[ad_1]

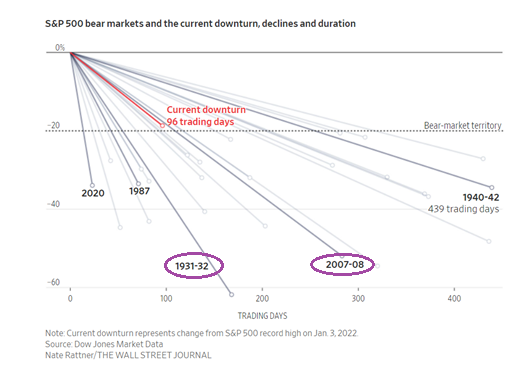

There’s an entire lot of hope that the inventory market can keep away from a extreme downturn. To date, the has been in a position to bounce out of bear market territory (-20%).

S&P 500 Bear Markets and The Present Downturn

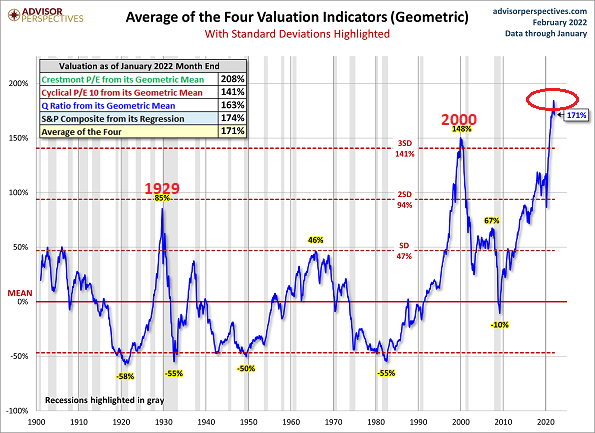

Going into this 12 months, nevertheless, shares have been extraordinarily overvalued. They have been pricier initially of 2022 than they have been heading into the Nice Melancholy.

Moreover, on most measures, they have been costlier than they have been going into 2000’s tech bubble or 2008’s monetary disaster. That’s one heck of a bubble!

Common Of The 4 Valuation Indicators

Might shares keep away from a real reckoning? When borrowing prices are considerably greater? When the Federal Reserve is trying to scale back its impression on the cash provide by way of quantitative tightening (QT)? When the Fed is targeted on reasonably than engineering a wealth impact?

The one plausible state of affairs that favors a inventory surge is one the place the Fed blinks. Extra particularly, a circumstance the place committee members on the central financial institution reverse course, selecting to forgo the battle towards inflation in favor of bailing out property.

Don’t wager on it.

The larger chance? Asset pricing might want to take a extra substantial beatdown earlier than the Fed may justify low charge stimulus with more cash printing.

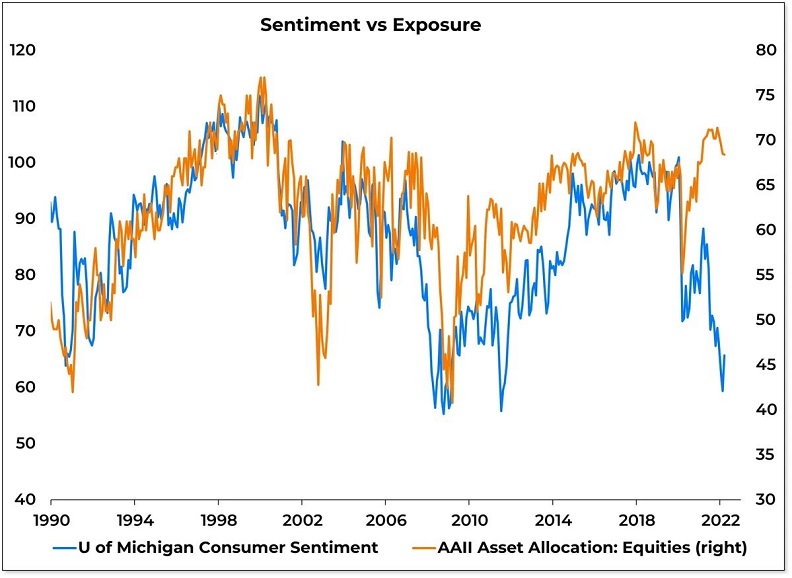

Right here’s how the bearish downtrend might evolve:

The economic system will proceed to gradual and sentiment will proceed to bitter. As extra people fret the chance of a recession, promoting exercise will “catch down” to deteriorating sentiment. Inventory promoting will beget extra inventory promoting. And by the point the Fed involves the rescue, the S&P 500 could have plummeted 35%-45% from its peak.

[ad_2]