[ad_1]

Cumulative Market Breadth Stays Impartial

The most important fairness indexes closed blended Friday with unfavorable internals on the whereas the ’s had been optimistic as NYSE volumes rose and NASDAQ volumes dipped from the prior session. A number of new closing highs had been registered on the extra in style indexes. Nevertheless, cumulative market breadth stays impartial, suggesting market individuals have turn out to be extra selective than the favored averages might suggest.

The near-term chart traits for the indexes stay principally optimistic with two nonetheless in impartial/sideways patterns. The information dashboard is sending usually impartial indicators apart from the contrarian detrended Rydex Ratio exhibiting the leveraged ETF Merchants leveraged lengthy. So, whereas the indexes proceed to rise, the variety of boats rising with the tide versus these declining stays pretty evenly break up. As such, we stay “impartial” in our near-term macro-outlook for equities.

On the charts, the foremost fairness indexes closed blended Friday with unfavorable NYSE internals whereas the NASDAQ’s had been optimistic.

- The DJT, RTY, and VALUA closed decrease as the remaining superior.

- New closing highs had been achieved on the SPX, DJI, COMPQX and NDX.

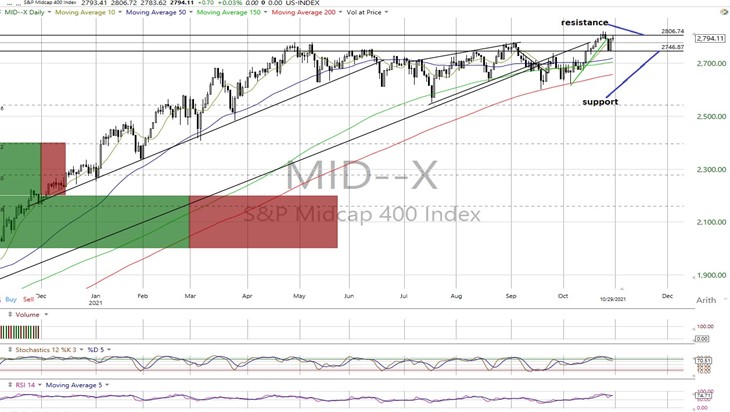

- The near-term chart traits stay optimistic on most apart from the MID and RTY which can be impartial.

- Friday’s motion had no impression on cumulative market breadth that continues to be impartial on the All Change, NYSE and NASDAQ. As famous above, the A/Ds disclose market breadth is moderately evenly break up between gainers and losers that the extra in style averages fail to reveal.

- No new stochastic indicators had been generated.

The information finds the McClellan 1-Day OB/OS Oscillator nonetheless impartial (All Change: +22.09 NYSE: +18.16 NASDAQ: +26.1).

- The detrended Rydex Ratio (contrarian indicator) measuring the motion of the leveraged ETF merchants moved deeper into bearish territory as they prolonged their leveraged lengthy publicity to 1.26.

- The Open Insider Purchase/Promote Ratio slipped again to impartial from unfavorable at 29.1.

- Final week’s contrarian AAII Bear/Bull Ratio (32.13/36.97) turned impartial with the rise in bulls. The Buyers Intelligence Bear/Bull Ratio (23.9/43.2) (opposite indicator) remained impartial.

- Valuation finds the ahead 12-month consensus earnings estimate from Bloomberg lifting to $217.91 for the SPX. As such, the SPX ahead a number of is 21.1 with the “rule of 20” discovering honest worth at roughly 18.4.

- The SPX ahead earnings yield is 4.73%.

- The closed decrease at 1.56%. Its uptrend stays intact with resistance at 1.70% and assist at 1.47%.

In conclusion, we stay “impartial” in our near-term macro-outlook for equities given the Rydex Ratio implications and the truth that market breadth isn’t as sturdy as the favored averages might recommend.

: 4,525/NA : 35,028/35,653 COMPQX: 15,153/NA : 15,426/NA

: 15,302/15,945 : 2,747/2,807 : 2,250/2,300 VALUA: 9,646/9,880

All charts courtesy of Worden

S&P 500

Dow Jones Industrials

NASDAQ Composite

NASDAQ 100

Dow Jones Transports

S&P Midcap 400

Russell 2000 Futures

Fusion Media or anybody concerned with Fusion Media is not going to settle for any legal responsibility for loss or injury because of reliance on the knowledge together with information, quotes, charts and purchase/promote indicators contained inside this web site. Please be absolutely knowledgeable relating to the dangers and prices related to buying and selling the monetary markets, it is likely one of the riskiest funding kinds potential.

[ad_2]