[ad_1]

Earlier than main market pullbacks, it is not uncommon to see inner market disconnections or divergences. And so they typically go on for for much longer than buyers suppose they may.

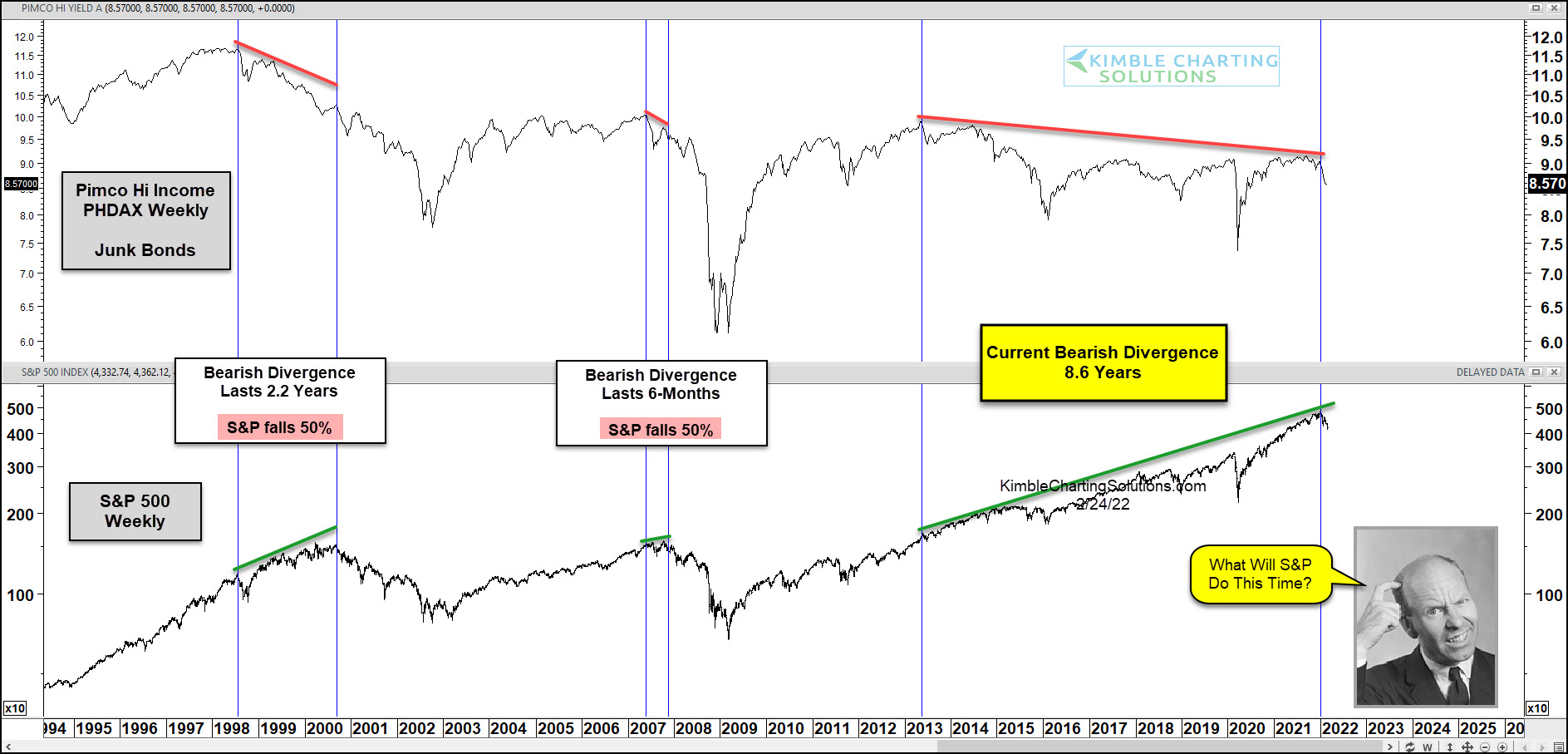

Right this moment we take a look at and what occurs when this asset diverges from the broader equities market. It’s regular for junk bonds to carry out effectively when shares are heading greater because it’s an indication of “risk-on” (buyers keen to take dangers).

Nevertheless, when junk bonds diverge and underperform whereas the inventory market heads greater, it may be a warning signal that “risk-on” is fading.

Earlier than the 2000 inventory market crash, excessive yield bonds created a bearish divergence that lasted 2.2 years. Then in 2007, they created a 6 month bearish divergence earlier than the market cracked.

Effectively, trying on the chart above we are able to see an 8.6-year bearish divergence. Yikes! Surprise what the will do subsequent?

Perhaps it is going to be completely different this time!

Fusion Media or anybody concerned with Fusion Media is not going to settle for any legal responsibility for loss or harm because of reliance on the knowledge together with knowledge, quotes, charts and purchase/promote alerts contained inside this web site. Please be totally knowledgeable relating to the dangers and prices related to buying and selling the monetary markets, it is without doubt one of the riskiest funding varieties doable.

[ad_2]