[ad_1]

The regulator has instructed insurance coverage corporations that their fee and remuneration payout needs to be based mostly on a board-approved coverage that will probably be reviewed yearly. Within the direct enterprise, no fee shall be payable to insurance coverage brokers or the insurance coverage intermediaries, and the insurers should grant reductions on the premium.

Insurers stated what was constructive concerning the new regulation was that insurance coverage corporations that had been spending extra on gross sales utilizing the advertising route might now spend the cash on commissions. “Public sector corporations have a better wage to premium ratio, however they don’t seem to be very completely different from non-public gamers in administration bills. It is because non-public corporations spend extra selling gross sales, which isn’t mirrored in fee bills,” stated an official with a public sector insurance coverage firm.

The brand new rules state that the fee restrict will keep however henceforth, it is going to be on the portfolio stage restrict and never a person line of enterprise. Which means an organization that does extra group well being enterprise at a low fee may have extra headroom than an organization with extra particular person medical insurance companies. Some insurers really feel that even when limits are set on the portfolio stage, rules shouldn’t mix wholesale and retail portfolios for calculating fee ceiling.

Earlier, there was a suggestion from some business members to reveal commissions, and the IRDAI has clarified that it’s not permitting such disclosures. However with commissions being freed, insurers are once more saying that, a minimum of within the wholesale enterprise the place patrons negotiate, insurers needs to be requested to reveal fee.

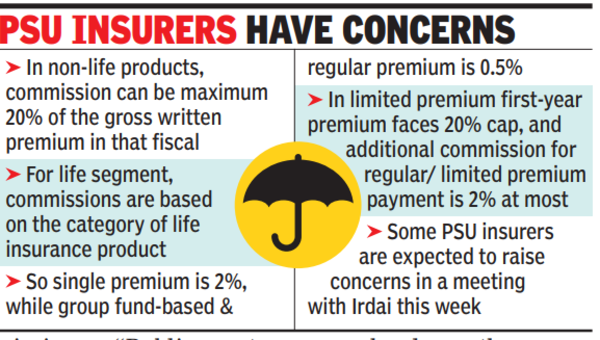

Some public sector insurers have considerations concerning the new pointers and are prone to increase them in a gathering with the regulator this week. There’s additionally a concern that banks and different massive distributors will be capable to squeeze insurers for greater commissions which is probably not in client curiosity.

For all times insurance coverage, commissions are based mostly on the class of life insurance coverage product, specifically single premium (2%), group fund based mostly and common premium (0.5%) or restricted premium for which max first-year premium 20% and max further fee for normal/ restricted premium fee is 2%.

[ad_2]