[ad_1]

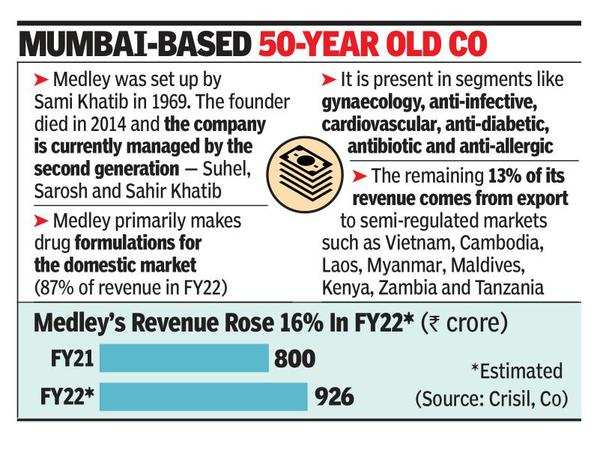

A mid-sized participant, Medley Pharma — based by Sami Khatib in 1969 as ‘Medley Laboratories’ — is among the many prime 40 pharmaceutical firms in India, in line with healthcare market analysis agency IQVIA. Khatib’s second technology — Suhel, Sarosh and Sahir — handle the corporate now.

It has manufacturing vegetation within the home formulations market, primarily within the hematinic, anti-diarrhoea, cardiovascular, anti-diabetes, analgesic and anti-ulcer segments. Gastroenterology, anti-diabetes and gynaecology medicine contribute two-thirds of revenues, with prime manufacturers like Telmed, RB Tone, Vogli, O2 and Dompan. Sure manufacturers launched first in India embrace Dompan (Domperidone & Pantoprazole), O2 (Ornidazole & Ofloxacin), Tazocef (Tazobactum & ceftriaxone) and Ostium k2 (first model of vitamin K27 mixture in India).

In line with a latest report from credit standing company Crisil, the corporate’s income is estimated to have grown by 16% to Rs 926 crore for fiscal 2022, from Rs 800 crore within the earlier yr, backed by elevated contribution from the acute section (about 53% of the general gross sales) and relaxation from power therapies. It’s anticipated to keep up development of over 8-10% over the medium time period, pushed by its established place within the home formulations market and rising concentrate on the power section (which now accounts for 47% of gross sales, as in comparison with 30%, just a few years in the past).

Two of its merchandise, RB Tone and O2 (to deal with hematinic deficiency and diarrhoea, respectively) function among the many prime 300 manufacturers, in line with market analysis information. In fiscal 2022, about 53% of revenues got here from acute therapies, and the remainder from the power section. The corporate’s product profile is reasonably diversified with the highest 5 manufacturers accounting for 57% of income.

Sources stated that the promoters are taking a look at a strategic sellout, together with all belongings, with Cipla presumably being a frontrunner. The corporate didn’t remark until the time of going to the press.

Medley’s working margins improved to 21% in fiscal 2022 and may maintain at 19-21% ranges, aided by an enchancment in scale and higher fastened value absorption. Moreover, there’s a concentrate on rising provides to regulated markets, which fetch greater realisations. The share of exports decreased to 13% of income in fiscal 2022, from 15-18% earlier, owing to logistic challenges and discontinuation of gross sales to sure African international locations equivalent to Uganda and Sudan, the place sure earlier funds are nonetheless caught.

The corporate will proceed to export to the UK and Europe and concentrate on rising contributions from these markets. It has additionally began supplying to the US from fiscal 2022. Although there’s a subsidiary in Russia, the enterprise scale is negligible (income of Rs 2-4 crore).

Armed with a modest mortgage of Rs 200,000 underneath the technician-entrepreneurs scheme of The Maharashtra State Finance Company and pushed by a dedication to succeed, Sami Khatib managed to get a toehold in a troublesome trade. The corporate’s first formulation plant was arrange at Aurangabad in 1976 for tablets, capsules and liquid orals, adopted by models at Daman and Jammu. The corporate exports to 26 international locations in southeast Asia, Africa, the Center East, Russia and the CIS.

[ad_2]