[ad_1]

It is early days since buying and selling hasn’t even began for this week but, however Friday’s shut into the lengthy weekend generated some strong backside breakouts. The , and all made optimistic resistance breakouts from their swing lows as technicals started to enhance.

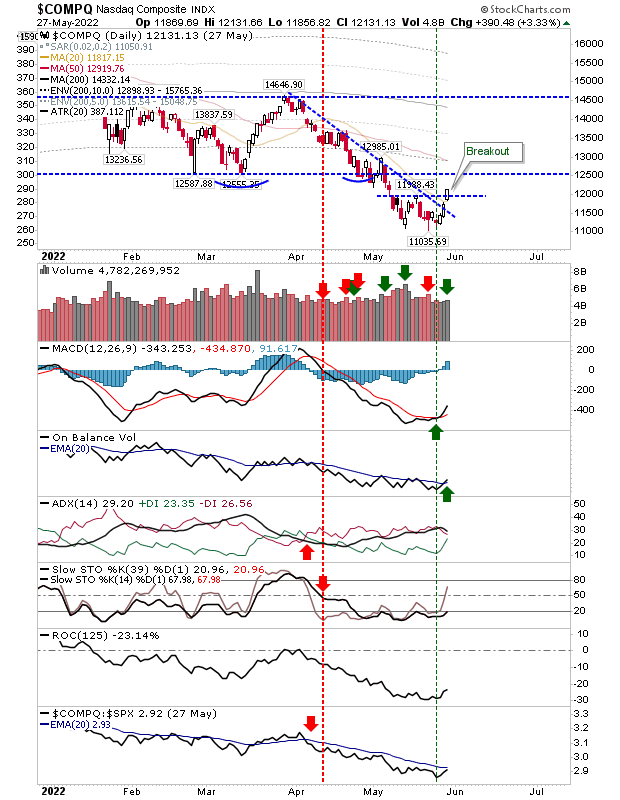

The NASDAQ closed above 12,000, and cleared declining resistance established from the March excessive. This got here with a MACD set off ‘purchase’ and On-Stability-Quantity ‘purchase’ set off. That is wanting higher than it did in March when the same breakout was tried, however the index is now buying and selling at higher worth.

COMPQ Day by day Chart

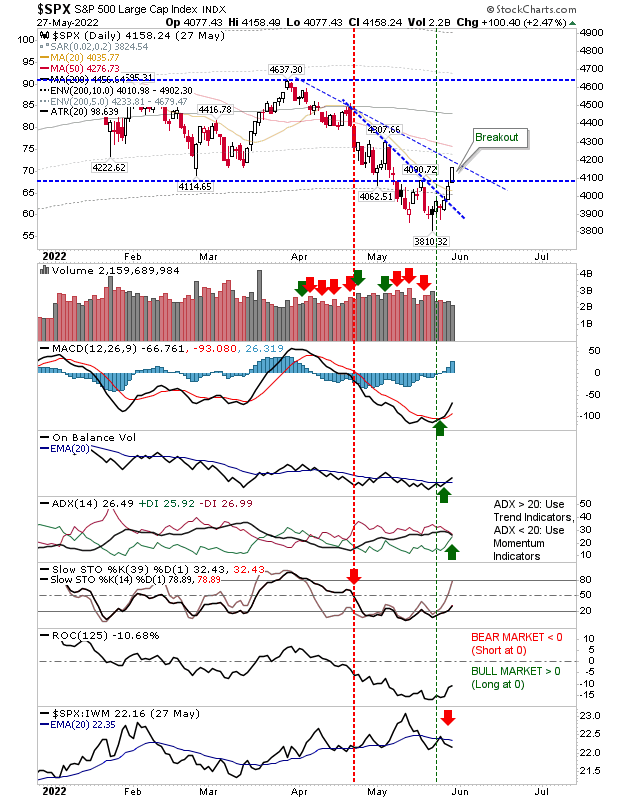

The S&P equally cleared its response swing excessive as a part of its backside formation. There have been technical ‘purchase’ triggers for the MACD, On-Stability-Quantity and the ADX as a part of this transfer. Not like the NASDAQ, nevertheless, it hasn’t but cleared declining resistance from the March excessive.

SPX Day by day Chart

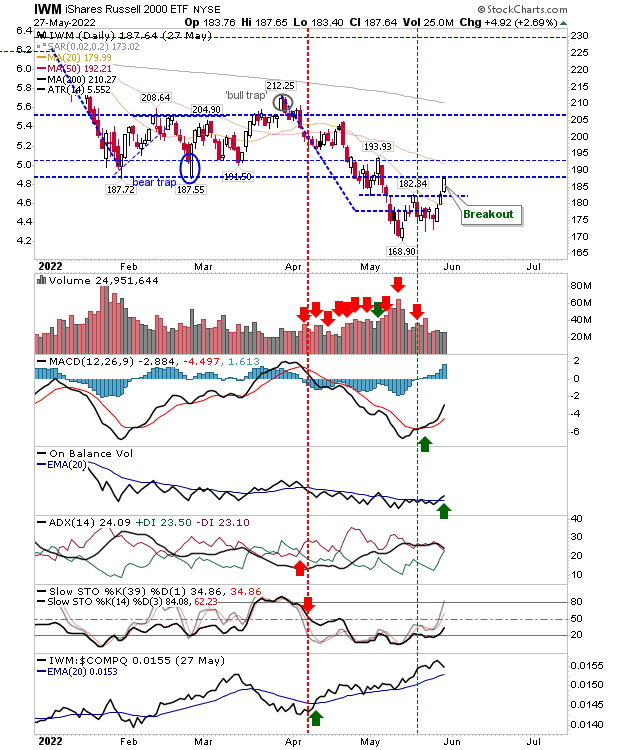

The Russell 2000 (by way of ) wasn’t to be overlooked of market beneficial properties because it cleared the newest swing excessive. This got here with ‘purchase’ triggers for the MACD and On-Stability-Quantity too. Of the indices, it is the one main the pack.

IWM Day by day Chart

Now we have an necessary alignment in markets as every work off their current lows on strong technical enchancment. As resistance ranges are ticked off, sideline cash will turn out to be extra engaged to take part and shorts might want to cowl.

I had mentioned in current weeks traders ought to be shopping for. Now it is wanting higher for merchants too.

[ad_2]