[ad_1]

pressures take the medias focus this week.

However, we should keep in mind the information doesn’t all the time align with market worth.

With that stated, costs are holding close to highs within the main indices.

It is a constructive signal as buyers are in search of a continuation in pattern or consolidation.

Nonetheless, decrease quantities of quantity paired with smaller each day ranges within the above chart’s level to extra consolidation.

Trying on the S&P 500 (), NASDAQ 100 (), Dow Jones (), and the Russell 2000 (), every is sitting inside their prior days’ vary.

If the market makes a small break from the highs, we will take a look at the final couple of day’s lows as minor assist ranges to bounce from.

These assist ranges are additionally proven as black strains on the above charts.

Utilizing these lows as reference areas we will watch them as potential purchase entries if the market begins to bounce.

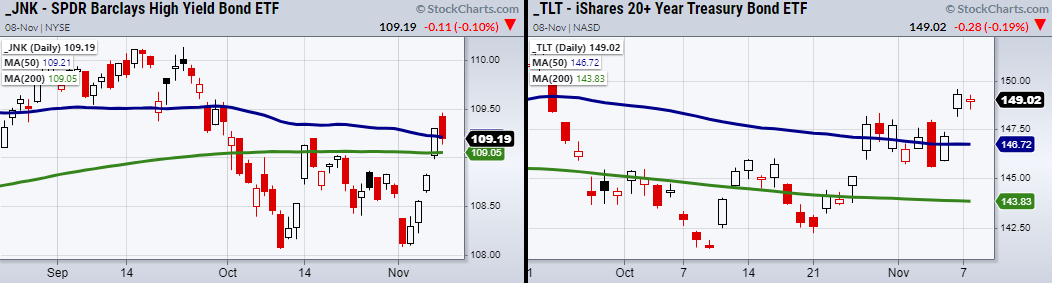

Moreover, utilizing bonds as a threat on or off indicator—Excessive Yield Company Bonds ETF () has pulled again in the direction of its 200-Day shifting common, whereas the 20+ 12 months Treasury bonds () is holding above current worth motion and over its 50-DMA.

With long-term bonds displaying energy and JNK pulling again in the direction of assist this additional factors to market hesitancy.

Nonetheless if a small pullback types, the media will probably level in the direction of inflation as a key stress, nevertheless, we will likely be one step forward realizing that the technical evaluation has already given us a partial warning.

ETF Abstract

S&P 500 (SPY) 466.92 minor assist.

Russell 2000 (IWM) 237-240 assist space,

Dow (DIA) 359.87-361.89 assist space.

NASDAQ (QQQ) 393.92 minor assist.

(Regional Banks) 72.90 assist space.

(Semiconductors) 294 minor assist.

(Transportation) 273.76 assist the 10-DMA.

(Biotechnology) Inside day.

(Retail) 100 minor assist.

Junk Bonds (JNK) 109.05 assist the 200-DMA.

(Silver) 23 resistance.

(US Oil Fund) Watching to carry over the 10-DMA at 56.89.

TLT (iShares 20+ 12 months Treasuries) Inside day.

(Agriculture) 18.93 assist. 19.57 resistance.

[ad_2]