[ad_1]

USO-Day by day Chart

Power performs have a few of the greatest chart setups proper now from a momentum breakout standpoint. An ideal instance of this may be seen within the above chart of the USA Oil Fund (NYSE:).

Presently, USO has been consolidating inside an upward development close to its key resistance space from $82 to $83. Moreover, on the backside of the chart, we are able to discover our RealMotion (RM) momentum indicator. Although it’s sticking near the 50-Day shifting common (blue line), it has but to clear again over.

With that stated, the very best purchase sign can be for each value and momentum to clear their resistance ranges on the identical time. This might verify that value together with momentum is in settlement since USO’s value is already buying and selling over its 50-DMA. If capable of get away, this might enhance already robust vitality firms even larger.

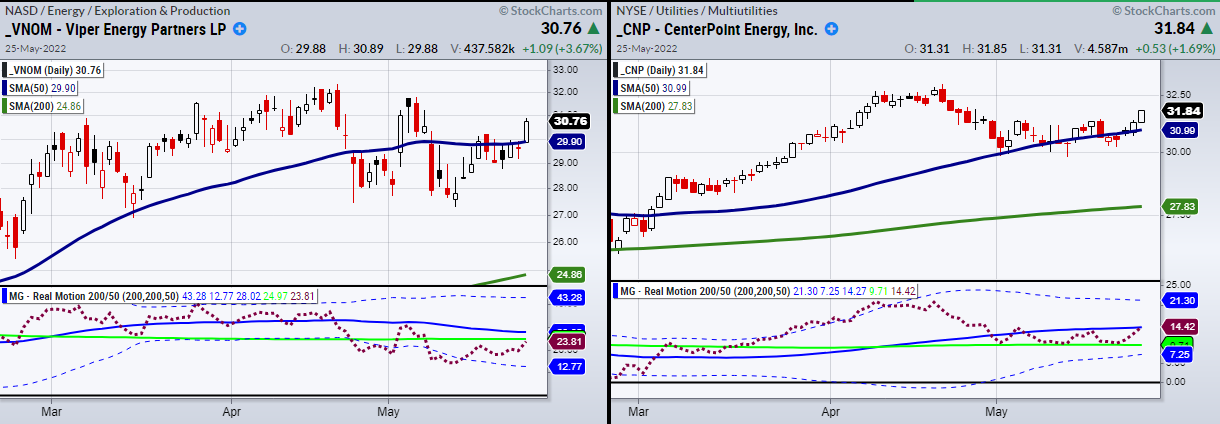

Power firms with comparable setups are Viper Power Companions (NASDAQ:) and CenterPoint Power (NYSE:).

Each cleared current consolidation and have momentum both breaking or on the verge of breaking a significant shifting common. Moreover, these may very well be attention-grabbing picks, particularly if USO clears and holds over $83.

With the Fed setting traders’ for extra 50 foundation level charge hikes, security performs by means of vitality firms look to have extra upside potential.

Key Ranges

() 397 pivotal. 380 minor help.

() 168 help.183 resistance.

() 322 resistance to clear and maintain.

() 285 minor help.

(Regional Banks) 62.17 to clear.

(Semiconductors) 215 help. 239 resistance.

(Transportation) 223 wants to carry.

(Biotechnology) 116.68. to clear and maintain.

(Retail) Giant comeback day. 58 help.

() Examined and held help kind the 200-DMA at 171.67.

USO () Look ahead to a breakout over 83.60.

(Agriculture) Look ahead to this to shut again over the 50-DMA at 22.15

[ad_2]