[ad_1]

The barely prolonged its downtrend yesterday, however on the finish of the day it was greater. So was it a reversal or simply one other short-term bounce?

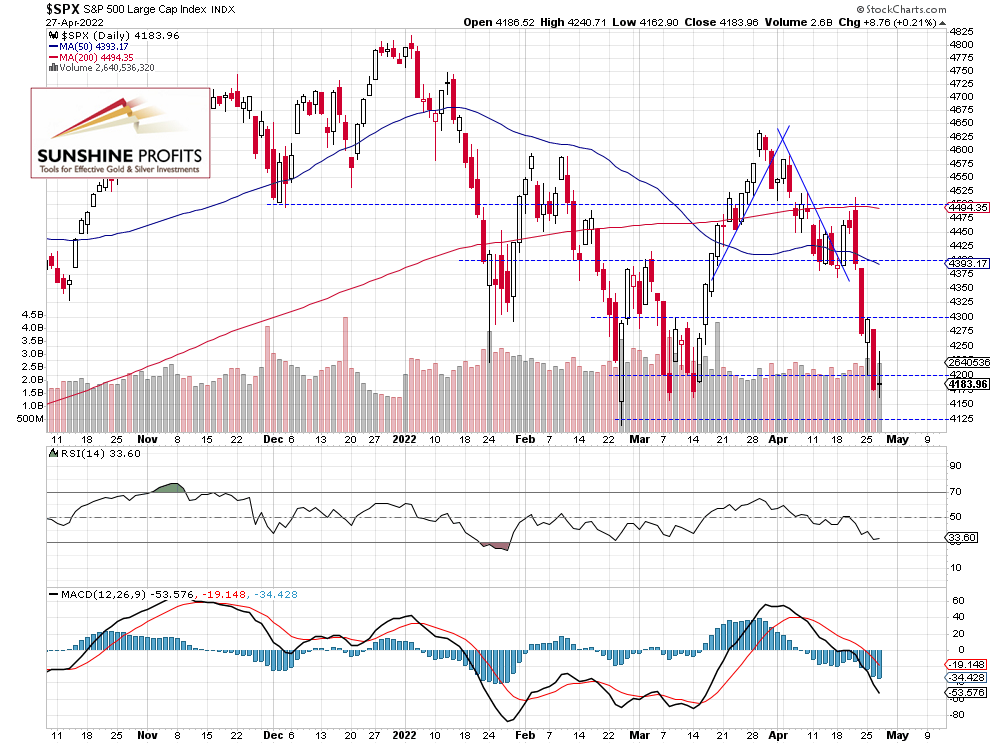

The broad inventory market index gained 0.21% on Wednesday, after bouncing from the brand new native low of 4,162.90. The S&P 500 fell to its March native lows of round 4,160. It prolonged the downtrend regardless of quarterly company earnings releases. There’s nonetheless a variety of uncertainty regarding the Fed’s financial coverage tightening fears and the Ukraine battle. This morning, the S&P 500 index is has gained for the reason that open following yesterday’s Meta Platforms (NASDAQ:) quarterly launch. Nonetheless, the market retraced a few of its in a single day advance after a lot worse-than-expected quarterly Advance GDP information launch (-1.4% vs. expectations of +1.1%).

The closest vital resistance degree is now at round 4,200-4,250. Alternatively, the assist degree is at 4,100-4,150, marked by the earlier lows. The S&P 500 index retraced the entire March advance, as we are able to see on the every day chart (chart by courtesy of http://stockcharts.com):

Futures Contract Above 4,200 Once more

Let’s check out the hourly chart of the S&P 500 futures contract. On Tuesday, the market fell to its earlier native lows of round 4,140, and yesterday it bounced again above the 4,200 degree once more.

The market is technically oversold and there are some optimistic development exhaustion indicators. Due to this fact, we expect an upward correction from the present ranges.

(Chart by courtesy of http://tradingview.com)

Conclusion

On Wednesday, the S&P 500 index fluctuated following its latest declines. The market closed greater, nevertheless it was nonetheless under the 4,200 degree. Right now, the vital Advance GDP launch was a lot worse than anticipated. Nonetheless, we may even see a “promote the rumor, purchase the information” motion right here. Traders will even watch for as we speak’s vital quarterly earnings releases from Apple (NASDAQ:) and Amazon.com (NASDAQ:).

Right here’s the breakdown:

- The S&P 500 index remained under the 4,200 degree yesterday; it could be counterintuitive, however as we speak’s worse-than-expected Advance GDP launch could set off an upward reversal.

- We expect an upward correction from the present ranges.

[ad_2]