[ad_1]

This submit is a part of a collection sponsored by CoreLogic.

Over the previous 12 months, on-line consumer demand has maintained a steep upward climb. Because of the pandemic, cloud and built-in expertise capabilities have been expanded to help distant work fashions beforehand unavailable to insurance coverage brokers. And corporations needed to implement operational adjustments quickly to navigate this drastically completely different panorama.

Insurers have needed to redefine their consumer engagement technique and settle for that policyholders now count on digital interactions, inflicting insurers to re-prioritize their expertise roadmaps, each within the brief and long run. To fulfill these new buyer expectations, carriers are targeted on three primary areas of change: on-line shopper engagement, expertise functionality, and operational alignment.

On-line shopper engagement

For a lot of carriers, the way in which insurance coverage merchandise are bought and administered will not be but a totally on-line engagement mannequin. Main Insurtech startups arrange their companies in ways in which guarantee any policyholder interplay begins on-line, paving the way in which for a greater buyer expertise. From buying round for quotes and including properties to a coverage to submitting claims via a self-service app, insurance coverage firms that get this digital expertise proper will lead the pack. In response to a 2021 J.D. Energy report, satisfaction with the insurance coverage customer support expertise improved whereas total satisfaction with the buying expertise declined as report numbers of insurance coverage prospects transitioned to digital through the unstable 12 months. The research famous that tech-savvy cellular app customers report considerably increased satisfaction total, as cellular app utilization elevated 26% this 12 months.

Know-how functionality

Successful Insurtech firms have carried out seamless workflow programs to automate the claims course of and help a digital journey finish to finish from the start. These implementations have quickly modified the insurance coverage panorama. New applied sciences create a digital transformation that provides the accuracy, security, and effectivity mandatory to save lots of money and time, in the end creating a greater buyer expertise whereas additionally enhancing the expertise for brokers.

One of the vital promising Insurtech improvements is claims automation. Claims automation is the creation and utility of expertise to watch and management the manufacturing and supply of claims processes to all events with out the necessity for human intervention. This sort of software program can present step-by-step directions for a way and what to scope through a cell phone or pill. Utilizing this expertise, an adjuster can comply with intuitive questions that information them via applicable photo-taking and scoping of the injury, guaranteeing vital declare documentation isn’t forgotten. Even new adjusters can doc declare loss particulars effectively and in a well-organized, uniform method, decreasing the quantity of cross-training and onboarding time. This workflow can even empower them to get out into the sector quicker with out time-consuming cross-training.

Operational alignment

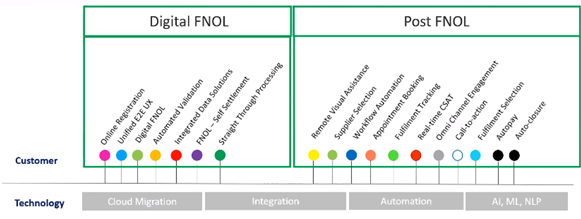

Lastly, firms are investing in operational alignment, together with digitizing first discover of loss (FNOL) and integrating expertise into post-FNOL declare achievement. There’s additionally a rising integration of information options and automation of validation processes with coverage functions and different varieties of validation information sources.

And after the primary discover of loss when the declare is in achievement, expertise can assist decide whether or not discipline inspection is required and automate approvals and provide chain appointments. Furthermore, policyholders can work together with different events on a declare by collaborating with suppliers and the provider whereas offering real-time suggestions indicating their satisfaction.

In Conclusion

Self-service claims and claims automation are anticipated to change into the usual for claims administration and claims processing for a lot of carriers. The existence of Insurtech startups and the transformational results of the COVID-19 pandemic have performed a major position in transferring insurers in direction of the digital panorama. The carriers targeted on on-line shopper engagement, expertise functionality, and operational alignment are accelerating their adoption of digital processes with brokers and enhancing the shopper expertise. For extra data on CoreLogic claims options, please go to CoreLogic.com.

Subjects

Claims

InsurTech

Tech

Excited about Claims?

Get automated alerts for this subject.

[ad_2]