[ad_1]

Final week I confirmed how, based mostly on the Elliott Wave Precept (EWP), the and might have put in a multi-year high. (See and , respectively).

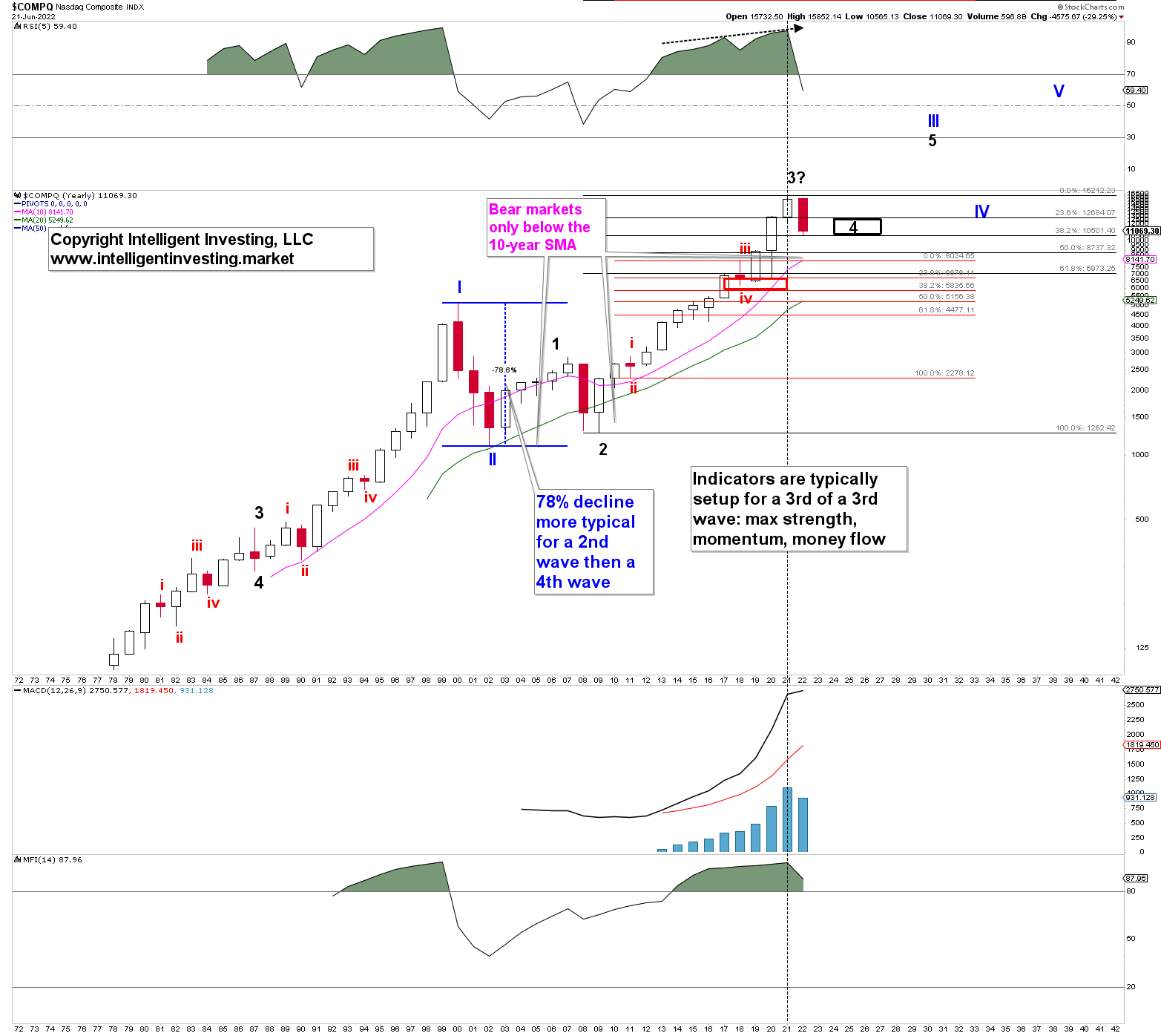

Moreover, based mostly on prior bigger diploma 4th waves and the EWP guidelines, I used to be in a position to logically deduct a extremely seemingly path ahead for the multi-year bear market the US main indexes could possibly be in. Thus, if the SPX and DOW are in such a bear market, additionally it is logical to imagine the is in such a bear market. On this article, I exploit the NASDAQ’s yearly-resolution chart to point out how this may be the case. See determine 1 under.

Determine 1. NASDAQ yearly candlestick chart with detailed EWP rely. Notice the log scale.

Down Years Are Corrective Years

This text won’t do any value forecasts however relatively present how counting down years as corrective years results in concluding that the NASDAQ has probably accomplished (black) major-3 of (blue) Major-III. Thus, just like the SPX and DOW, a bigger diploma 4th wave (of the 2007-2009) bear market degree ought to now be underway.

This technique can solely affirm that thesis when the index closes decrease for the yr. Then the index has accomplished clear, clear 5 (pink) waves up from the 2009 low. Therefore, it’s going to take six extra months, however for now, this appears very feasibly, contemplating the index has now declined for 5 out of the final six months. And forewarned is forearmed.

The 78% haircut in the course of the Dotcom bubble burst is typical for a 2nd wave (quick and deep), whereas the yearly (!) technical indicators affirm the introduced EWP. Though the index has already reached the perfect draw back goal for this 4th wave (the 38.20% retrace of all the rally that began in 2009), there’s no assure that degree is it. In actual fact, the index may even retrace to the March 2020 lows over time.

Nevertheless, as proven for the S&P 500 and DOW, the trail to get there’ll seemingly be advanced, thus laborious to forecast, and long-drawn.

However once more, this isn’t a technique to make value predictions; it’s a technique to trace the a lot bigger EWP waves within the index–and each different index, as a matter of truth.

[ad_2]