States searching for an extension of the assured compensation interval have been unable to make any headway on the assembly of the Items and Providers Tax Council that ended Wednesday, even because the physique rationalised charges and eliminated exemptions, measures that consultants stated would add to the soundness of the Items and Providers Tax regime.

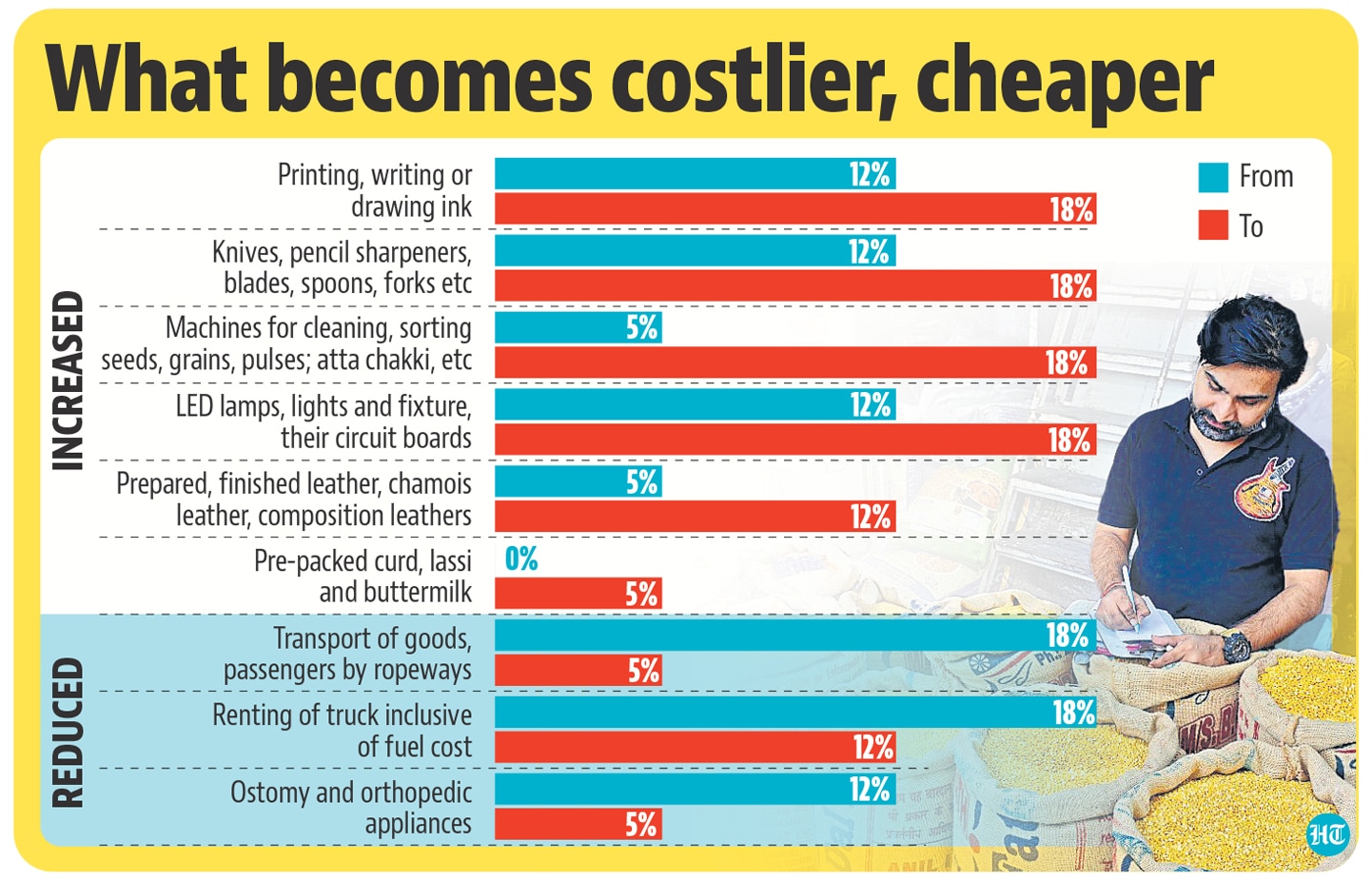

College students, housewives, farmers and vacationers might want to pay extra for some objects of every day use after the GST Council determined to boost levies on a bunch of things, together with ink, pencil sharpeners, cutlery, LED lamps, power-driven pumps, and dairy, poultry and horticulture equipment.

The transfer, which additionally entails eradicating some tax exemptions, is aimed toward ironing out inconsistencies within the construction that led to what’s often known as “responsibility inversion”, the finance minister stated following the conclusion of the council’s assembly, however the choice – collectively taken by states and Centre – was panned by some opposition events for its potential to fan inflation.

A proposal to levy 28% GST on casinos, on-line gaming, horse racing and lottery was deferred, Union finance minister Nirmala Sitharaman stated on Wednesday, following the two-day assembly of the council.

