[ad_1]

There may be an terrible lot of speak about a recession lately. And whereas everyone seems to be speaking in regards to the idea, the views on when and/or whether or not or not the nice ‘ol U.S. of A will fall into recession differ extensively.

For instance, on this high quality summer time Tuesday morning alone, Bloomberg studies that “Elon Musk, Nouriel Roubini and Goldman Sachs are all warning of the rising threat of a recession within the U.S., regardless that economists are estimating a lower than one-in-three likelihood of an incidence this yr. In the meantime, President Joe Biden has weighed in on the talk, saying {that a} contraction is not “inevitable” following a dialog with former Treasury Secretary Lawrence Summers.”

Clear as mud, proper? In brief, this seems to be an “on the one hand, but alternatively” state of affairs as an incredible many people proceed to argue their case on the topic – in each instructions.

How can this be, you ask? Is not it clear that the financial system is slowing down? And since U.S. shrank by 1.5% within the first quarter, aren’t we already midway to recession?

Therein lies the rub. In the event you had been to ask 10 monetary professionals for the definition of a recession, 9 would possible reply with: Two consecutive quarters of damaging GDP development.

So, with one quarter of damaging GDP already within the books and the Atlanta Fed’s GDPNow at the moment sitting at 0%, it’s straightforward to see why many analysts are saying we’re already in recession.

The issue is that two quarters of damaging GDP development shouldn’t be the precise definition of a recession. In accordance with the Nationwide Bureau of Financial Analysis (NBER), which is the official scorekeeper of such issues, the definition of a recession is: A big decline in financial exercise that’s unfold throughout the financial system and lasts quite a lot of months.

Put one other method, a recession is a persistent, broad-based deep decline in financial exercise. To make certain, this isn’t what is going on now.

Positive, the financial system is slowing. The proof/information is in every single place. Nevertheless, the present “slowdown” has extra to do with the speed at which the financial system was rising after the reopening. As we have mentioned many instances, the 6.9% development price seen within the fourth quarter of final yr and 5.7% development for all of calendar yr 2021 was (a) artificially induced and (b) unsustainable.

Subsequently, we have identified for a very long time now that the speed of financial development would “decelerate.” Nevertheless, there’s a large distinction between the speed of development slowing from an unsustainably excessive price and an precise financial slowdown. You realize, the place folks cease taking journeys, shopping for stuff and primarily do much less.

To make certain, the markets perceive the state of affairs. And from my seat, that is why shares hadn’t been freaking out. Properly, till lately, that’s.

Up till a Russian dictator determined to invade his neighbor, issues had been “slowing” in a comparatively calm vogue. However the provide of stuff (like wheat) and supply-chain points introduced on by Putin’s reprehensible assault prompted inflation to enter overdrive. And when coupled with the $10 trillion that had been dumped into customers’ checking accounts and extra supply-chain issues stemming from China’s COVID shutdown, the Fed was compelled to take motion.

And take motion, it did. Final week, Fed Chairman Jay Powell “went huge” with the newest price hike and instructed there may be extra of the identical coming.

In essence, Powell and his merry band of central bankers try to whip inflation – now. And since they do not have instruments that might enhance the provision of grains, oil and different commodities, loosen provide chains, kill COVID, and/or persuade Russia to face down, the Fed will use the one instruments it has accessible – price hikes and promoting bonds.

The traditional definition of inflation is “too many {dollars} (which on this case, got here from the Fed and Washington’s response to COVID) chasing too few items (which is at the moment attributable to supply-chain points and Russia’s struggle). So, Powell & Firm are elevating charges with a view to scale back the demand for items/providers. In financial circles, that is known as “demand destruction.”

The idea is straightforward sufficient, elevate charges to some extent the place the extreme demand begins to tail off. You may consider this because the Fed making use of the brakes to financial development.

The trick is for the Fed to carry out its inflation preventing ways with out hurting the financial system too badly within the course of. Professor Jeremy Siegel summed up the state of affairs properly final week by saying that whereas the Fed is slamming on the brakes, it should additionally attempt to keep away from sending the financial system by way of the windshield within the course of.

