[ad_1]

I can’t keep in mind a time in my life when there appeared to be such common settlement that:

- The market is actually, actually oversold;

- It’ll rally mightily, and a lot farther than anybody dare imagines.

Even essentially the most wild-eyed bears have fixated on 4,400 on the as their goal, which is properly greater than 10% above present worth ranges. As I discussed in my posts final night time, even former perma-bear (and I do imply perma-bear, as in since its inception in February 2009) ZeroHedge has absolutely joined the buy-equities-now bandwagon.

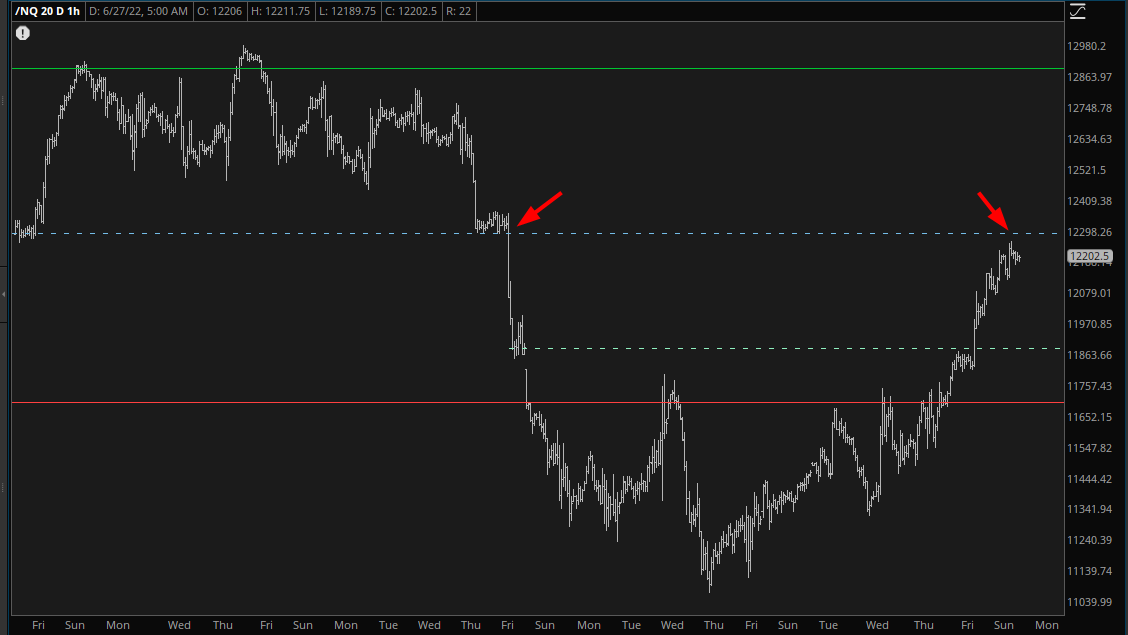

As for me, as you may guess, I’m not fairly in that celebration. To make sure, I don’t really feel like the child in a sweet retailer that I’ve at occasions earlier this 12 months, however once I have a look at the , what I see is a market that may simply be argued to have burned off its oversold situation, even now:

These two dashed traces characterize the vital worth gaps we noticed this month (and, boy, had been they superb once they occurred). The /NQ has been essentially the most sturdy of the foremost fairness futures markets, recovering to this ranges essentially the most swiftly and powerfully. Within the wee hours of this morning, it nearly completely sealed that second, increased hole.

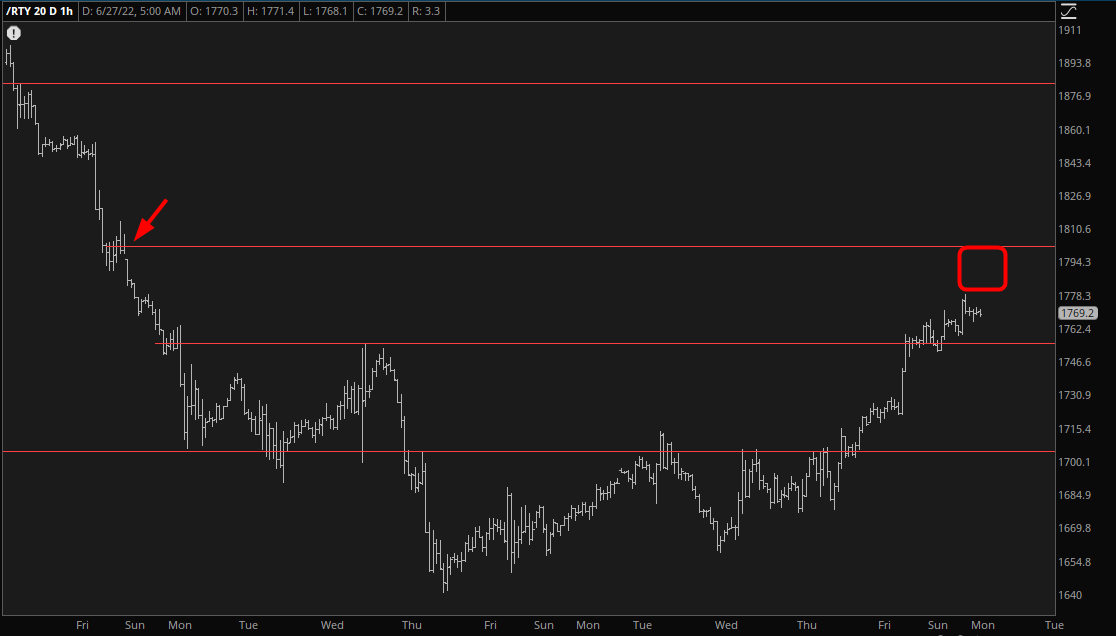

That is in distinction to, for instance, the small cap futures, which go nowhere near sealing its personal hole. As a matter of relative power, maybe means the market as a complete has increased to go (which suggests the /NQ will merely blow proper previous its hole whereas the / achieves its personal) or possibly it means This Is All She Wrote, and as soon as once more, in 2022, it will have been a bull entice.

Given the wretched pounding I endured on Friday (having ascended to a lifetime portfolio peak on Thursday!) I’m in no temper to be fearless. I’m exceedingly gentle at proper, with greater than 50% money (gack!) and can enter this week cautiously. Intuitively, I’m extra snug ready till June is within the bag earlier than I get aggressive once more, significantly because the fabled Tim Getting on a Aircraft sign takes place on Friday, and historical past tells us that may be a strong market occasion.

[ad_2]