[ad_1]

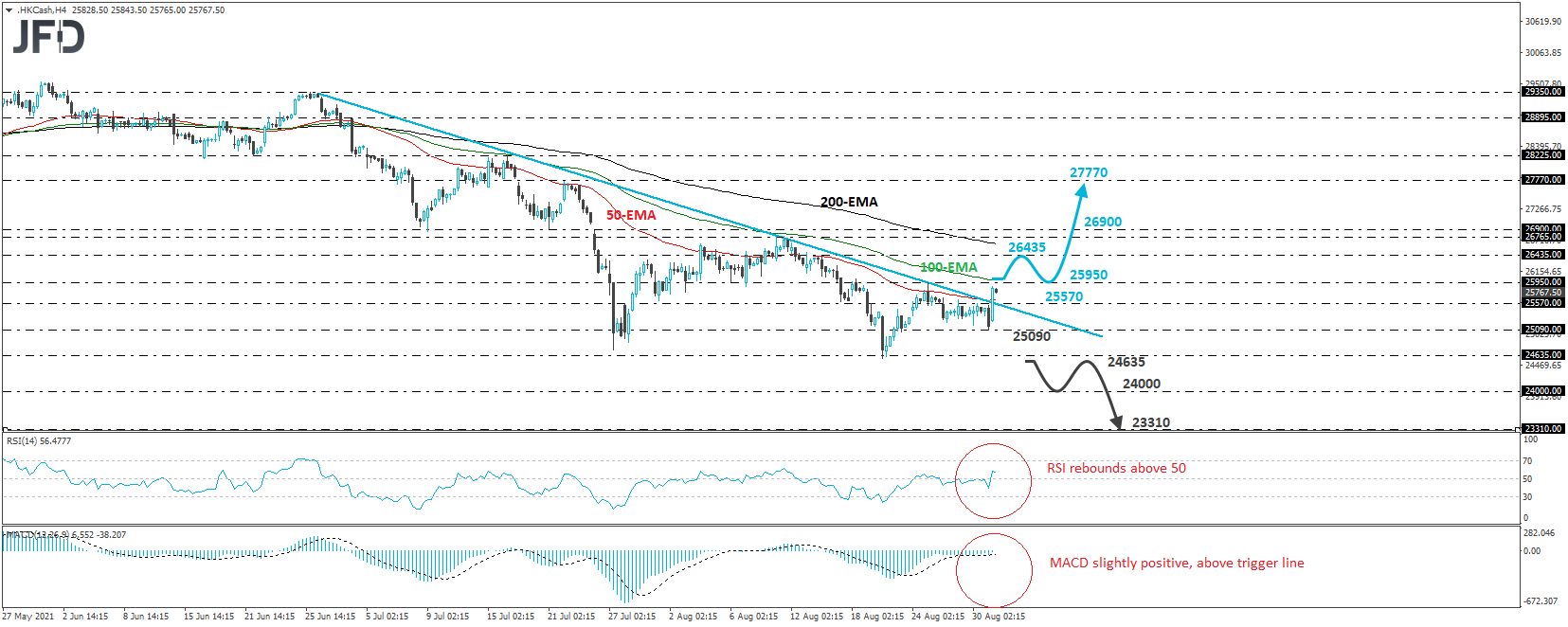

The Hong Kong’s money index edged north through the Asian buying and selling Tuesday, breaking above the draw back resistance line drawn from the excessive of June 28. In our view, this has dismissed the bearish case, but it surely has not but confirmed a bullish reversal. Subsequently, for now, we are going to keep impartial.

We imagine {that a} bullish reversal will likely be confirmed upon a break above 25950, the excessive of Aug. 25. This may verify a forthcoming increased excessive on the 4-hour chart and will pave the best way in direction of the 26435 zone, marked by the excessive of Aug. 16, or the 26765/26900 territory, outlined by the excessive of Aug. 11 and the within swing low of July 21. If neither space is ready to halt the advance, then we might expertise extensions in direction of the 27770 hurdle, marked as a resistance by the excessive of July 16.

Shifting consideration to our short-term oscillators, we see that the RSI rebounded again above 50, however simply turned down, whereas the MACD lies barely above each its zero and set off strains. Each indicators counsel that the momentum has turned constructive, however the downtick of the RSI make us a bit cautious and enhances our selection to attend for a transfer above 25950 earlier than we get assured on extra advances.

On the draw back, a dip beneath 24635 is the transfer that may make us assess whether or not the bears have gained the higher hand once more. This may verify a forthcoming decrease low on each the 4-hour and each day chart and will open the trail in direction of the 24000 zone, marked by the lows of Oct. 15 and 30. If that space doesn’t maintain both, then the autumn might prolong to the 23310 territory, marked by the low of Sept. 30.

Disclaimer: The content material we produce doesn’t represent funding recommendation or funding suggestion (shouldn’t be thought-about as such) and doesn’t in any manner represent an invite to accumulate any monetary instrument or product. The Group of Corporations of JFD, its associates, brokers, administrators, officers or staff aren’t accountable for any damages which may be brought on by particular person feedback or statements by JFD analysts and assumes no legal responsibility with respect to the completeness and correctness of the content material introduced. The investor is solely accountable for the danger of his funding choices. Accordingly, it’s best to search, when you think about applicable, related unbiased skilled recommendation on the funding thought-about. The analyses and feedback introduced don’t embody any consideration of your private funding targets, monetary circumstances or wants. The content material has not been ready in accordance with the authorized necessities for monetary analyses and should subsequently be considered by the reader as advertising data. JFD prohibits the duplication or publication with out express approval. 73.90% of the retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you possibly can afford to take the excessive threat of dropping your cash. Please learn the complete Threat Disclosure – https://www.jfdbrokers.com/en/authorized/risk-disclosure .

[ad_2]