[ad_1]

What a distinction one weekend could make!

We noticed an enormous risk-off transfer in Friday’s low-liquidity, holiday-shortened session, with collapsing greater than -12%, the dropping practically -1%, and main US indices shedding greater than -2%, as spooked merchants opted to “promote first and ask questions later” concerning the new Omicron COVID variant.

After a weekend of analysis and reflection, the market has decided that Omicron shouldn’t be (but) purpose to panic. Certainly, based mostly on early proof, the related signs look like comparatively gentle to date, doubtlessly avoiding the necessity for broad journey and financial restrictions, even when Omicron finally proves extra transmissible or immune-resistant than the Delta variant.

With the perceived odds that Omicron is the “worst case” COVID variant (learn: each extra virulent and lethal) falling, merchants are speeding to reverse Friday’s panicked selloffs. Each WTI crude oil and the US greenback have recovered about half of Friday’s losses to date, and extra impressively, main US indices just like the (US Tech 100) have erased virtually all of Friday’s losses already.

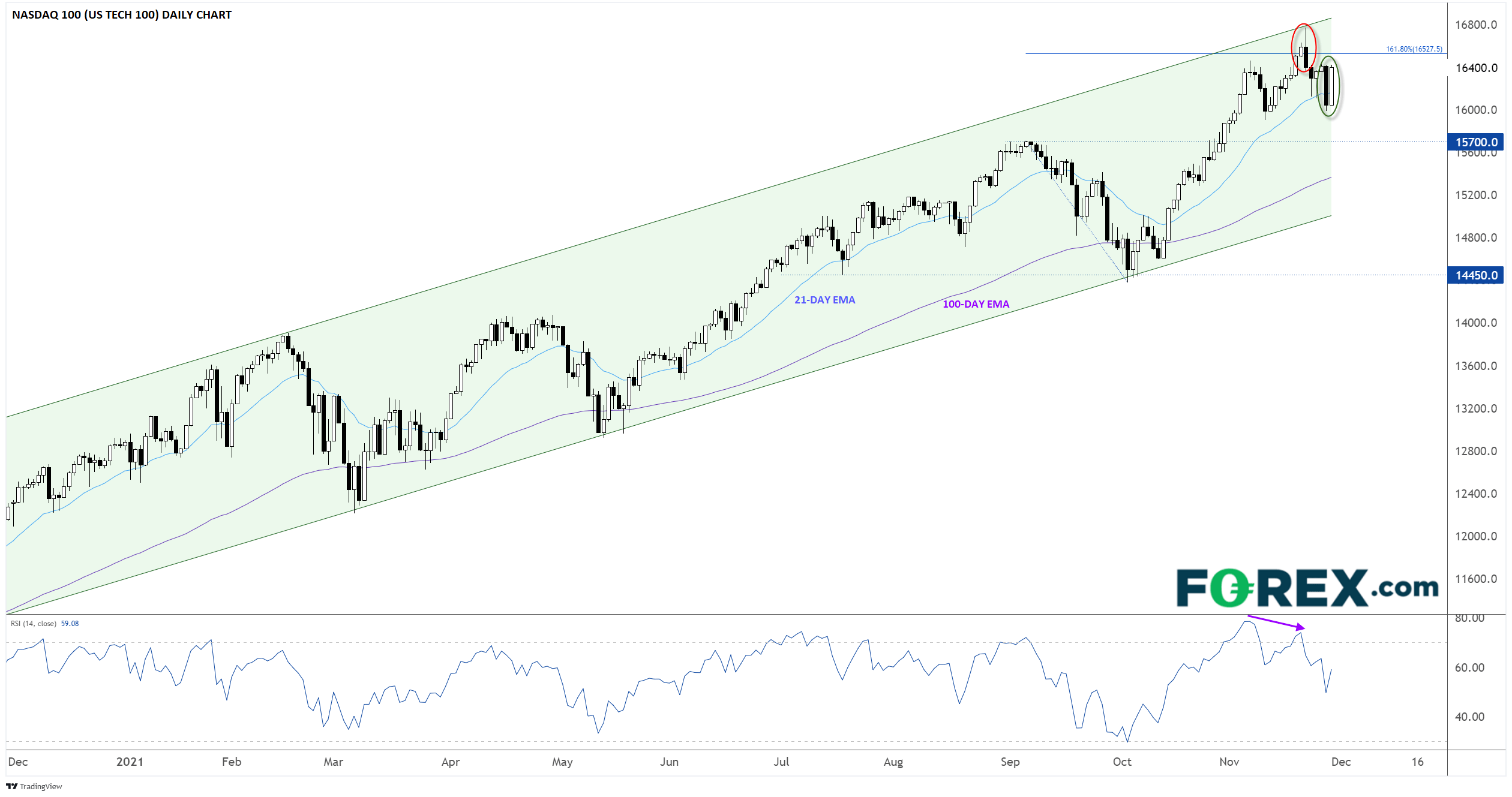

NASDAQ 100 technical evaluation

Talking of the NASDAQ 100, the tech-heavy index stays comfortably inside its longer-term bullish development, with costs bouncing from the 21-day EMA close to 16,000 to date. Final Monday’s bearish reversal candle close to the highest of the bullish channel and the 161.8% Fibonacci extension of the September pullback stays a transparent barrier to continued power, however so long as the index can maintain above its 100-day EMA close to 15,300 and inside the well-established bullish channel (help close to 15,000), merchants ought to favor shopping for short-term dips for a possible “Santa Claus Rally” to recent report highs by New 12 months’s Day:

Supply: StoneX, TradingView

Authentic Submit

Fusion Media or anybody concerned with Fusion Media won’t settle for any legal responsibility for loss or harm because of reliance on the data together with knowledge, quotes, charts and purchase/promote indicators contained inside this web site. Please be totally knowledgeable concerning the dangers and prices related to buying and selling the monetary markets, it is without doubt one of the riskiest funding types potential.

[ad_2]