[ad_1]

Markets proceed to see elevated demand for dangerous property because of a number of basically constructive information directly, from strong labour market knowledge and the adoption of a assist bundle to hopes for a covid-19 tablet from Pfizer (NYSE:).

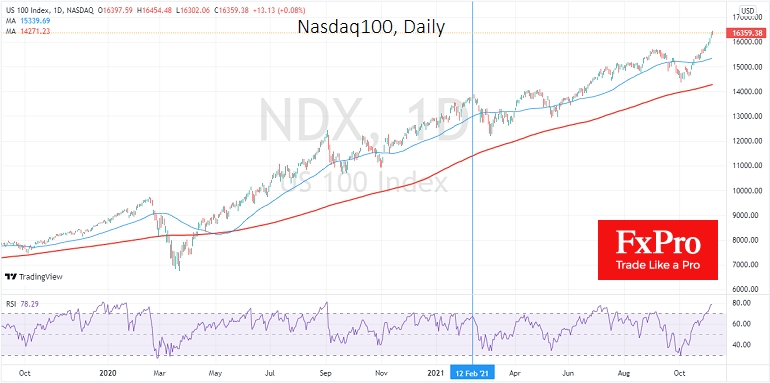

A rally in equities is getting underway within the US markets, with the including 12.7% from its native lows of Oct. 13, when the most recent rally began. Throughout the identical interval, the and gained 8.9% and 6.7%, respectively.

We listen not solely to the rally’s energy but in addition to the stability of energy between the important thing US indices. Shares within the NASDAQ are very delicate to adjustments in rates of interest. Within the final two weeks, we’ve got seen a decline in US yields, which have fallen from ranges above 1.7% to 1.48% at writing.

Behind the decline in long-term bond yields has been a powerful efficiency by the world’s main central banks, the Fed, the ECB, the Financial institution of England and the Financial institution of Japan, who’ve satisfied markets that they’re being too hasty with their charge hike forecasts. The damaging expertise can simply clarify this strategy by the large 4 central banks after the GFC when the restoration was too uneven and prolonged.

Many observers level to elementary variations between the present scenario and what we noticed ten years in the past. Specifically, again then, households had excessive money owed and declining incomes. Nevertheless, their money owed aren’t as excessive now, and private financial savings are at document highs because of coronavirus governments paychecks. Brief-term, the present scenario is beneficial for fairness markets.

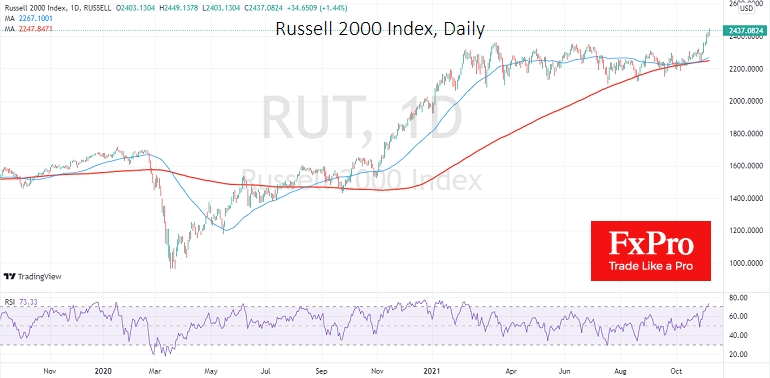

Apart from NASDAQ’s bull run, it’s value noting the climbing out of its sideways channel since March of this yr. The expansion of this index, which incorporates small inventory market corporations, is a major sign of the energy of the present rally. It has gained 4.8% versus 3% for the NASDAQ, 2% for the S&P 500 and 1.1% for the Dow Jones within the final 5 days.

The Russell 2000 made new highs a yr earlier, with a 50% rise from November to March. We might not see the identical amplitude of progress this time, however the timing units up a powerful end to the yr for equities.

Curiously, danger urge for food has not undermined the greenback’s place in opposition to main currencies in latest weeks, as main central banks have taken an identical and even softer strategy to financial coverage than the Fed. In consequence, the has remained in an upward hall for the reason that begin of the yr.

The FxPro Analyst Staff

[ad_2]