[ad_1]

The LIC IPO will open for public subscription on Wednesday and can shut on Could 9. The anchor portion opens to institutional traders forward of the retail IPO and anchor traders must decide to holding on to the shares. In accordance with market sources, the Rs 21,000 crore IPO, which is the biggest within the nation, would get totally subscribed given the big variety of policyholders that the company has. The policyholders are being provided shares at a reduction of Rs 60. Nevertheless, many retail traders are cautious as a number of giant IPOs have did not retain their momentum after itemizing due to their dimension. In accordance with analysts, the scope for appreciation of the company’s shares would rely upon how surplus is distributed between policyholders and shareholders and the kind of merchandise LIC will promote.

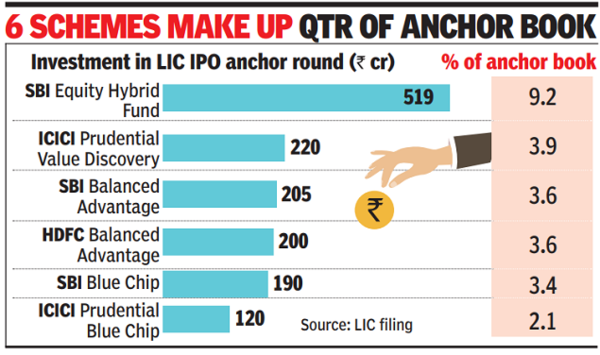

In a inventory alternate submitting, the company mentioned it has finalized the allocation of 5.92 crore shares to anchor traders on the anchor investor allocation worth of Rs 949. Apart from SBI, the opposite largest mutual fund investor was ICICI Prudential which picked up Rs 700 crore value of shares and HDFC Mutual Fund Rs 650crore. Total, 15 home mutual funds invested over Rs 4,000 crore by 99 schemes.

Amongst international traders, the biggest subscription got here from the Singapore authorities’s wealth fund (GIC), adopted by BNP Investments. The lukewarm participation from international traders comes when international institutional traders have been web sellers within the inventory exchanges this 12 months. Overseas traders have been exiting rising markets within the wake of the financial uncertainty arising out of the Russian invasion of Ukraine.

Regardless of the poor present by international traders and the outsized problem, many brokerage corporations suggest the LIC IPO to traders within the wake of the federal government adopting a conservative valuation.

“On the higher finish of the worth band, the LIC IPO is obtainable at a worth to the embedded worth of 1.1x as in comparison with different listed non-public life insurance coverage firms like HDFC Life, ICICI Pru Life, and SBI Life that are buying and selling at multiples of two.5-4.3x Sep ‘21 EV. Whereas LIC valuations look like low cost as in comparison with listed non-public gamers, traders have to remember that LIC has a decrease worth of latest enterprise margin of 9.3% in 9MFY2021 as in comparison with non-public gamers who’ve VNB margins of 25-27%,” mentioned Yash Gupta- Fairness Analysis Analyst, Angel One

In accordance with Gupta, LIC has a decrease valuation due to its increased share of low margin taking part & group insurance coverage merchandise in LIC’s portfolio. “Whereas there are issues over LIC concerning market share loss in particular person insurance coverage companies and traditionally decrease margins, we imagine that valuations think about a lot of the negatives,” he added. Different elements supporting the problem are the anticipated enhancements in product combine, and extra vital switch of surplus to shareholders account over the approaching years which might drive earnings from present low ranges.

[ad_2]