The rise in levies can be within the vary of 1.25-13 proportion factors and can come into impact on July 18. Specialists stated the adjustments take GST nearer to its initially envisioned construction — few charge slabs and fewer exemptions. The method is predicted to spice up income collections which have been in extra of ₹1.4 lakh crore a month over the previous three months.

When GST was envisioned, states have been promised a assured 14% improve in income yearly, with the Centre making good on the shortfall by means of a cess on luxurious and sin merchandise. That involves an finish on June 30, and whereas some states have been pushing for it, the Centre isn’t eager on doing so. Specialists preserve {that a} secure revenue-neutral charge (the present revenue-neutral charge is just too low) ought to deal with considerations of the states, and in addition encourage them to simply accept charge will increase.

The council additionally determined to chop GST on some health-related objects and on fares for ropeways used to move items and passengers.

Addressing a press convention in Chandigarh, Sitharaman, who’s the chairperson of the council, stated the choices to right responsibility inversion and withdraw tax exemption was taken unanimously by all members on the advice of the group of ministers (GoM) headed by Karnataka chief minister Basavaraj Bommai.

“There was no opposition to any improve or something to do with the charges. There was not one…,” she informed reporters whereas briefing the outcomes of the assembly.

However opposition events attacked the Union authorities for elevating costs at a time when folks have been reeling below the stress of excessive inflation. Even earlier than the Council’s assembly ended, Congress chief Rahul Gandhi referred to as GST as “Grihasthi Sarvanash Tax” (family destruction tax).

A central authorities official, who was on the assembly and requested to not be named, stated: “No one, not even Congress-ruled states, raised any voice in opposition to the transfer within the assembly.”

Whereas pre-packed curd, lassi and buttermilk are set to develop into costlier with the introduction of a 5% tax on them, GST on banks’ cheques (until now, there was no GST on getting cheques issued, whether or not in free or as a guide) have been raised from zero to 18%. College students and professionals utilizing maps and hydrographic charts, together with atlases, must pay a 12% GST because the council determined to take away this stuff from the exempt record. The council additionally determined to boost GST on petroleum and coal mattress methane from 5% to 12%, and e-waste from 5% to 18%.

It, nonetheless, determined to cut back GST on sure health-related objects resembling ostomy and orthopaedic home equipment from 12% to five%, based on an official assertion. It additionally determined to cut back GST on diethylcarbamazine (DEC) tablets provided freed from price for the Nationwide Filariasis Elimination Programme from 5% to zero. Whereas the council decreased tax on transport of products and passengers by ropeways from 18% to five%, it slashed GST on renting of truck inclusive of gas price from 18% to 12%.

The GST Council is the apex decision-making physique on the oblique taxes represented by the Centre and states, and barring one occasion associated to tax charge on lottery, all its selections have been primarily based on consensus since its inception in July 2017.

The Council has withdrawn a number of exemptions on providers additionally to broaden the tax base. Now solely financial system class passengers will be capable of take pleasure in GST-exempted transport from the north-eastern states and Bagdogra.

There’ll now not be tax exemption on transportation of railway tools, warehousing of commodities that entice tax (nuts, spices, copra, jaggery, cotton), fumigation in a warehouse of agricultural produce, providers offered by monetary establishments and regulators such because the Reserve Financial institution of India (RBI), the Insurance coverage Regulatory and Improvement Authority (IRDA), the Securities and Trade Board of India (Sebi), the Meals Security and Requirements Authority of India (FSSAI), and the Items and Providers Tax Community (GSTN).

Renting of residential dwelling to enterprise entities, and providers offered by twine blood banks by means of preservation of stem cells will now not be tax exempt both, based on the official assertion.

From July 18, lodge lodging priced as much as ₹1,000 per day is not going to take pleasure in any exemption and it’ll entice a 12% GST. Equally, room hire (excluding ICU) exceeding ₹5,000 per day per affected person charged by a hospital shall be taxed to the extent of quantity charged for the room at 5% GST with out enter tax credit score (ITC), it stated. “Tax exemption on coaching or teaching in leisure actions regarding arts or tradition, or sports activities is being restricted to such providers when provided by a person,” it added.

Based on Sitharaman, the Wednesday’s selections are primarily based on the suggestions of the GoM associated to correction of responsibility inversion and withdrawal of exemptions. A 3rd and main train to rationalise GST slabs is predicted later because the council has given extra time to the group to undertake the train.

Abhishek Jain, accomplice, Oblique Tax at consultancy agency KPMG in India, stated: “The GST council has offered an extension of some months to the GoM to submit its report on tax slab rationalisation. Contemplating that the present income impartial charge is in need of the goal charge of 15.5%, new GST tax slabs could also be anticipated.”

MS Mani, accomplice at Deloitte India stated: “The withdrawal of sure exemptions and a number of charge adjustments introduced as we speak are a part of the general charge rationalisation train because the GST structure, as initially envisioned, had few charges and only a few exemptions. It appears that evidently over a time frame, GST is now shifting in that path.”