That is what the markets have been fretting about recently. That is what despatched the into “bear market territory.” And that is why oil shares dove and yields backed up final week – concern of the financial system going by way of the windshield and winding up within the ER.

This is hoping the seatbelts work.

So, analysts of all shapes, sizes and colours at the moment are busy prognosticating in regards to the future. The bears inform us the sky is falling (once more) and that the inflation downside will grow to be a 1970’s redux. The bulls counsel all the pieces might be high quality and an amazing shopping for alternative is shut at hand. In all probability, actuality is someplace in between.

In market vernacular, that is what “value discovery” is all about. Shares have to “determine” what the longer term appears like. So, after we get dangerous information, shares go down – arduous. Once we get excellent news, they rise. And when the “argument” between the bulls and bears evens out, a backside will type and a “basing section” can start.

Then, when the worst is considered behind us, the bulls will possible prevail and the following bull market might be born. For these of you conserving rating at residence, you will need to keep in mind that the typical acquire for bull market cycles since early 1900 has been greater than 80%. And in my guide, that is one thing to look ahead to whereas markets try to work by way of the present macroeconomic outlook.

Now let’s evaluate the “state of the market” by way of the lens of our market fashions.

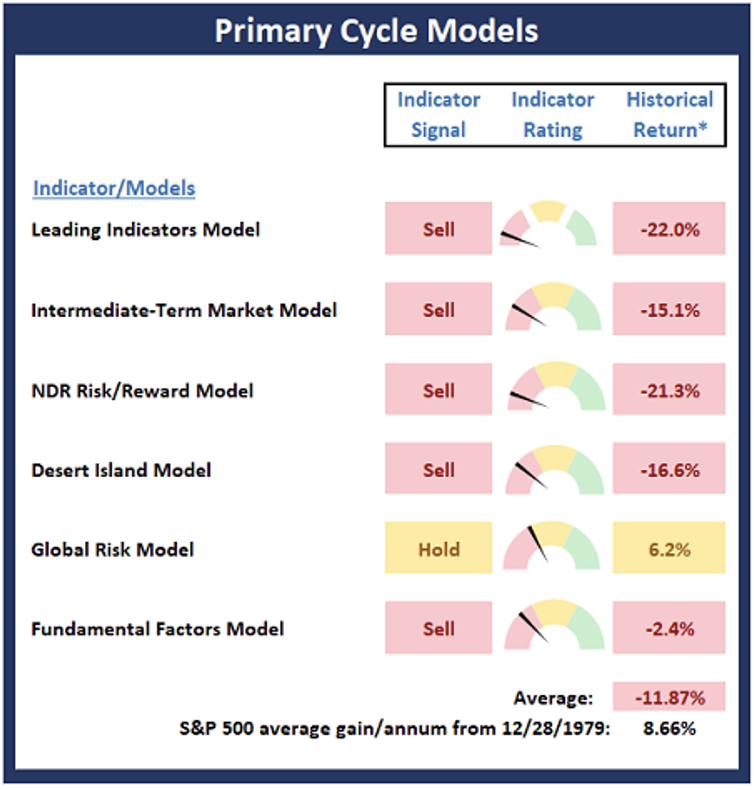

The Massive-Image Market Fashions

We begin with six long-term market fashions. These fashions are designed to assist decide the state of the general market.

