[ad_1]

On-line journey company MakeMyTrip (NASDAQ:) is making an attempt to coil on the persevering with unfold of COVID-19 . The quickly rising Indian market platform was a pandemic loser remodeled right into a benefactor of the .

COVID-19 vaccinations have been the motive force for customers taking journeys once more to and from India. As of November 8, 2021, the US has opened up its borders to allow totally vaccinated Indian vacationers to journey into the US Moreover, e-commerce customers are anticipated to develop to 500 million by 2030, greater than doubling the present customers right now.

India has the second-largest inhabitants on the planet with over 1.2 billion folks. MakeMyTrip has restoration and progress tailwinds in its favor. Prudent traders in search of publicity within the journey phase within the second largest populace can look ahead to opportunistic pullbacks in shares of MakeMyTrip.

Q2 FY 2021 Earnings Launch

On Oct. 26, 2021, MakeMyTrip launched its fiscal for the quarter ending September 2021. The Firm reported an earnings-per-share (EPS) revenue of $0.09 excluding non-recurring gadgets versus consensus analyst estimates for a lack of (-$0.08), a $0.17 beat.

Revenues grew 274.2% year-over-year (YoY) to $86.4 million beating analyst estimates for $10.45 million. Deep Kalra, Group Govt Chairman stated,

“MakeMyTrip continued to guide and be instrumental within the restoration of journey in India because the nation’s new each day reported COVID-19 infections have declined considerably since Might 2021, aided by over one billion vaccine doses which have been administered to date. The outcomes of the reported fiscal quarter clearly showcase the sturdy power of its a number of manufacturers, pushed by its relentless deal with serving its clients with the very best expertise for his or her journey reserving wants.”

“Getting into the height festive season in India, we’re optimistic in regards to the anticipated ongoing restoration of journey demand within the quarters to return and can proceed to leverage our extremely variable and extra environment friendly fastened price construction to take care of our main place within the journey market in India.”

Convention Name Takeaways

CEO Kalra set the tone,

“On our final name in late July, we shared that India was already seeing a large discount within the variety of each day new infections for the reason that second wave peaked in early Might this 12 months. The excellent news is that, new each day infections have remained comparatively muted with about 16,000 each day new instances on a seven-day common foundation.

We imagine serving to to drive this progress has been the dramatic improve in vaccinations since late July, and pure immunity from unreported vaccinations pardon me – from unreported infections through the second wave. As of final week, over one billion doses of the vaccine had already been administered throughout the nation, which is a major world landmark.

Practically 300 million of our personal residents at the moment are totally vaccinated, and we count on that quantity to rise as many will obtain their second dose within the coming months. It is encouraging to see that selling social distancing and use of masks is steadily serving to to revive normalcy, which has shortly spilled over to journey demand.

As of final week, the Directorate Normal of Civil Aviation or DGCA had lifted the cap for home flights restored home seat capability again to 100% and completed away with many different restrictions. Whereas scheduled worldwide flights stay suspended for now India has carried out journey bubble preparations with 28 nations, together with the US, Canada, the UK, many EU nations, the UAE, Qatar, and the Maldives.

With declining COVID instances throughout India beginning November eighth, the US will enable totally vaccinated Indian vacationers to enter. Equally, the UK had already relaxed quarantine necessities since October 11. India has additionally reopened its borders to totally vaccinated inbound vacationers on chartered flights in mid-October.”

He concluded,

“We’re much more enthused by the elemental shift in shopping for conduct that has taken place over the last six quarters. A current remark from RedSeer Consulting is predicting that e-commerce customers in India will attain 500 million to 600 million by 2030, up from roughly 150 million to 200 million right now.

This prediction, which is more likely to play out will place India solely second to China by way of the general dimension of web shoppers, equating to an anticipated TAM or whole addressable market of $350 billion. We essentially imagine that the long-term upside for our enterprise stays large, and we proceed to adapt and drive improvements to maintain tempo with ever-changing on-line vacationers’ wants.”

Opportunistic Pullback Ranges

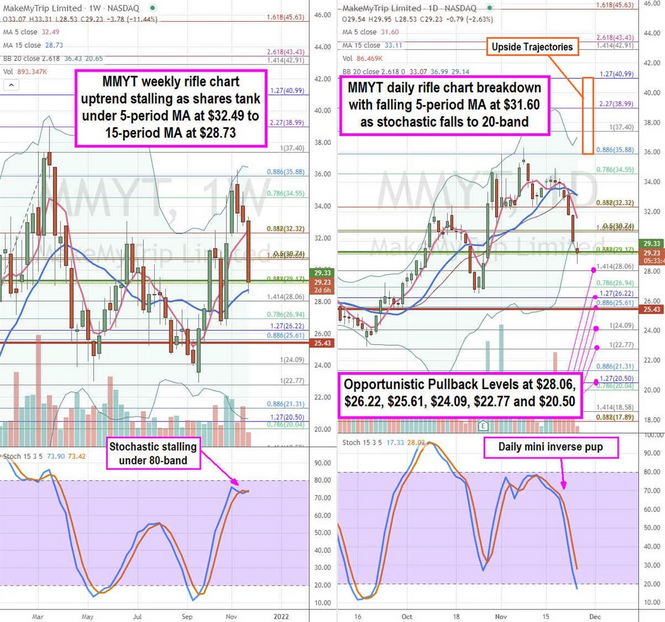

Utilizing the rifle charts on the weekly and each day time frames gives a precision view of the enjoying subject for MMPT shares. The weekly rifle chart peaked close to the $35.88 Fibonacci (fib) degree. The weekly rifle chart uptrend was abruptly shaken as shares fell beneath the 5-period shifting common (MA) at $32.49 because it shortly tightened to the 15-period MA at $28.73.

The weekly stochastic stalled just below the 80-band because the weekly uptrend stalls for a possible pup or breakdown. The weekly market construction excessive (MSH) promote triggers a breakdown beneath $25.43. The weekly market construction low (MSL) purchase triggers above the $29.33 degree.

The each day rifle chart breakdown shaped on the each day stochastic mini inverse pup sending the stochastic to the 20-band. Shares even overshot the each day decrease Bollinger Bands (BBs) at $29.14. The each day 5-period MA is falling at $31.60. Prudent traders can search for opportunistic pullback ranges on the $28.06 fib, $26.22 fib, $25.61 fib, $24.09 fib, $22.77 fib, and the $20.50 fib degree. Upside trajectories vary from the $35.88 fib up in the direction of the $40.99 fib.

Unique Put up

[ad_2]