[ad_1]

In its newest World Financial Outlook replace, the IMF on Tuesday additionally lowered the expansion projections for the worldwide financial system. It identified that the stalling of development within the US, China and the euro space has main penalties for international outlook.

It mentioned that for rising markets and growing economies, the unfavorable revisions to development in 2022-23 mirror primarily the sharp slowdown of China’s financial system and the moderation in India’s financial development.

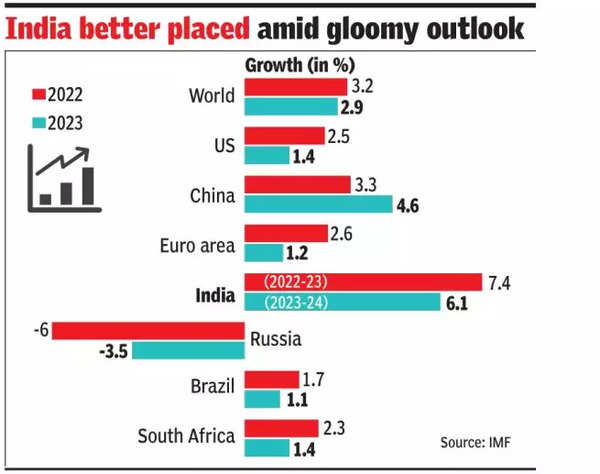

“The revision in rising and growing Asia is correspondingly giant, at 0.8 share factors within the baseline for 2022. This revision features a 1.1-percentage-point downgrade to development in China, to three.3% (the bottom development in additional than 4 many years, excluding the preliminary Covid disaster in 2020), owing primarily to the aforementioned Covid outbreaks and lockdowns,” in line with the IMF doc. “Likewise, the outlook for India has been revised down by 0.8 share factors to 7.4%. For India, the revision displays primarily much less beneficial exterior circumstances and extra speedy coverage tightening,” mentioned the IMF replace.

The newest projections by the IMF allow India to retain its quickest rising main financial system tag for the present fiscal 12 months and the following. The expansion estimates for India are in step with the RBI’s, which projected development of seven.2% within the present fiscal 12 months. A number of different multilateral companies have additionally projected development within the 7.2% vary. India’s financial system is estimated to develop by 6.1% in 2023-24, 0.8 share factors down from the sooner estimate of 6.9%.

The IMF mentioned downgrades for China and the US, in addition to for India, are driving the downward revisions to international development throughout 2022-23, which mirror the materialisation of draw back dangers highlighted within the April 2022 World Financial Outlook. These are a sharper slowdown in China on account of lockdowns, tightening international monetary circumstances related to expectations of steeper rate of interest hikes by main central banks to ease inflation stress, and spillovers from the conflict in Ukraine.

It mentioned the baseline forecast is for international development to gradual from 6.1% final 12 months to three.2% in 2022, 0.4 share factors decrease than within the April 2022 World Financial Outlook. World inflation has been revised up on account of meals and vitality costs in addition to lingering supply-demand imbalances, and it’s anticipated to achieve 6.6% in superior economies and 9.5% in rising market and growing economies this 12 months – upward revisions of 0.9 and 0.8 share factors, respectively. In 2023, disinflationary financial coverage is anticipated to chew, with international output rising by simply 2.9%, the IMF mentioned.

“With growing costs persevering with to squeeze residing requirements worldwide, taming inflation needs to be the primary precedence. Tighter financial coverage will inevitably have actual financial prices, however delay will solely exacerbate them. Focused fiscal help will help cushion affect on probably the most weak, however with authorities budgets stretched, such insurance policies will have to be offset by elevated taxes or decrease authorities spending,” the IMF report cautioned.

[ad_2]