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

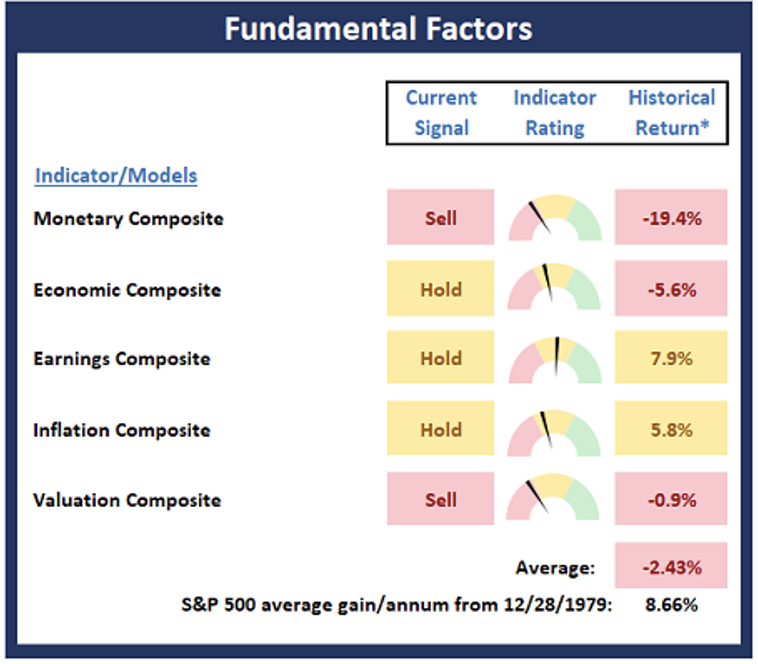

The Elementary Backdrop

Subsequent, we evaluate the market’s elementary elements, together with rates of interest, the financial system, earnings, inflation and valuations.

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

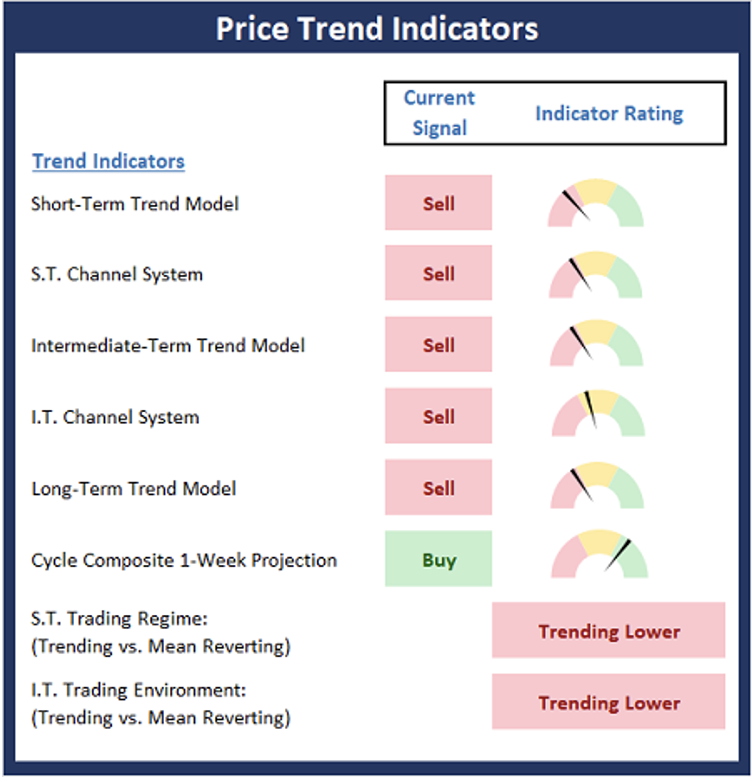

The State Of The Pattern

After reviewing the big-picture fashions and the elemental backdrop, I like to take a look at the state of the present development. This board of indicators is designed to inform us in regards to the general technical well being of the market’s development.

