessities.”

If it begins to method 4% of GDP, coverage makers would wish to take each fiscal and financial steps, he stated.

Falling reserves

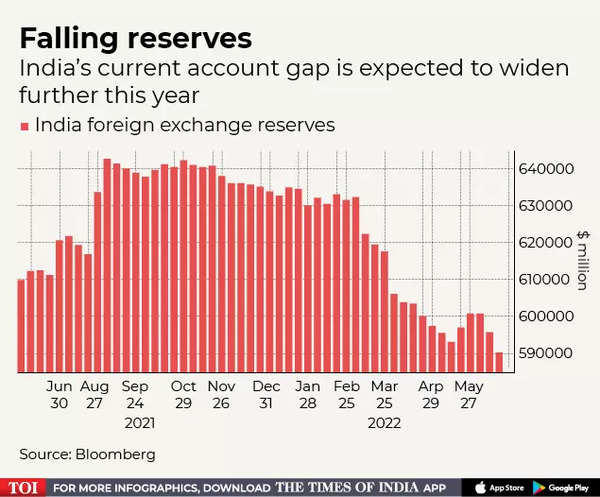

India’s international trade reserves, which may cowl about 10 months of imports, have slumped greater than $50 billion from a peak in September to $587 billion within the week to June 17 because the RBI seeks to stabilize the forex and importers search extra {dollars} for pricey vitality imports.

The RBI is preventing on a number of fronts to sluggish the rupee’s decline, whereas its said stance is that it intervenes to curb forex volatility and never affect its path. However, the RBI has spent $18 billion within the spot market to help the rupee between January and April, newest knowledge from the central financial institution confirmed.

Costlier imports

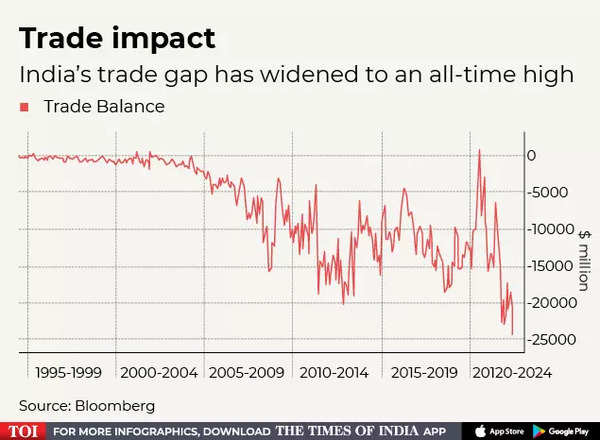

India’s commerce deficit widened to an all-time excessive of $24 billion in Could after the nation’s import invoice virtually doubled due to a surge in international crude oil costs. In the meantime, exports slowed as Russia’s invasion of Ukraine and tighter financial insurance policies globally weigh on development.

“A broader enhance in commodity invoice will underpin annual imports — a mixture of crude oil, coal, fertilizers, edible oils purchases,” stated Radhika Rao, senior economist with DBS Financial institution Ltd. She estimates a 20% enhance in total imports, out-pacing export development. “This may probably go away the merchandise commerce deficit about 40% wider this yr.”

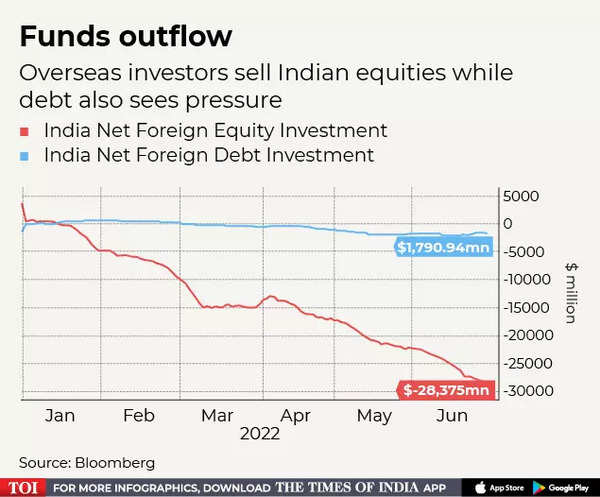

Capital flows

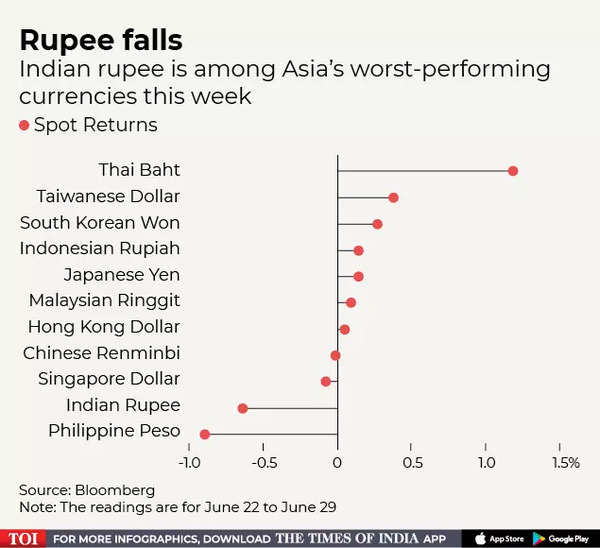

International buyers have pulled out greater than $32 billion from Indian equities within the final one yr, making it the worst performer in Asia after Taiwan. There was an outflow from bonds too, putting India simply behind Indonesia and Malaysia.

“With portfolio outflows anticipated to proceed amid weakening international fairness efficiency, and additional deterioration in steadiness of funds in coming months, the dangers of rupee under-performance can’t be discounted,” stated Madhavi Arora, lead economist at Emkay World Monetary Companies Ltd.

[ad_2]