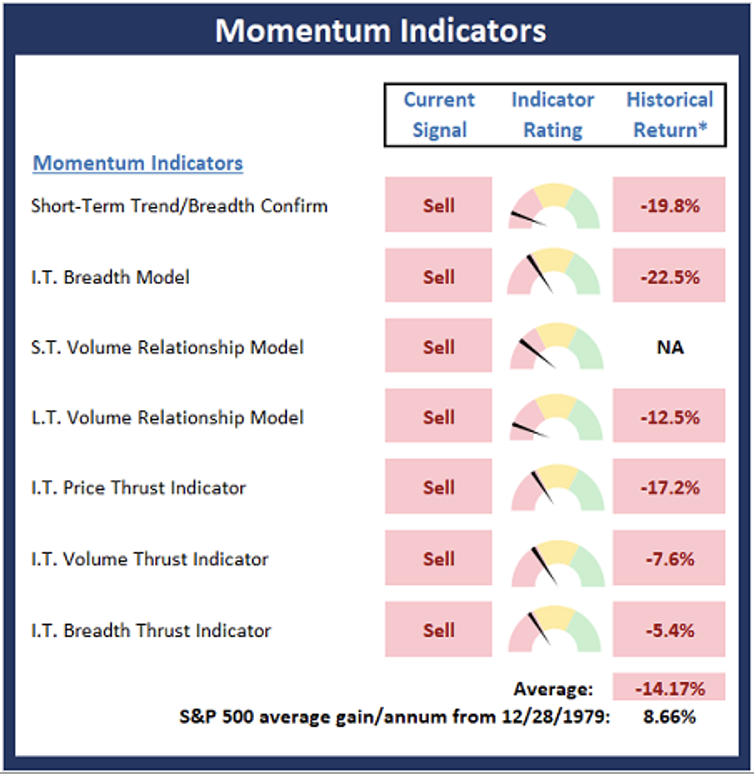

The State Of Inside Momentum

Subsequent, we analyze the momentum indicators/fashions to find out if there may be any “oomph” behind the present transfer.

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

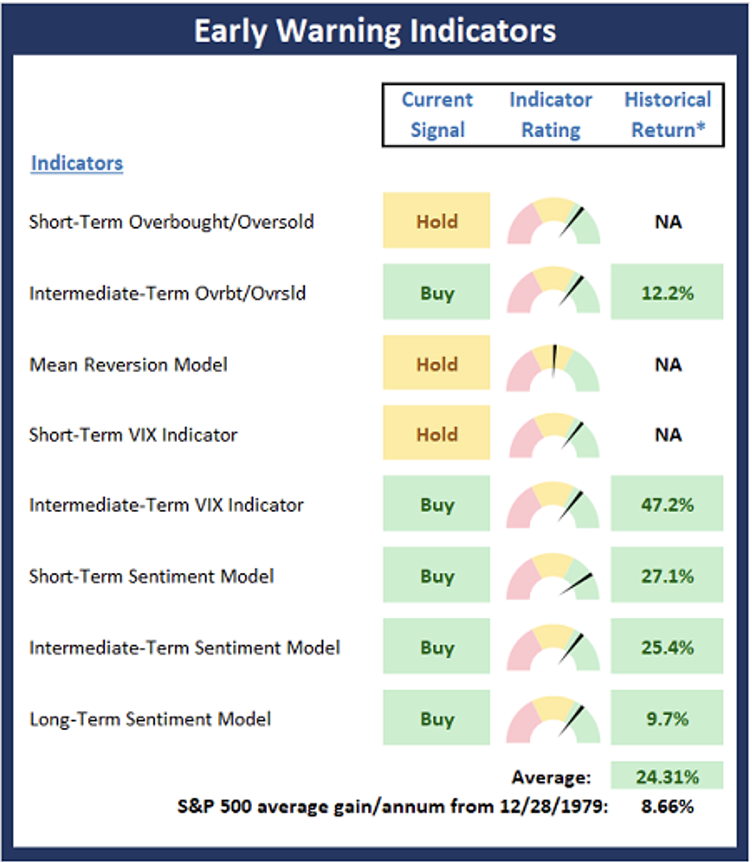

Early Warning Indicators

Lastly, we have a look at our early warning indicators to gauge the potential for countertrend strikes. This batch of indicators is designed to counsel when the desk is about for the development to “go the opposite method.”

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

Thought For The Day:

As you stroll down the golf green of life you could scent the roses, for you solely get to play one spherical.

– Ben Hogan

[ad_2]